LendingClub released its earnings for the first quarter of 2024 after the bell today, demonstrating a robust performance marked by significant achievements and strategic advancements. Here are some of the details from their earnings report and presentation.

Financial Highlights of Q1 2024:

- Total Assets: Increased to $9.2 billion, up from $8.8 billion in the previous quarter, driven mainly by growth in securities related to the structured certificate program.

- Deposits: Rose to $7.5 billion, a slight increase from $7.3 billion at the end of Q4 2023, bolstered by high-yield savings and certificates of deposit.

- Loan Originations: Remained stable at $1.6 billion, demonstrating the company’s consistent demand despite market fluctuations.

- Net Revenue: Slightly decreased to $180.7 million from $185.6 million in the prior quarter, attributed to a shift in asset mix and elevated deposit funding costs. This exceeded analyst expectations of $173.9 million.

- Net Income: Improved to $12.3 million, up from $10.2 million in the previous quarter, reflecting efficient operational execution and favorable market conditions. Again, this significantly exceeded analyst expectations of $3.9 million.

- Capital and Liquidity: Strong with a Tier 1 leverage ratio of 12.5% and substantial coverage of uninsured deposits, positioning the company well above regulatory minimums.

Strategic and Operational Developments:

- Digital Marketplace Bank: LendingClub’s positioning as a leading digital marketplace bank is strengthened by its high Net Promoter Score of 80 and an average customer review rating of 4.83 out of 5 stars, indicating strong customer satisfaction and retention.

- Innovative Product Offerings: The company has effectively expanded its product range, focusing on providing lower-cost credit options to consumers burdened by high-interest debt. This strategic direction is not only aligned with market needs but also enhances LendingClub’s competitive edge.

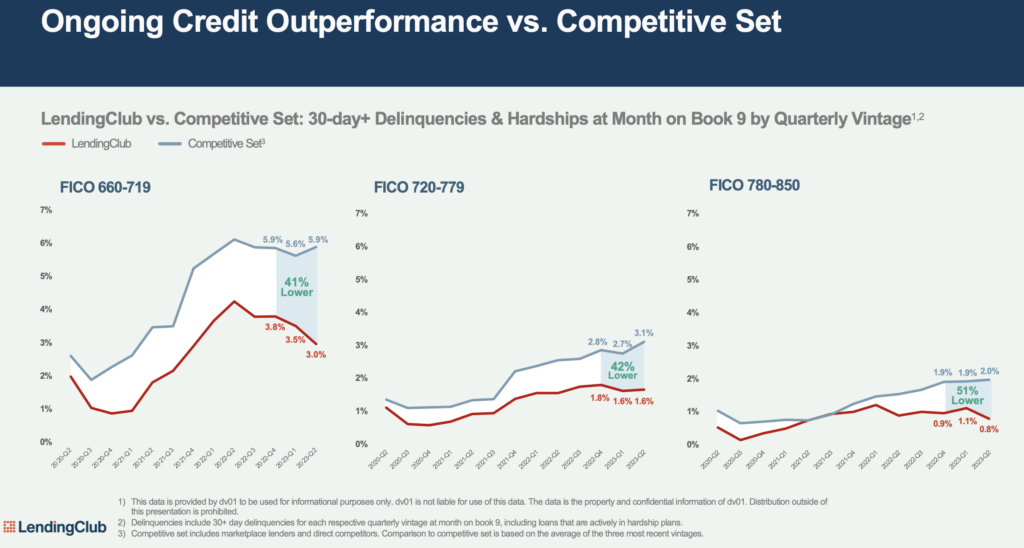

- Risk Management: Demonstrated lower delinquency rates compared to the competitive set, with proactive measures in place to manage credit risk effectively. This is reflected in their superior performance metrics such as lower net charge-off ratios across various FICO score segments.

Forward-Looking Statements and Guidance:

- Q2 2024 Projections: LendingClub expects loan originations to range from $1.6 billion to $1.8 billion and anticipates Pre-Provision Net Revenue (PPNR) between $30 million and $40 million. This guidance accounts for ongoing strategic initiatives and market conditions expected to influence operational performance.

- Long-Term Strategy: The company remains committed to expanding its suite of financial products and enhancing digital capabilities to better serve its growing customer base, reinforcing its market position as a leading innovator in the fintech space.

LendingClub’s Q1 2024 financial results reflect a solid performance underscored by strategic growth initiatives and prudent financial management. Investors were pleased with the earnings report, the stock price was up 4% in after-hours trading today.