The SEC is at it again.

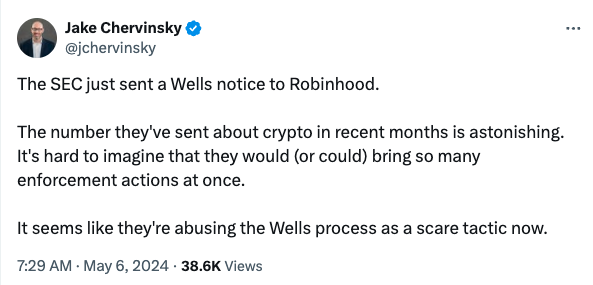

Over the weekend we learned that the SEC has sent a Wells Notice to Robinhood regarding its crypto activities.

The SEC said that it has “made a preliminary determination recommending that the SEC file an enforcement action against the [crypto] unit for alleged violations of the Securities Exchange Act of 1934”.

If ever there was an argument for new crypto regulation in the U.S., that sentence is it. We really are regulating crypto from rules written 90 years ago. Yeah, that seems like a good idea.

Robinhood published this response this morning, arguing it has tried to engage with the SEC, like many other crypto exchanges, seeking regulatory clarity but the regulator has responded with the threat of an enforcement action.

Robinhood reports earnings on Wednesday where I am sure this will be a topic of discussion.

Featured

> Robinhood says SEC could pursue enforcement actions over its crypto operations

By Tanaya Macheel

Robinhood had disclosed in February that it received subpoenas from the SEC related to its crypto business.

From Fintech Nexus

> Enough Already! Funding Circle Deserves to Keep Their 7(a) Lending License

By Peter Renton

Funding Circle was approved for a 7(a) license by the SBA but now there are some in Congress that want to take that away from them.

Podcast

Daniela Binatti, Co-Founder & CTO of Pismo on building fintech infrastructure

The CTO and Co-Founder of Pismo discusses the importance of modern infrastructure and what their acquisition by Visa means…

Tweet of the Day

Also Making News

- USA: JPMorgan Offers Faster Domestic Payments Via Visa Direct

J.P. Morgan and Visa have teamed to offer faster domestic payments via Visa Direct. The collaboration, announced Monday (May 6) is designed to improve merchant experiences and empower cardholders for customers of J.P. Morgan Payments.

- USA: Tensions Rise in Silicon Valley Over Sales of Start-Up Stocks

The market for shares of hot start-ups like SpaceX and Stripe is projected to reach a record $64 billion this year.

- USA: Small banks ‘feel like hostages’ to their core systems: OCC’s Hsu

A set of panels discussing minority depository institutions and digitization found that cost is a significant challenge to minority depository institutions, especially in the core processing space.

- USA: Fed proposes expanded operating hours for FedWire and NSS

The US Federal Reserve Board is seeking feedback on a proposal to start operating its two large payments services seven days a week.

- Global: China’s Ant Group doubles down on global expansion with cross-border payments offering Alipay+

Ant introduced Alipay+ in 2020, allowing foreigners to use certain mobile payment apps from their home countries to scan Alipay QR codes to pay in China.

- USA: Enterprise Fintechs Continued to Claim Higher Portion of VC Deal Value than Retail Fintech Firms – Report

PitchBook has released their latest retail Fintech ecosystem report.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.