On Friday, the CFPB announced it was suing mobile peer-to-peer lending platform SoLo Funds for multiple issues.

SoLo Funds targets minority and other underserved borrowers with short-term loans of up to $575. This is a challenging population to serve and a difficult niche to profit from.

The CFPB alleges that SoLo Funds has misrepresented the cost of its loans, tricked borrowers into a mandatory donation, threatened borrowers who don’t pay, and created a social credit score without safeguards.

I have been following SoLo Funds since they began and have chatted with the founders multiple times. I have also invested in dozens of loans on their platform. I believe they are trying to do the right thing but are operating a new model that has never passed regulatory muster before.

While some of these allegations are serious, I have sympathy for SoLo Funds. They serve borrowers who have few low-cost options, and while they have had regulatory challenges all the way through (several state actions are pending), the CEO said that this latest action from the CFPB was a surprise.

I believe that SoLo Funds does more good than harm, but it may be an uphill battle to prove that to the CFPB and other regulators.

Featured

> SoLo Funds ‘Blindsided’ by CFPB Lawsuit

By PYMNTS

SoLo Funds said it was “blindsided” by a CFPB lawsuit alleging that the online lending platform illegally collected fees from borrowers.

From Fintech Nexus

> Embedded lending’s many considerations

By Tony Zerucha

StashWorks is the new B2B offering from Stash, allowing any employer to add savings and investing as a benefit to employees.

Podcast

Brendan Carroll, Co-Founder & Senior Partner of Victory Park Capital, on the growth of private credit

The Co-Founder of Victory Park takes us through the history of asset backed lending, how the industry has grown, and what…

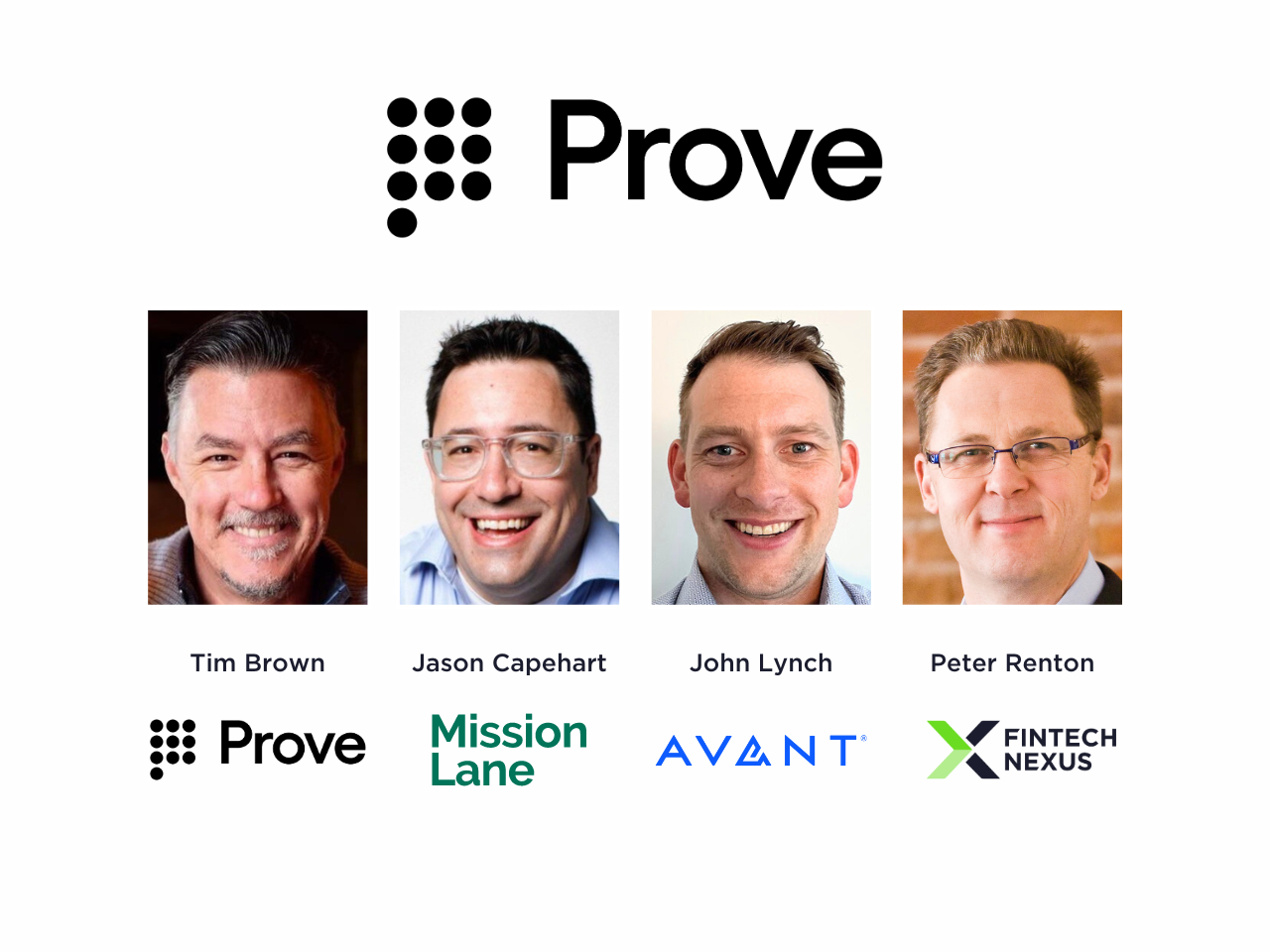

Webinar

Identity Verification Strategies in a World of Deepfakes and AI

May 22, 2pm EDT

With the rapid proliferation of deepfakes and advancements in AI, businesses face new challenges in verifying identities…

Register Now

Also Making News

- USA: SEC: Data Breaches at Financial Institutions Must Be Reported in 30 Days

New federal regulations give some financial institutions (FIs) a tighter deadline for reporting security breaches. The SEC adopted changes last week that require institutions to notify people whose data was compromised “as soon as practicable, but not later than 30 days” after learning of a breach.

- USA: After loss at Supreme Court, payday lenders vow to keep fighting CFPB

The payday loan industry is looking to extend its years-long legal fight with the Consumer Financial Protection Bureau. It’s planning to ask a federal appeals court to revisit a ruling that upheld a proposed limit on how often payday lenders can try to pull money from their customers’ accounts.

- Global: Grayscale CEO Michael Sonnenshein Steps Down

Sonnenshein’s replacement will be Peter Mintzberg, currently head of strategy for asset and wealth manager at Goldman Sachs

- USA: For Gen Z and Millennials, Embedded Loans Beat Traditional Credit

Even though only a small segment of American consumers currently use embedded lending, they’re intrigued by it. Embedded lending could represent a great opportunity for banks and credit unions to win over coming waves of consumers, while also creating a sustainable long-term relationship.

- USA: US Fintech Yendo Bags $165m in Latest Funding Round

Yendo, the creator of the first vehicle-secured credit card, announced that it has closed a significant financing round, with $15 million of equity and $150 of debt financing, totaling $165 million.

- Global: Revolut opens job recruitment tool to companies on LinkedIn

Revolut has integrated its inhouse recruitment platform with LinkedIn, enabling companies to use the toolkit to manage their application and hiring processes direct from the business and employment-focused social media platform.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.