LoanPro has made a name for themselves as a scalable lending platform. Now, they are beefing up their credit card platform with the announcement of a new integration with Visa.

Visa DPS (Debit Processing Service) is one of the world’s largest issuer processors of Visa debit transactions globally and with this integration with LoanPro it will help companies better launch, service and manage card programs.

One of the unique new features is Transaction Level Credit™ which allows for more precise transaction management by allowing card programs to customize interest rates, credit limits, and grace periods based on transaction specifics.

There is a movement in the fintech space towards credit in response to pressure on debit card fees and the growth of pay by bank. This new program from LoanPro will make it easier for these companies to make the leap.

The largest profit center for most banks is their lending business, which includes credit cards. It is inevitable that this will soon be true for fintech companies.

Featured

> How LoanPro’s Visa DPS Integration Will ‘Expand The Availability Of Credit In This Country’

By Renato Capelj

LoanPro, a leading credit platform, announced a direct integration with Visa DPS, one of the largest issuer processors for Visa debit transactions.

From Fintech Nexus

> Plaid launches a new product to take cash flow underwriting mainstream

By Peter Renton

Plaid has announced a new cash flow underwriting tool call Consumer Report that is the most comprehensive offering for lenders yet.

Podcast

Anthony Sharett, President of Pathward, on how to do banking-as-a-service right

While the BaaS space is having a moment right now, there are some banks, like Pathward, that continue to serve their many…

Listen Now

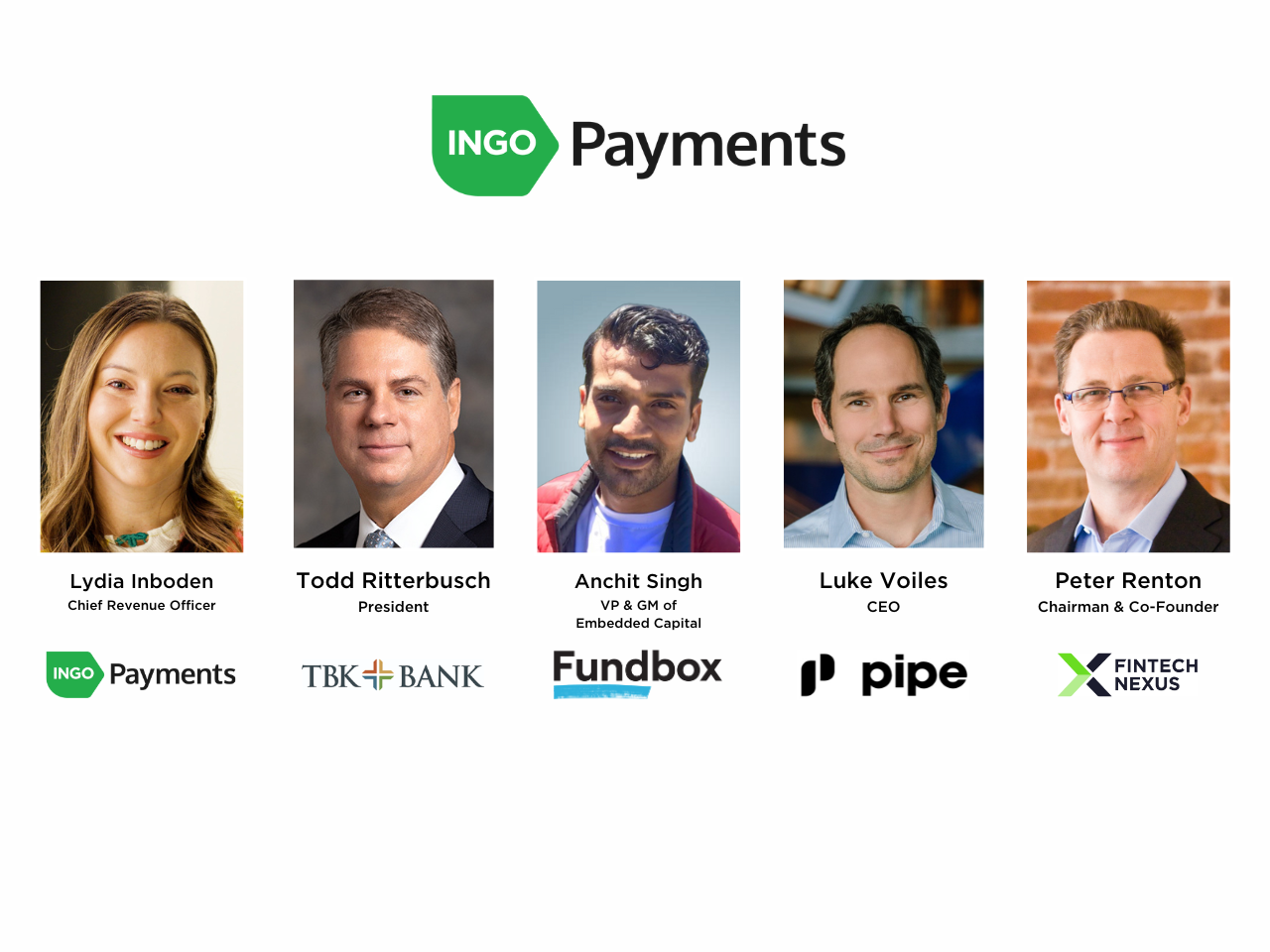

Webinar

Instant payments orchestration: an essential tool now for lending and factoring

Jun 5, 2pm EDT

In today’s on-demand economy, instant payments are moving from a nice-to-have to a must-have. In the small business space…

Also Making News

- USA: After raising $100M, AI fintech LoanSnap is being sued, fined, evicted

The company has been sued by at least seven creditors, including Wells Fargo.

- USA: The SBA is unveiling new credit lines of up to $5 million to fund small businesses

The project is part of the SBA’s efforts to broaden its flagship lending program for American small businesses under Administrator Isabel Casillas Guzman.

- USA: California digital bank reaches $1 billion deposit mark in six months

Though Jenius Bank hasn’t reached breakeven, it’s evidencing solid progress gathering deposits and making loans as it gets ready to celebrate its first birthday.

- Global: How to build a chatbot: Lessons from Bank of America, Klarna, and Lili

Building chatbots that add value to the customer experience is hard. Mostly because incorrect design decisions can make the customer feel confused about who they are speaking to (computer or human) or frustrated, if they feel like they aren’t getting what they want.

- USA: Live Oak Bank Launches First Embedded Banking Partnership

Live Oak Bank has launched its first embedded banking partnership. Powered by the bank’s in-house technology and a Finxact core, this offering enables software companies to directly deliver Live Oak banking products and services to their own customers, Live Oak Bank said in a Monday (June 3) press release.

- Europe: Marqeta Appoints New Leader to Manage Embedded Finance Boom

Financial services company Marqeta announces new leader after seeing 86% growth in Europe, on account of rising demand for its embedded finance offerings

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.