One dev’s guide to solving the data-parsing problem with a hybrid approach safe for high-stakes workflows.

In banking and fintech, we talk a lot about APIs, real-time payments, cloud migration, and AI-driven insights. Yet much of the financial industry still depends on one of the least structured formats imaginable: PDFs.

Bank statements, transaction reports, regulatory disclosures, onboarding documents, customer-uploaded files, and other insight-packed analytics continue to arrive as PDFs.

On paper, extracting tabular data from PDFs seems simple. In production, it is anything but.

I have worked across multiple industries, including banking and financial services, building enterprise systems where PDF extraction was critical. If incorrect data flows downstream, it’s a business risk.

This article explains:

- Why PDF table extraction consistently fails in production banking systems

- Where Java-based approaches fall short

- How a more robust, architecture-led strategy — combining stream parsing, lattice parsing, hybrid techniques, and ML-assisted enhancements — is necessary for real-world fintech use cases

PDFs in Banking Are Mission-Critical

PDFs carry transactional truth. A bank statement is a legal record. A mis-parsed debit or credit can impact affordability checks, lending decisions, or regulatory reporting. Unlike consumer applications, banks cannot tolerate “mostly correct” data.

The problem is that PDFs are designed for visual fidelity, not data semantics. Columns are implied by spacing. Rows are inferred by alignment.

These layout inconsistencies becomes more pronounced in banking because:

- Statements come from multiple institutions and vendors

- Layouts change without notice

- Older statements are often scanned images

- Transactions frequently span multiple lines

- Headers, footers, and disclaimers interrupt tables

Java-Based PDF Extraction Often Breaks First

Many banking platforms are Java-first. Unsurprisingly, teams start with Java PDF libraries that extract text and positional data, then infer tables from alignment. This approach is called stream parsing and only works under ideal conditions.

Consider a transaction that wraps across lines:

A stream parser typically interprets this as “two rows,” not “one transaction.” Multiply this by thousands of customers and years of statements, and the data quality problem compounds quickly.

At a technical level, the logic determines columns by x-coordinates and rows by y-coordinate proximity. But this assumes stable alignment, predictable spacing, and single-line rows — atypical of real bank statements.

Quickly, a parsing issue becomes a data trust issue.

The Python Detour Many Teams Take

At some point, many teams turn to Python-based tools like Camelot. Its lattice parsing mode detects table structure using visual cues, lines and intersections, rather than text flow. For statements with clear borders, accuracy improves significantly.

However, introducing a Python-based extraction service into a Java-centric banking platform solves one problem and creates several others.

Banks care deeply about:

- Deployment consistency

- Security reviews

- Observability and auditability

- Long-term maintainability

A cross-language service introduces friction in all of these areas. As debugging becomes harder, operational risk increases.

More importantly, Camelot works well only for a subset of documents. When gridlines are faint, broken, or missing—as is common in scanned statements—lattice parsing fails just as often as stream parsing.

At this point, teams realise the uncomfortable truth: there is no single extraction strategy that works for all financial documents.

So What Works? A Hybrid Approach to Extraction

The most effective shift I discovered over the course of my career was not adopting a new tool, but changing how we thought about extraction.

Instead of asking “Which parser is best?”, we started asking “Which parser is best for this document?”

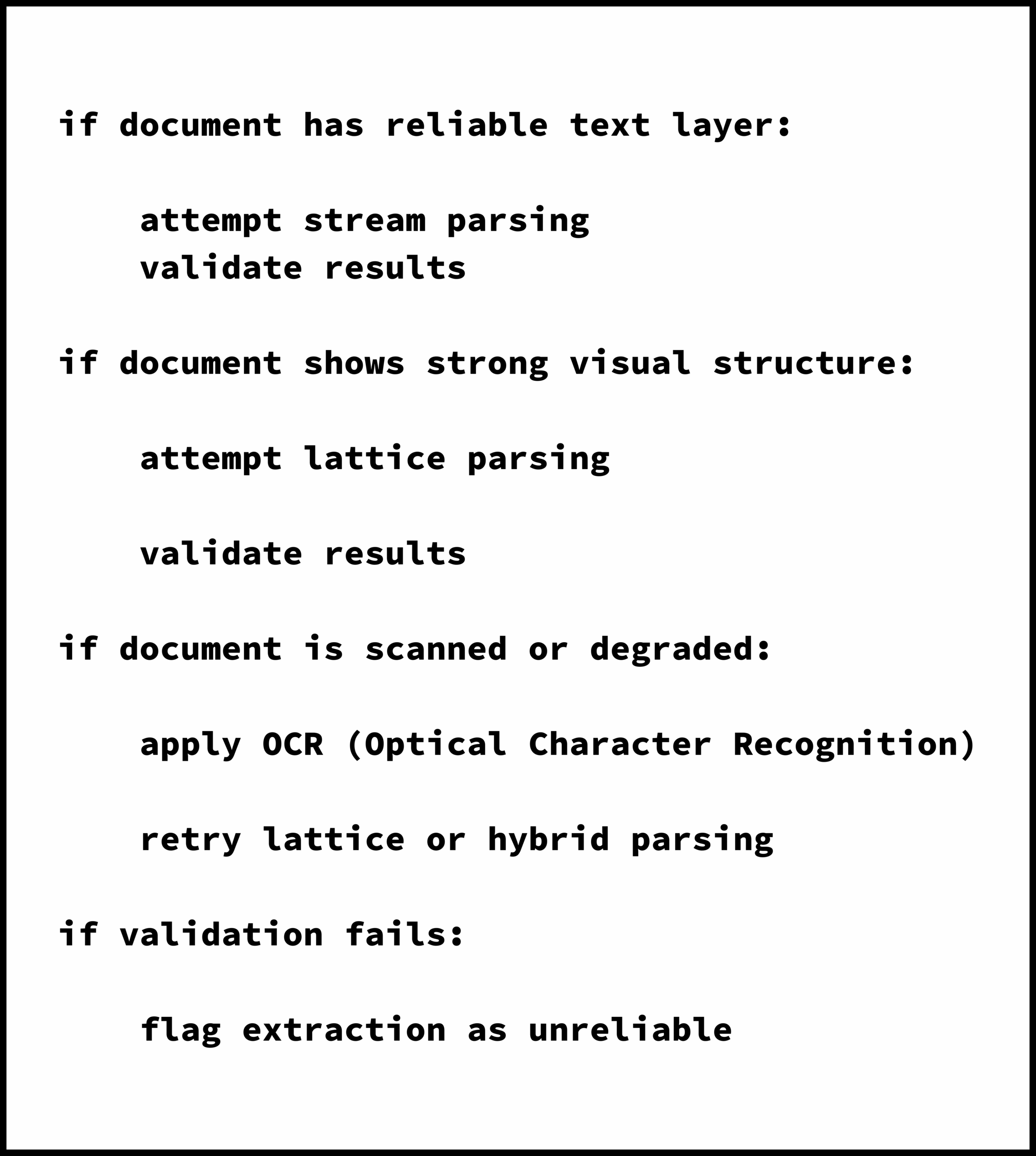

That led to a hybrid strategy.

First, the system validates whether a document has either reliable text or visual structure. After, it either accepts the extraction, tries an alternative method, or escalates. If the result looks right (columns line up, numbers make sense, key fields like dates and amounts are readable), it returns the data in a clean structured format. If something looks off, it tries a different method — for example switching from text-based extraction to line-based extraction, or using Optical Character Recognition (explained in the next section) for scanned pages. If the system still can’t get a reliable result, it marks the output as “needs review” and returns only what it’s reasonably sure about, instead of guessing.

HIGH-LEVEL PSEUDOCODE:

With this approach, validation (for column/row alignment and numeric consistency) is as important as extraction itself. A system that occasionally says “I don’t know” is safer than one that always returns something, and that’s what makes it enterprise-grade — not always elegant, but certainly resilient.

One open-source library that can accomplish this is ExtractPDF4J. I developed this in tandem with other contributors after witnessing the gap for an enterprise-grade solution.

What’s Optical Character Recognition, and Why is it Key? =

When a document is scanned, it may look like a normal PDF, but to a computer it’s basically a set of pictures — not real text. OCR (Optical Character Recognition) is the step that reads those pictures and converts them into actual words and numbers that software can understand. It’s what turns a scanned bank statement from something you can only view into something a system can process.

In many banking systems, OCR is treated as a fallback, not the priority. But poor OCR integration leads to:

- Misaligned bounding boxes

- Incorrect numeric values

- Broken row grouping

To be usable in financial contexts, OCR output must be normalised, corrected, and validated.

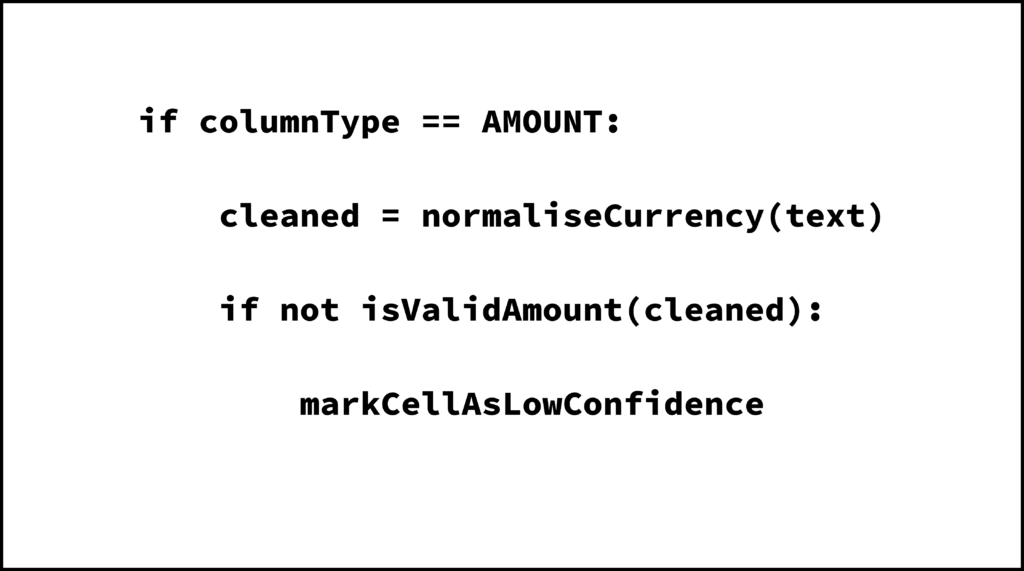

For example:

If the system thinks a piece of text belongs in the “Amount” column, it doesn’t trust it immediately. First, it cleans the text up into a standard money format (i.e., removing extra symbols/spaces and fixing commas/decimals). Then it checks whether the cleaned value actually looks like a valid amount. If it doesn’t, the system flags that cell as “low confidence” — meaning “this might be wrong, so don’t rely on it without review.”

HIGH-LEVEL PSEUDOCODE:

Where AI Helps, and Where It Doesn’t

There are still documents where stream and lattice parsing both fail. Examples of this are borderless tables, mixed layouts, and low-quality scans.

This is where machine learning-assisted layout detection adds value by intelligently detecting table regions to identify column boundaries.

It’s imperative to remember in regulated environments, ML must remain explainable. Every ML-assisted result still needs validation and fallback paths.

In banking, ML is an enhancer, not a replacement for deterministic logic.

A Java Core for a Hybrid Extraction Strategy

This isn’t an argument against Python — it’s an argument for hybrid extraction. PDFs vary too much for a single technique to win consistently: some are text-native, some are tabular, many are scanned, and layouts drift over time.

A pragmatic solution is therefore hybrid by design:

- Use stream when text positioning is trustworthy

- Use lattice when tables are defined by visible lines

- Use OCR when the document is an image

- Combine them with confidence scoring and explicit failure modes

Implementing this hybrid strategy in a Java-first architecture reduces operational overhead and makes behaviour more predictable in production-like pipelines. The goal isn’t perfect extraction; it’s predictable behaviour.

Closing Thoughts: Designing for Trust, Not Perfection

PDF table extraction fails in production because banking data is messy, historical, and inconsistent. The mistake many teams make is treating this as a tooling problem.

It is not.

It is an architectural problem that requires layered strategies, validation, fallback mechanisms, and clear confidence signals.

For fintech and banking teams, the real challenge is not extracting data from PDFs, it is ensuring that downstream systems can trust the data that survives extraction.

That is the difference between a demo and a production system.