One of the many things I love about p2p lending is the transparency. Any investor can download the entire loan history of Lending Club and Prosper and analyze it for themselves. Not only that but the financials of both companies are publicly available. So, it is in this spirit of transparency that I share my own returns every quarter. You can see all my historical returns here.

Before I get into this quarter’s returns I need to point out that I made an arithmetic error last quarter. I stated my overall returns as 11.09% but when I went back and checked my numbers I realized that I had overstated that number. My actual return for the second quarter was 10.89%. My second quarter report has been updated with the correct numbers.

Total Return for all Accounts is 11.62%

This past quarter was the best ever for my p2p lending investments. My trailing 12-month (TTM) return came in at 11.62% which is the highest it has ever been. Like many investors I started out investing in a conservative way but about two and half years ago I shifted my strategy to focus on the higher yield loans. This has meant that every quarter for the past two years my TTM return has increased.

The table below shows the breakdown of my returns for all six accounts that I have at Lending Club and Prosper.

[table id=46 /]

When looking at this table you should keep the following points in mind:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Age column shows how old on average the notes are in each portfolio. Because I am reinvesting all the time this number changes slowly.

- The XIRR ROI column shows my real world return for the previous 12 months. I believe the XIRR method is the best way to determine your actual return.

- The Return on Site number is obtained from the platforms on the last day of the quarter.

Now, I will dig a little deeper into each account and provide some commentary on the numbers in the table.

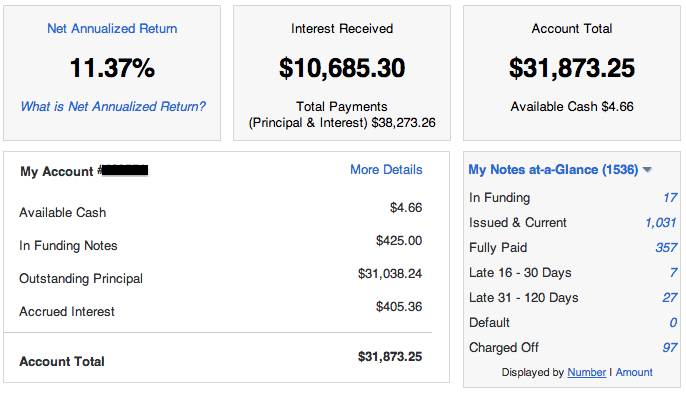

Lending Club Main

[Update: Accrued interest has now been removed from the Lending Club account page so the following paragraph is now a moot point.]

The first thing I want you to notice about this account is the account total. The screenshot above was taken on the last day of the quarter and you can see that my account total displayed on the screen ($31,873.25) was almost $400 more than what was on my statement (from the table: $31,482.85). This is because Lending Club includes accrued interest in your account total on LendingClub.com but in the statement it does not include this number.

This is my original Lending Club account that was opened in June 2009, back when I really had no idea what I was doing when it came to p2p investing. I did no filtering back then and let Lending Club choose the notes for me with their portfolio builder tool. And I wasn’t very diversified either. About three years ago I started being more selective in my loan picking and for the past 12 months or so I have been using P2P-Picks for most of the reinvestments in this account. So far, I have invested $15,900 in 629 notes through P2P-Picks at a weighted average rate of 18.03%.

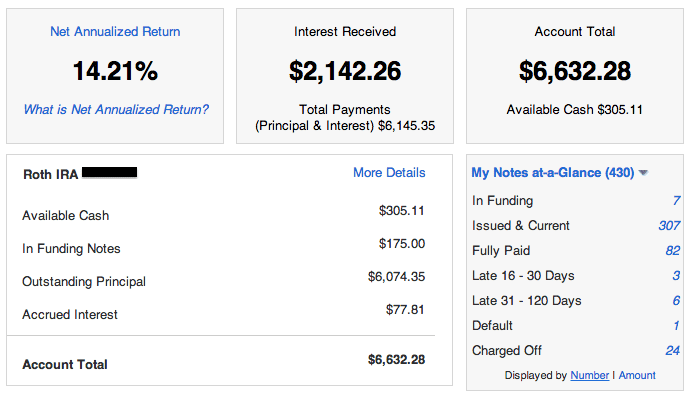

Lending Club Roth IRA

My first Lending Club Roth IRA was opened with $5,000 in April 2011. One important point to note about this account is that I have only ever invested in high interest loans so I have seen a steady decline in returns as the account has aged. This past quarter saw my TTM fall from 11.62% to 10.82% as I was hit with several more defaults.

What is curious to me is how the Net Annualized Return in the screenshot above is so much higher now than my TTM return. We are talking over 3.5% higher. The main reason is that I am using a very different method to calculate returns. The Net Annualized Return is an annualized number that looks at the outstanding principal of all notes in the portfolio and my calculation is focused purely on net interest earned in the past 12 months. And my Net Interest earned actually went down this quarter over last quarter.

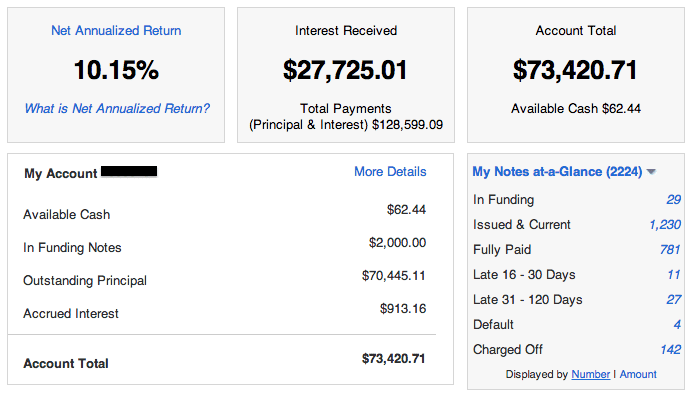

Lending Club Traditional IRA

This was my best performing account this quarter and the main reason that my overall return jumped so much. This is actually my wife’s IRA that I opened in April 2010 when I rolled over several different 401(k)s and IRAs into Lending Club. It was opened as a PRIME account but in November 2011 I took the account off PRIME and began managing it myself. I also decided to get more aggressive with this account.

In the past three months I have gone from a TTM return of 10.57% to 12.51%. I went back and double checked these numbers because I was surprised by such a large jump. It was helped by the fact that the vast majority of my lower interest notes have now been paid in full and the bulk of the outstanding principal is now higher interest notes. In the early days of this PRIME account my weighted average rate was around 12%, today that number is close to 17%.

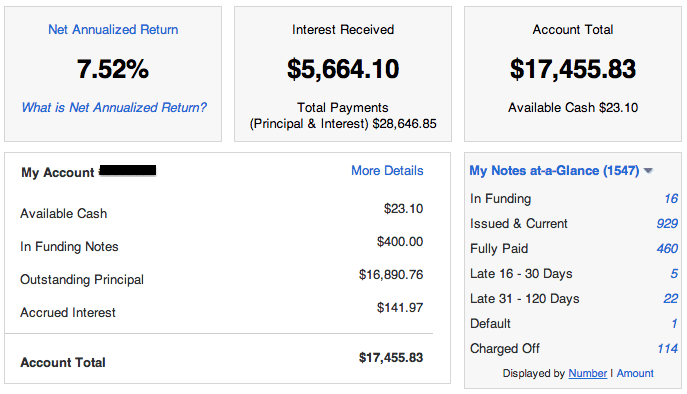

Lending Club Roth IRA – 2

This Roth IRA account is also in my wife’s name and it was opened at the same time as the traditional IRA back in April 2010. It was also setup as a conservative account using Lending Club PRIME. And I kept this account on PRIME until just a couple of months ago. The main reason I kept it on PRIME for so long was that I wanted to see the kinds of returns an investor could expect from a moderate risk PRIME account.

If you have been following along you will have noticed that the TTM returns have been in the 5-6% range for the last 18 months. My experiment has now ended and I will be reinvesting with my higher interest strategy from now on. It will take a long time but I expect in the next 12-18 months I can bring this account into double digit returns as well.

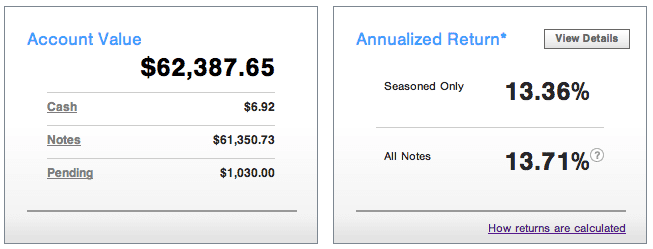

Prosper Main

My first Prosper account is now three years old. I opened this account with $1,000 back in September 2010 and have added to it steadily over the last three years. I have invested a total of $50,000 into this account now but that is all I will be doing. Any new investments in Lending Club or Prosper now will be coming through an IRA.

Returns have been in the mid-teens for this account for quite some time but the TTM has stabilized in the 12%-12.5% range for now. I will be very happy if it stays that way. My weighted average rate of notes in this account is 24.2%, it is primarily invested in grades C, D, and E.

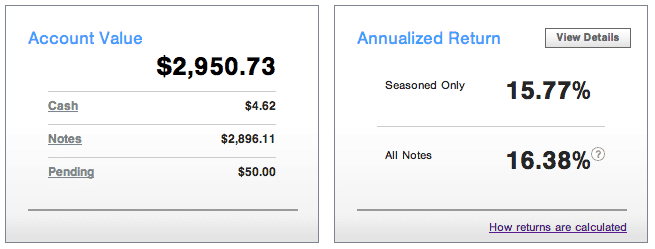

Prosper – 2

My smallest account has been my best performing account every quarter since it was opened back in April 2011. Back then Prosper ran a promotion where they gave away $104 to any investor who opened an account. So, I had my wife open an account then and have since added $2,000.

I have been wondering when these lofty 16% returns were going to adjust to a more normal level and it appears this quarter was it. My TTM has dropped from 15.87% down to 12.36% in the past quarter thanks to several new defaults. The weighted average rate on this account is 27.74%, the highest of all my accounts. I should also note that both my Prosper accounts have an average age of around 12 months so they are the least seasoned of all my accounts. This could mean my returns here will continue to drop. We will see.

Final Thoughts

I couldn’t be happier with the overall performance of my p2p lending investments this past quarter. My goal has been sustainable double digit returns and I am confident I have achieved that now. Of course, who knows what the future holds but this now marks my fifth consecutive quarter of real world double digit TTM returns. It also marks my 8th consecutive quarter of TTM return increases. I don’t know how much longer I can keep that streak going because I don’t think my overall returns will head over 12%.

Finally, I always like to focus on the Net Interest number because, while returns numbers are nice, it is only the net interest number that shows you the real dollars earned. This number is now almost $20,000 up from $18,000 in the previous quarter. I will update these accounts again in three months. I am happy to respond to any questions or comments you have about these numbers.