In this Holiday shortened month Lending Club and Prosper have a lot to be thankful for. November was another robust month as the industry continues its steady growth upwards. Between the two companies they issued $280.0 million in new loans up from $273.1 million last month and from $99.8 million in November last year.

Lending Club Crosses $3 Billion in Total Loans Issued

They waited until the last business day of the month but Lending Club crossed another major milestone this month. The $3 billion milestone came just over 12 months since they first crossed $1 billion and less than five months since they crossed $2 billion.

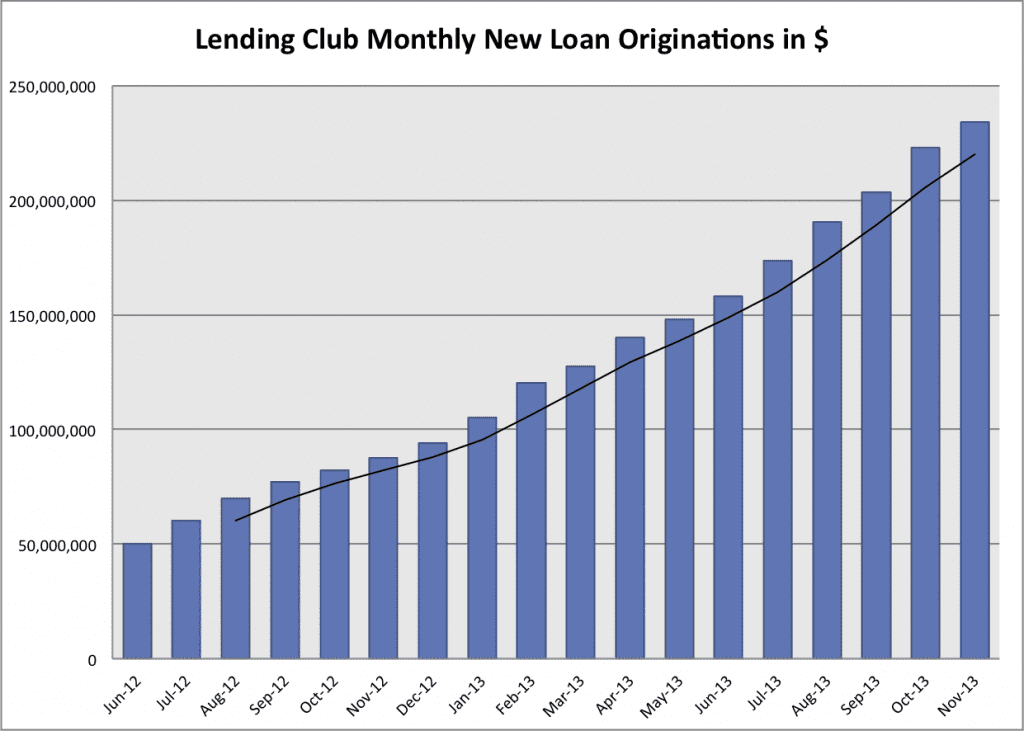

Their total volume of new loans issued in November was $234 million up from $223 million in October. They are now on an annual pace of $2.8 billion in loans, a pace that continues to increase every month. Although, the 4.9% month over month growth marked their slowest monthly growth of the year – no doubt impacted by the four day Thanksgiving long weekend.

Below are the monthly statistics for Lending Club as well as the 18-month loan volume chart. (Note: FICO has been removed from the download file so I could not track it this month).

[Update: Lending Club does still make FICO available in the download file but you have to be logged in to your Lending Club account to see this. If you are not logged in you will see the file without FICO scores. FICO was removed from the public file “at the request of our credit reporting partners” said Lending Club in an email to me about this.]

Average loan size: $13,884

Average dollars issued per business day: $12.3 million

Percentage 36/60 month loans: 77.4%/22.6%

Average interest rate: 15.5%

Percentage of whole loans: 35.8%

Total Policy Code 2 loans: $17.6 million (7.5% of the total)

Prosper Issues $46 Million in New Loans

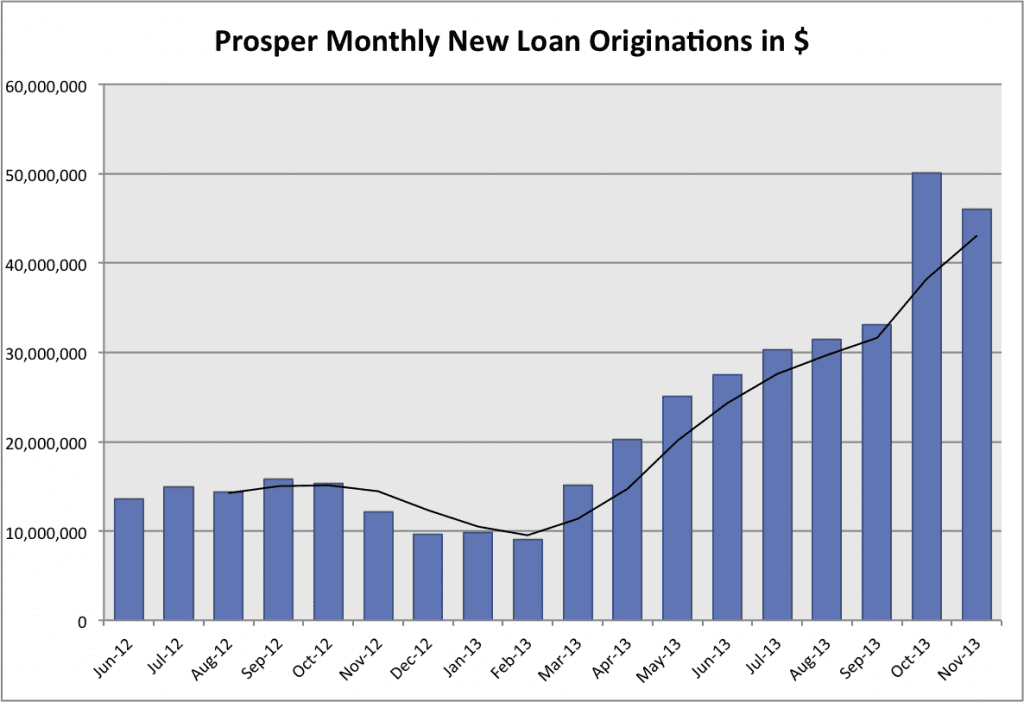

We were told this was going to happen. Prosper had said that their overall loan volume in November would be less than October and that is what happened. But the totals can be misleading because every month has a different number of business days and October was the biggest month of the year with 23 business days. With the Thanksgiving holiday we had just 19 business days in November.

With that in mind, we can see that Prosper’s average daily loan originations actually went up substantially this month. In October they averaged $2.2 million in new loans per day whereas in November they averaged $2.4 million per day. Prosper’s president Aaron Vermut told me that they are not trying to hit any specific monthly goal but instead trying to grow the amount of loans issued per day. So, as you can see I am now tracking that metric.

Here are some of the stats from this month as well as Prosper’s 18-month loan volume chart:

Average loan size: $10,980

Average dollars issued per business day: $2.4 million

Percentage 36/60 month loans: 66.8%/33.2%

Average interest rate: 17.3%

Percentage of whole loans: 63.5%

Average FICO score: 700