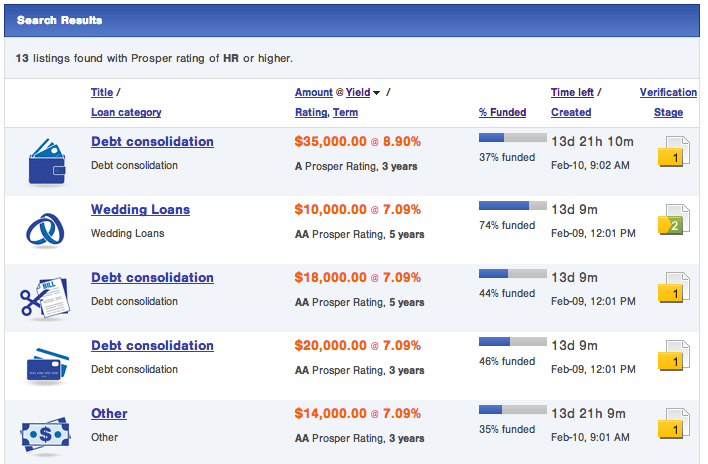

For some weeks now the number of loans available to retail investors on Prosper has been paltry. The above screenshot is pretty typical. Just a handful of loans available and all have a AA or A Prosper rating (loan grade). If you want to invest in higher interest loans, even B or C grade, then you are out of luck.

But keep in mind every day there are many other loans available; Prosper adds new batches of loans regularly (at 9am and 5pm PT on weekdays, noon on weekends). And during this time there are a number of loans available from a wide range of loan grades. But what happens is this. Within seconds pretty much every loan with a loan grade of B or below is fully invested. Large investors have been dominating the retail platform and that is leaving very little for the average investor.

Platform Dominated by Institutional Investors

I spoke with Prosper’s president, Aaron Vermut, about this problem last week. He acknowledged that Prosper has let the scales tilt too far in favor of the institutional investor. He also said that Prosper is fully aware of the problem and is in the process of making some changes.

One of the issues is that institutional investors have been able to invest in the fractional platform at up to 50% of a loan. So, it only takes two large investors to close out a loan immediately. And that explains most of the loans being fully funded in seconds.

“Clearly the 50% limit for institutional investors is not working,” said Vermut. “We are making some changes here that will help to level the playing field. I can tell your readers this – the future at Prosper is going to continue to have retail investors as an important part of our platform.”

A 10% Limit for Loans on the Retail Platform

Here is the big change. Over the last week Prosper has contacted all their institutional investors and told them to limit themselves to 10% of the loan amount on the fractional (retail) platform. Prosper is evaluating this change and may make this permanent by programmatically putting in a hard limit for every investor on the retail platform. Already, we are seeing loans stay on the platform longer. Last night when 36 new loans were added, 29 of these loans were still available for investors ten minutes after they were added.

As to be expected this move is not being welcomed by some of Prosper’s largest investors. Institutional investor interest has never been stronger but Vermut said that he is having to say no a lot lately. But he sees this as important. He is committed to maintaining a more balanced mix of investors at Prosper.

Prosper clearly had to do something. I have received many emails from disgruntled Prosper investors and you only need to read the forum to hear what many of these investors have to say. Prosper was in danger of losing a good chunk of their retail investor base.

Vermut also said that Prosper has stopped taking on new institutional investors and no funds are being approved to take on new leverage. I am sure that is going to disappoint some of the hedge funds out there but it is understandable given how far the pendulum had swung in their direction.

The Weather is in Part to Blame

Even with the increased investor interest Vermut said there should have been more loans on the platform in the last week or two. February has started out slower than expected because of some weather related delays. Some promotional mailings have been delayed due to the winter weather and that has caused fewer borrowers to apply for loans. There was also a couple of technical glitches that caused fewer loans to be added (this issue has since been resolved).

One final interesting tidbit that Vermut shared with me was this: “Despite the lower loan supply retail investor inflows have remained positive. And we want to keep it that way.”

I would like to hear from you? Have you noticed more loans available in the past week or so? I am always interested to hear your thoughts.