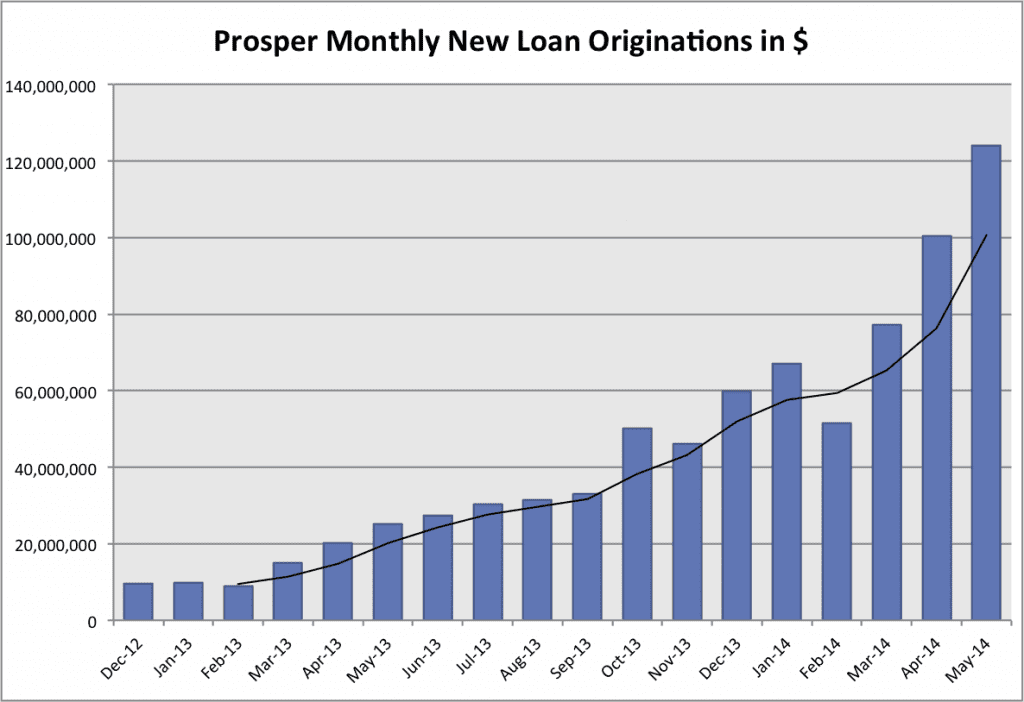

Prosper has maintained their incredibly rapid growth this past month and issued $124 million in new loans in May, up from $100.3 million in April. Even more impressive is that they issued just $25 million in loans one year ago.

You can see the three month moving average (the black line in the chart above) has steepened sharply the last three months. Clearly the marketing initiatives that Aaron Vermut talked about last month are bearing fruit for Prosper.

What is even more important to everyday investors than this impressive growth in loan originations is the number of loans available at any one time. And this increase has also been dramatic. Just three months ago Prosper only had 50-75 loans available to investors on their Browse Listings page – today that number is at 350-400 loans. There are even a few of the higher yielding loans staying on the platform for more than just a couple of minutes. But, as has been the case for months now, the majority of available loans are AA and A grade loans.

Below are some of the stats from loans issued in May. The average loan size is at an all time high of $13,281 and the average borrower interest rate is at an all time low of 14.79%. This means that Prosper is issuing larger loans at a lower interest rate than before as their loan book becomes more conservative. The other data point I found interesting is that, even with more loans available for retail investors, the vast majority of loans originated by Prosper go to their whole loan buyers with just 11% being made available on their retail platform.

Average loan size: $13,281

Average dollars issued per business day: $5.6 million

Percentage 36/60 month loans: 64.3%/35.7%

Average interest rate: 14.79%

Percentage of whole loans: 89.0%

Average FICO score: 699

Note: If you are wondering about the Lending Club numbers this month they have unfortunately stopped updating their new loan data.