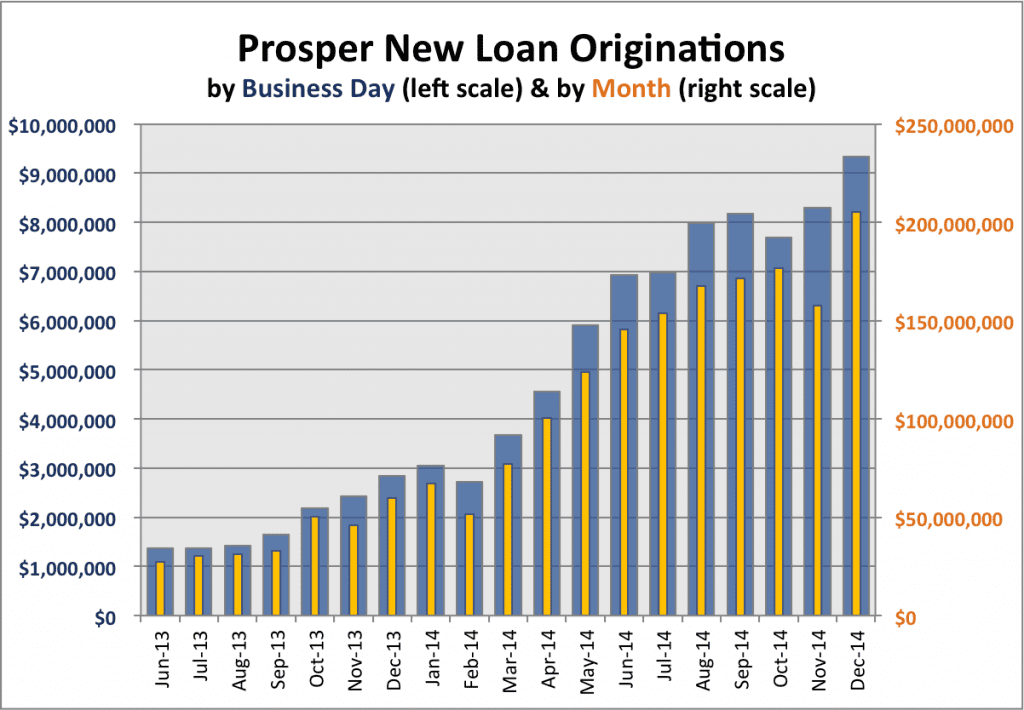

The year 2014 will certainly go down as the best year in Prosper‘s history. They built on their success of 2013 and created some amazing momentum this past year. As you can see in the chart above Prosper had a record month in both total volume and volume per business day. Not only that but in the third quarter of this year they made a profit for the first time.

The recent numbers speak for themselves. Prosper issued $205 million in new loans in December bringing their 2014 total to just under $1.6 billion. This compares to $60 million in loans last December and “only” $357 million in total loans issued in 2013. That is a staggering 347% year over year loan growth. In the fourth quarter Prosper issued $540 million in new loans, the first time they have issued more than half a billion in loans in a quarter.

After a successful Lending Club IPO the team at Prosper have got to be feeling pretty good about themselves. I am going to have the Prosper CEO, Aaron Vermut, on the Lend Academy Podcast later this month so we can explore some of the stories behind this growth and their plans for the future.

Below are the some of the stats from the December data that Prosper makes available for download to all investors. One interesting point to note last month is that the percentage of 36-month loans was at an all time high. These loans typically carry lower interest rates than 60-month loans, so this resulted in the lowest monthly average interest rate ever.

Average loan size: $13,369

Average dollars issued per business day: $9.3 million

Percentage 36/60 month loans: 69.0%/31.0%

Average interest rate: 14.1%

Percentage of whole loans: 91.5%

Average FICO score: 697