French fintech has been nipping at the heels of the UK and Germany for some time.

2021 was their year. With $13 billion in investments, $34.6 billion in exits, and $1.8 billion in early equity rounds, France secured their status as a start-up industry to watch.

Moving into 2022, in January alone, Payfit, Ankorstore, Qonto, Exotec, and Spendesk achieved unicorn status, breaking the target of 25 by 2025 set by President Macron 3 years early. Macron has since established a new record to reach 100 by 2027.

“The sector is rapidly accelerating in part due to a dynamic demand by the younger demographic (18-35 year-olds) for technology-enabled solutions and a search for diversity and reduced costs,” said Ouarda Merrouche, Professor of economics at Universite Paris Nanterre and EconomiX UMR CNRS.

High costs of traditional banking services and an influx of VC capital have driven the industry.

It seems all are in favor of the growing sector, “The boom is helped by strong tax incentives for (R&D) investors,” continued Merrouche.

“A strong network of VC and business angels is an asset, helped by multiple regulators and the central bank’s initiatives (e.g., Fintech Forum, Fintech Innovation Unit at ACPR).”

Vive La FrenchTech

Groups such as La French Tech are at the forefront of the French fintech movement. The organization brings together start-ups, policymakers, community builders, and investors in the push to develop the fintech sector. It is through these think tanks that France continues its momentum.

Merrouche explained that a more robust market diversification accompanied the recent developments in the French fintech sector. Credit, payments, and insurance services are some of the many new areas fintech start-ups have addressed in the last year.

Related:

Adoption rates have risen and are projected to continue as more users within France turn to alternative sectors.

According to Statista, although the number of users of digital payments may stay around 51 million between 2022 and 2026, the adoption of neobanking, Digital assets, and Digital investment is expected to rise. An influx of alternative funding sites half focused on SMEs has supported the industry.

On track to compete with London

“The government’s desire to support innovative sectors has been expressed in Macron’s presidential address,” said Merrouche. “If this trend is sustained for a few more years, France (Ile de France) will certainly become a serious competitor to London.”

For many, diversity is a significant instigator of innovation in fintech. Since the implementation of Brexit, diversity of talent has shied away from the UK due to strengthened restrictions for work visas, turning instead to European capitals such as Berlin and Paris.

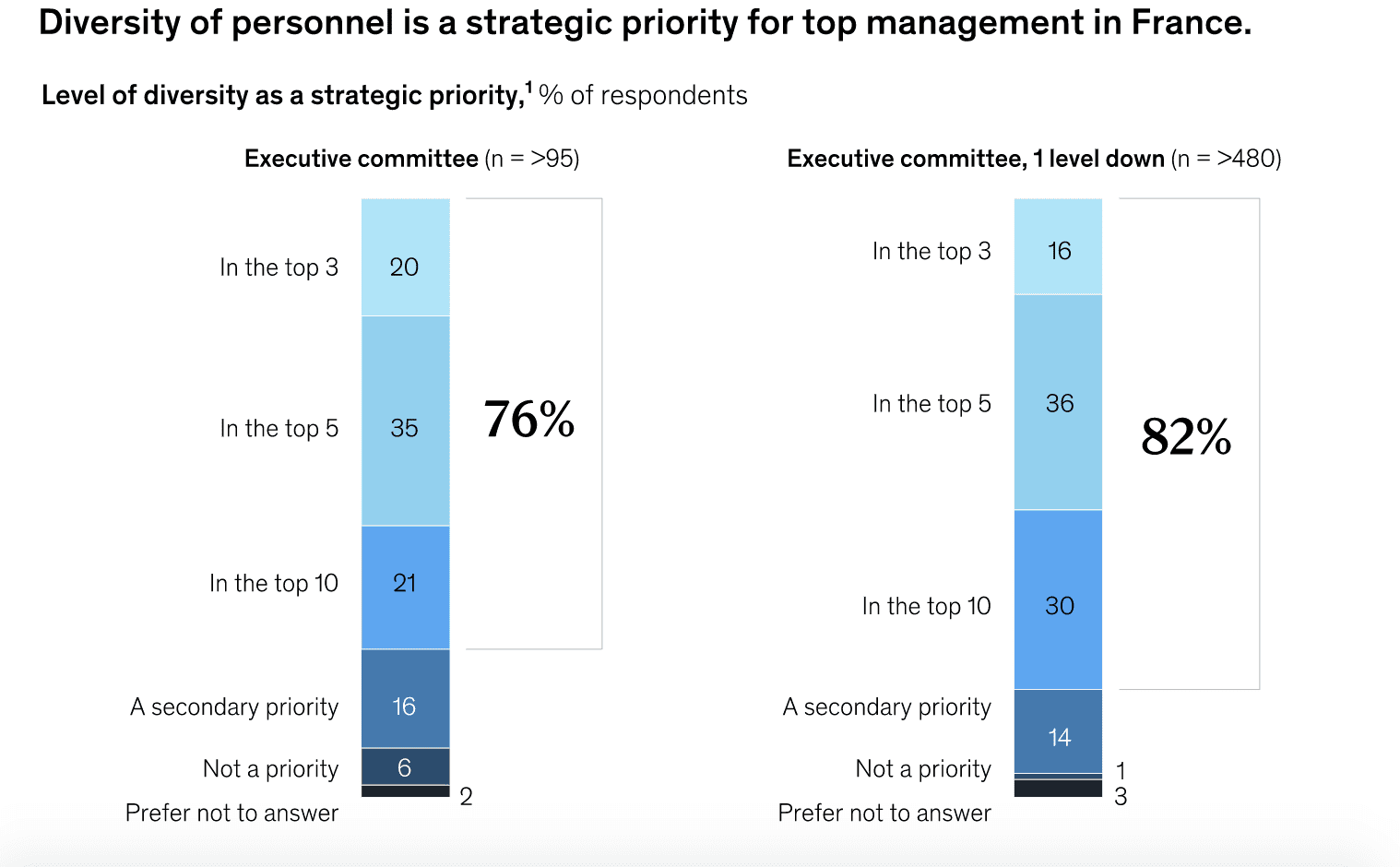

In partnership with McKinsey, Club 21e Siècle has created the French Corporate Diversity Barometer. The barometer is designed to measure, for the first time in France, the sociocultural diversity of the executive ranks of large companies and to help organizations advance in this area.

In the creation of the barometer, it was found that a significant majority of leaders have turned to the issue of diversity as a strategic priority. Nearly half of executives came from diverse backgrounds, with 39% of foreign ancestry, a proportion that mirrors that of the French population.

The focus on diversity at a time when the UK’s access to diverse talent is limited, in conjunction with the supportive environment, could give French fintech the edge to progress faster than their competitors.

Regulatory framework holding French fintech back

The underlying issue which restricts France is its regulatory framework. Like many regulators, action is slow. The tangle of laws and guidelines was further complicated with the added layer of European legislation.

“The regulatory framework is still unclear and subject to progress at the EU level, which is a slow process,” said Merrouche. “France has not opted for a regulatory sandbox like the UK. They have opted for a “level playing field”: for the same type of services, exists the same regulation.”

“Regulation is dense and complex to navigate. Our research shows that the UK sandbox has contributed to a massive increase in VC capital and reduced the number of failures and increased innovation activity by the targeted fintechs.”

For Merrouche, extensive work is needed for the regulatory environment to support innovation within the sector further to retain a competitive edge. “In this context, more and clearer regulation is not a hindrance to innovation; it is a booster of innovation because, in financial services, investors expect to be reassured that companies comply with the rules as they risk closure if not.”