As Ryan wrote last week in an article about an industry-wide push into online retail point-of-sale financing, Affirm is changing the game for many retail brands. Ryan wrote about the partnership between StubHub and Affirm, wherein Affirm underwrites major ticket purchases (think SuperBowl) and books the interest on a 12-month payback that ranges in annual interest from 10% to 30%. In other cases the partnership can look very different. Take the popular smart exercise equipment brand Peloton.

I’ve been a studio cyclist since the 90s, when studio cycling was called spinning, and the only spinning studios were at the local YMCA. Yet as we closed out the second decade of the new millennium, the studio cycling hype had reached a fever pitch. Peloton had arrived, and the very real possibility of enjoying a high quality in-home studio experience became real.

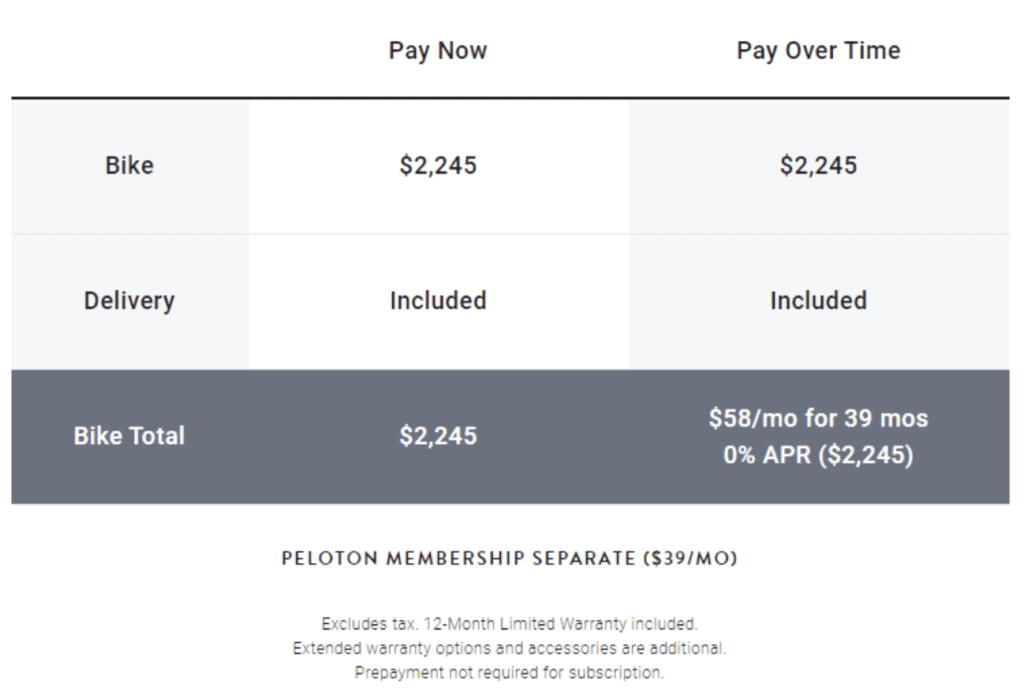

Even for a gearhead like me, the steep cost of entry remained a barrier to adoption. While the monthly membership for Peloton is a modest $39/month, one needs to purchase an in-home bike — or treadmill, pick your poison — to get started, and the bike lists at $2,245. Yowza. If it weren’t for the up-front cost, I would have adopted Peloton immediately. As it was, I didn’t buy in, and instead continued to drop in on my local FlyWheel studios for $28/ride.

Enter Affirm, which offers up to 39 months of interest-free financing for the purchase of a Peloton bike directly from the Peloton website. That caught my attention, and closed the deal. Affirm’s financing option eliminated the large up-front expense and replaced it with a $58/month commitment. All-in, I’m looking at less than $100 for the complete experience, including paydown of a 0% APR loan. With this capability, Affirm effectively eliminated a material barrier to entry, making the Peloton purchase decision a slam-dunk for a household like mine, which has several cycling enthusiasts under one roof.

The results? For Peloton, this massively expands their addressable market. This 2018 case study points to a 15% increase in conversion rates after it deployed Affirm’s financing solution. The company has effectively expanded its ability to capture an “increasingly mass market audience” by using Affirm’s 0% APR financing option as a customer acquisition tool. As of 2018, Affirm sales accounted for close to 30% of Peloton’s monthly online business sales. That, my friends, is market expansion.

Now, Affirm can afford to offer 0% financing because they are being compensated directly by Peloton. There is no deferred interest, it is a true 0% financing deal.

The results for the Brustkern family are almost as impressive. We now get 24×7 access to the entire Peloton video library, including individual logins for each member of my family. At this rate, even with the monthly amortization of our bike purchase, we are going to do about 40 workouts this month as a family. That’s just a touch over $2 per session, which compares pretty favorably to what we were doing before. That, mis amigos, is a win-win.

As Ryan rightly pointed out, Point of Sale financing has massive potential. While total credit card debt keeps expanding the younger generation are opting out. They are much more likely to be open to a fixed term deal, particularly with 0% interest, than financing a large purchase on a credit card. Instead of a credit card bill with multiple purchases they will have multiple fixed term loans on their bank statements. This is a more financially responsible than taking 20+ years to pay down a credit card bill.

=============

Bo Brustkern is the co-founder & CEO of LendIt Fintech. He can be found on Strava at https://www.strava.com/athletes/bbrustkern