With compliance regulations evolving regularly and becoming more demanding in recent years, banks and fintechs have had to devote more resources to keeping up with the shifting regulatory landscape and changing customer expectations.

The stakes are high. Not only do banks and fintechs face sizable fines and other regulatory punishments — such as product shutdowns and prison sentences — for failing to adhere to compliance rules, but they can also run afoul of their most important allies: consumers. The appearance of instability and untrustworthiness can shake the all-important relationship between banks/fintechs and their customers to their core.

For its 2023 State of Compliance Benchmark Report, Alloy – a company that offers more than 500 banks and fintechs an end-to-end identity risk solution and connects clients to more than 190 sources of identity, fraud, and compliance data – surveyed more than 200 professionals working in compliance-related roles at fintechs to learn more about their organizations’ compliance strategies.

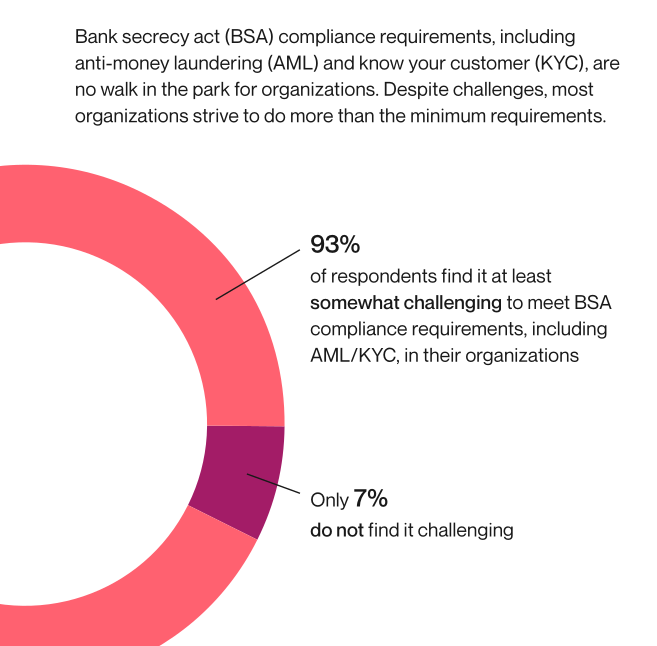

Alloy reported that 93 percent of respondents find meeting regulatory requirements at least somewhat challenging.

The same report found that 55 percent of those surveyed identified a lack of automation as one of the biggest obstacles to meeting compliance requirements laid out by the Bank Secrecy Act. Unsurprisingly, 55 percent are using artificial intelligence (AI)/machine learning to help reach those goals. Another 29 percent are exploring using AI/machine learning for that purpose.

Fintechs that use automated, data-backed systems to streamline compliance processes report being able to more effectively satisfy regulatory requirements such as Consumer Financial Protection Bureau regulations, anti-money laundering regulations and sanctions issued by the Office of Foreign Assets Control.

Data orchestration is an automated process that takes siloed data from multiple points, organizes it and makes it usable for analysis, helping firms move to an automated, holistic approach, which is helpful for:

- Complying with AML regulations.

- Expediting the creation of suspicious activity reports by making real-time data more accessible.

- Helping teams identify potentially suspicious activity by finding how inconsistencies fit together to form a larger perspective.

For banks, compliance is becoming more challenging as new guidance issued jointly in June by a trio of federal financial agencies – the Federal Deposit Insurance Corporation, the Federal Reserve Bank and the Office of the Comptroller of the Currency – gives them strategies for managing their third-party relationships, including those with fintechs.

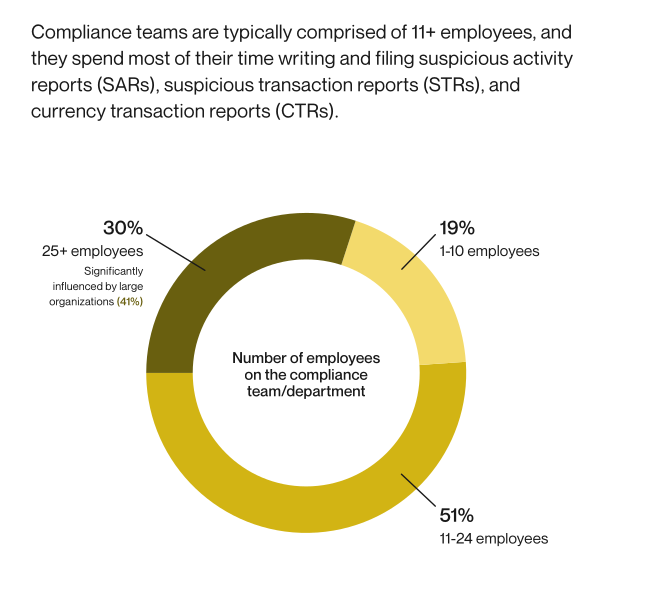

Alloy’s report shows that fintechs have started to invest more heavily into meeting requirements set out by partner financial firms in light of the recent changes to guidance. It reveals that 51 percent of fintechs surveyed employ compliance teams of 11-24 people, while 93 percent express that they use at least one third-party platform to assist with compliance management.

To explore how Alloy can help organizations keep pace with regulatory compliance at onboarding and throughout the customer lifecycle, explore their compliance tools and schedule a demonstration.