The financial world is no stranger to fraud. According to a study by the Federal Trade Commission, fraud rates have increased consistently over the past three years. In 2022, consumers lost over $8.8 billion to scams.

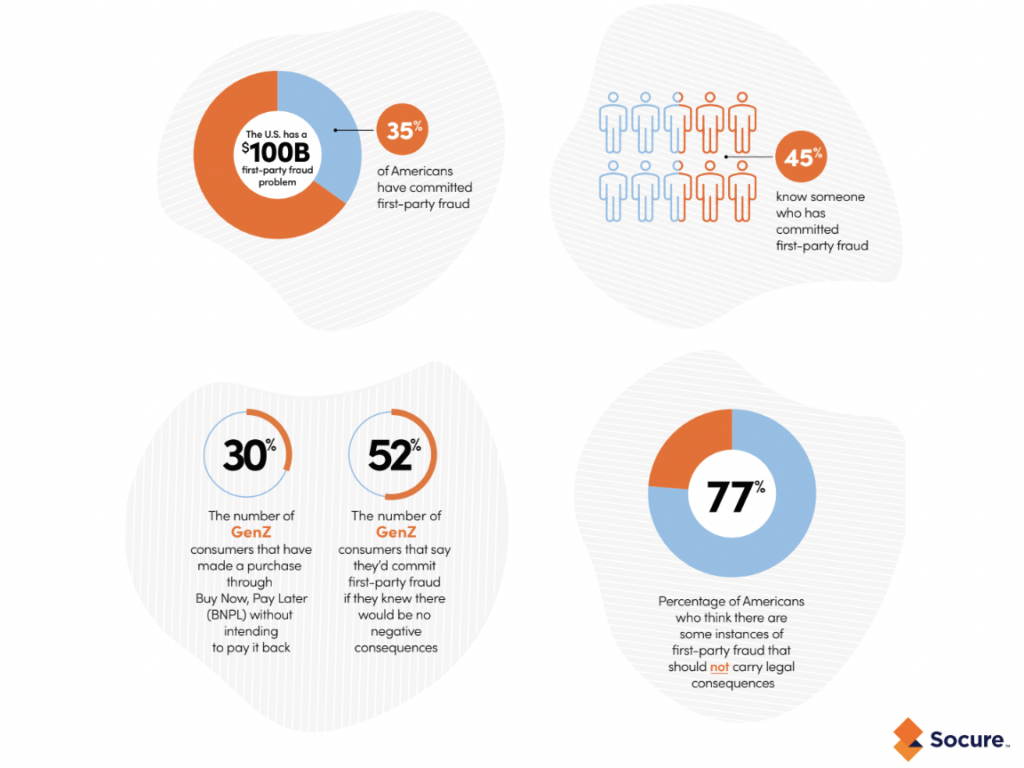

However, there is another beast that has plagued financial institutions and merchants. One that over 30% of Americans participate in, racking up over $100 billion in losses for targeted enterprises. First-party fraud.

An Everyday Occurrence

First-party fraud refers to consumers’ use of their own identity to “commit a dishonest act for financial gain.” This can take the form of requesting a refund for an item that had “not been delivered,” even though it stands, pride of place, on the consumer’s living room floor, maxing out a credit card with no intention to pay it off, or disputing a legitimate transaction.

“America has an enormous first-party fraud problem that we’ve swept under the rug for too long. Countless consumers take advantage of a system with little to no consequences, despite causing billions in losses,” said Mike Cook, Vice President, Fraud Product and Investigations at Socure.

In a study carried out by Socure, whose results were released yesterday, October 23, 2023, the practice has almost become commonplace. One in every three adults admitted to committing first-party fraud themselves, and 40% said they knew of others who had done so. Younger generations were found to be more likely to commit first-party fraud, with 52% of GenZ respondents admitting to having done so; 19% didn’t believe the practice to be ethically wrong.

Respondents’ primary rationale for committing first-party fraud was economic issues, and others said that it had happened by mistake. “First-party fraud can be hard to spot and even seem accidental in many cases—which has invited fraudsters to take advantage of this confusion to the tune of billions of dollars each year,” said Johnny Ayers, founder and CEO of Socure.

However, the study identified “telltale signs” that could differentiate accidental instances and times that could be a purposeful attempt at financial gain.

Repeated First-Party Fraud Leaves Its Mark

While many respondents stated that their first-party fraud had been accidental, Socure found many were repeat offenders. Ayers explained that over 40% of fraudsters commit first-party fraud again less than 60 days after their first “fraudulent event.”

“While many may feel that first-party fraud is a victimless crime, this blossoming culture of unalloyed theft is driving higher costs for every single consumer,” said Cook.

Ayers elaborated in a statement, explaining, “First-party fraud not only unnecessarily drives up costs of goods for the average consumer, but can also quickly escalate to involve money mules, many of which funnel money directly to larger criminal organizations.” The existence of multiple offenders, therefore, posed a significant issue to financial institutions.

After analyzing “hundreds of millions of transactions beyond the standard credit report,” Socure identified key indicators of instances where first-party fraud could be purpose-driven:

- “Fraudsters were found to often use newly created identity contact elements such as email, address, and phone numbers to create new accounts (oftentimes during the same week), most likely in an effort to avoid follow-on collection attempts.

- Consumers who have two or more closed accounts associated with first-party fraud are 189 times more likely to commit fraud again.

- The more users are on an account, the more likely first-party fraud will occur. For instance, accounts with five or more registered authorized users are 22 times more likely to be linked to fraud.

- An account closed within 90 days from opening is three times more likely to have committed first-party fraud.”

Multiple attempts were also spread across different platforms, which could be an attempt to elude detection, according to Socure.

An Industry-Wide Approach

In order to combat increased instances of repeated fraud, Socure stated the industry was in need of a coordinated approach.

Yesterday, October 23, the digital identity platform announced the launch of a solution, Sigma First-Party Fraud, to help institutions combat the threat. The solution is powered by the First-Party Fraud Consortium (FPFC), also launched on October 23, which is an industry-wide attempt at pooling data to detect and prevent first-party fraud.

“We designed the industry’s first holistic first-party fraud solution with many of our strategic partners to break down data silos and bring together top industry players to thwart repeat first-party fraud abusers in their tracks,” said Ayers.

The Consortium, including Socure’s partners, SoFi, Varo, and Dave, launched with 50 million active accounts and plans to rapidly increase the scope to 200 million. Data will be shared between members into Socure’s Sigma solution, which will then analyze millions of consumers’ transactions to identify instances of fraud.

Just under half of the FPFC’s members have overlapping customers, which Socure stated made collaborative data sharing all the more valuable. Using this approach, the company said it could identify fraudulent behavioral patterns that may have otherwise been mistaken as legitimate if not for the identification of repeat fraud across providers.

“It’s time for our industry to share intelligence, create a widely accepted definition that focuses on these fraudulent behaviors, and push for regulatory changes that will close loopholes for those carrying out these all-too-common acts,” said Cook.

RELATED: USA 2023: First Party Fraud: Vulnerabilities Across the Customer Journey