[Editor’s Note: This is a guest post by Jorrit van Rijswijk, an Analyst at Dynamic Credit/LoanClear]

EU member states have been quick to announce stimulus packages, and other measures, aimed at supporting key sectors of their economies. In the face of potentially severe revenue contractions for SME’s it is critically important that countries and lenders work together to support sound companies that would in normal times represent ‘good’ credit risk but need some assistance to get through the dislocations created by COVID-19.

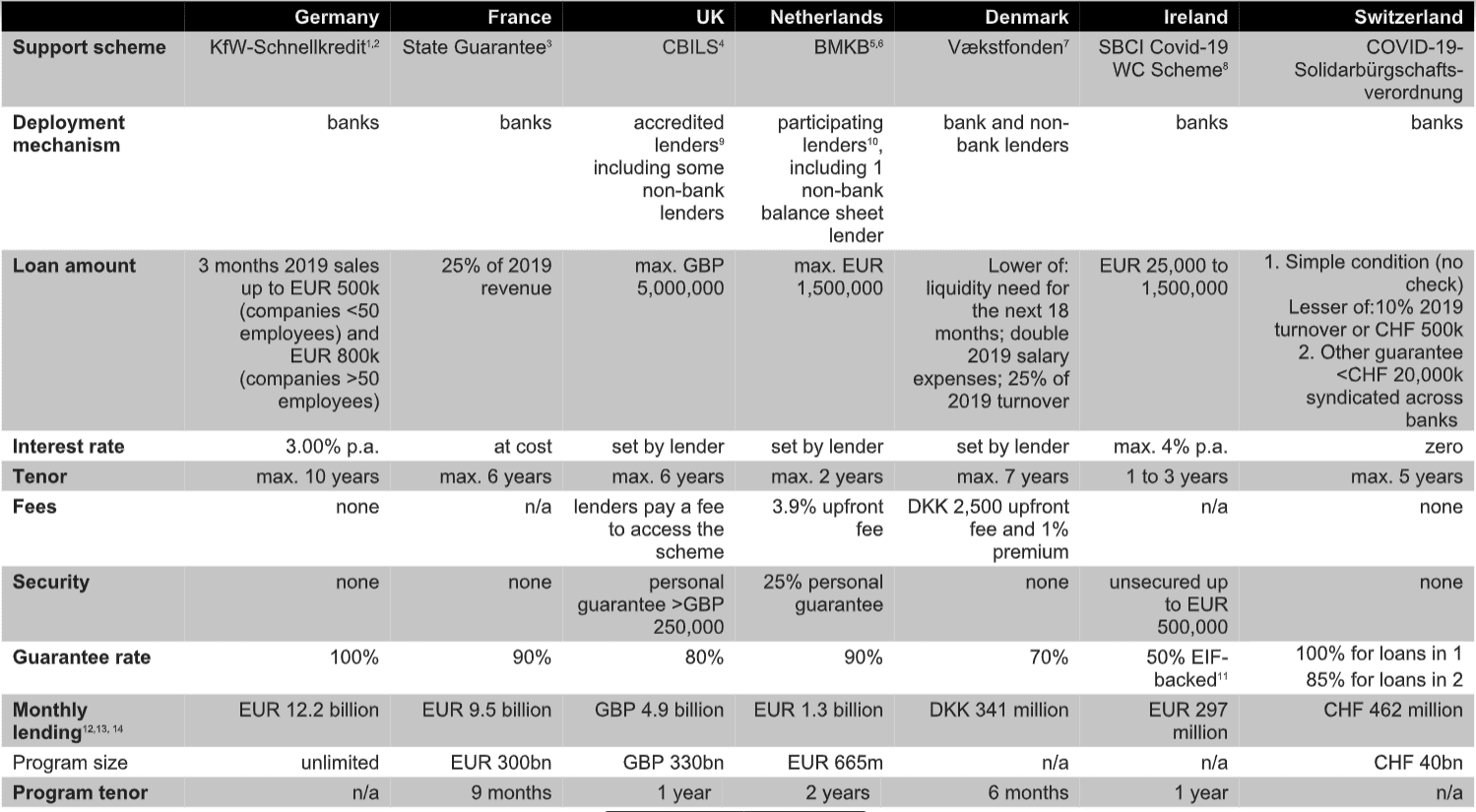

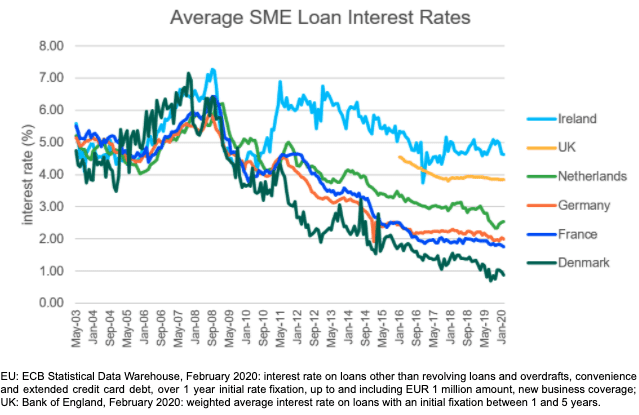

1Federal Ministry of Finance, 6 April 2020, 2 KfW, 6 April 2020, 3 BPI Financement, April 2020, 4 Britsih Business Bank, April 2020, 5 Rijksoverhied, April 2020, 6 RVO, April 2020, 7 Vækstfonden, April 2020, 8 SBCI, April 2020, 9 British Business Bank, April 2020, 10 RVO, April 2020, 11 EIF, April 2020, 12 ECB Statistacal Data Warehouse, February 2020: Loans other than revolving loans and overdrafts, convenience and extended credit card debt, up to and including EUR 1 million amount, new business coverage, 13 Bank of England, February 2020: UK, monthly gross lending to SMEs by MFIs, 14 SNB, January 2020: Credit lines to corporates with between 10 and 250 employees

The recently announced programs are coordinated at the national level by government, or quasi-government, bodies that, although often requiring explicit pre-approval, typically delegate the credit decision to participating lenders.1 This makes good sense as it should be ‘the market’ not the government, that identifies sound credits and prices the risk, and this should also ensure more rapid deployment of funding. However, with some exceptions, the support schemes are accessible only for banks – which has raised concerns on accessibility where the granting of loans still remains subject to generally less efficient bank-credit processes. By way of illustration, just 2,022 loans for a total of GBP 292 million was made available to UK SMEs via CBILS up to April 62, out of a total facility of GBP 350 billion, and several cases of Dutch SMEs being denied funds have also been reported3.

As pointed out by a number of commentators4, the non-bank lending sector can play a vital role in deploying the support made available by governments in areas where banks may be less capable of assessing creditworthiness in a timely manner. Numerous non-bank firms have proven their ability to rapidly assess SME credit worthiness but they often rely on the traditional banking sector to facilitate this lending, for example via warehouse funding. With the notable exception of Australia, nothing has been done to encourage banks to work with non-banks, to maximize credit creation. To maximize the efficacy of market-based solutions governments should move quickly to encourage established banks to work with non-banks and fintechs to assist in creating credit for SME’s.

In addition, non-bank lenders are highlighting that thus far government sponsored programs rely on existing loans being refinanced or new loans being taken out, which in both cases involves an inherently complex and slow process together with new capital. Governments are also being urged to explore loan payment extension schemes whereby existing borrowers are given a payment moratorium with the government providing a senior underwrite for a proportion of the loan. This provides faster assistance and relies on no new capital being provided and by putting the government in as the ‘senior’ lender ensures that the private sector is assuming most of the risk.

To ensure swift relief for the critically important SME sector governments must develop the initiatives already announced and recognise that the non-bank sector is well placed to assist. Assuming that good sense prevails, and state-backed SME loan support schemes do eventually become more accessible for non-bank lenders, the investors who were driving huge growth in the ‘private’ credit markets pre-COVID are likely to recognise an attractive risk/reward profile in SME lending versus the low yield environment that persists in other fixed income assets.

1Germany’s fast-credit program is a special case allowing for instant sanctioning of loans upon fulfilment of the eligibility criteria without further risk assessment.

2Based on figures compiled by industry body UK Finance and independently obtained by City A.M.

3Financieel Dagblad, Maart 2020

4Altfi, April 2020