Let’s face it, it is a real pain to switch to a new bank. Moving the payroll direct deposit has become easier thanks to fintech companies taking the lead on that. But what about all the subscriptions and payments coming out of that account? Who has the time to move all of those?

This is one of the reasons why the Director of the CPFB, Rohit Chopra, has been talking about the need for formal open banking guidelines in this country.

The reality is it is still too difficult and cumbersome to switch primary bank accounts. And we need to change that.

Today, there is news from Atomic that they have launched a new product suite called PayLink. What this will do is allow users to move their recurring payments without ever sharing their personal login credentials.

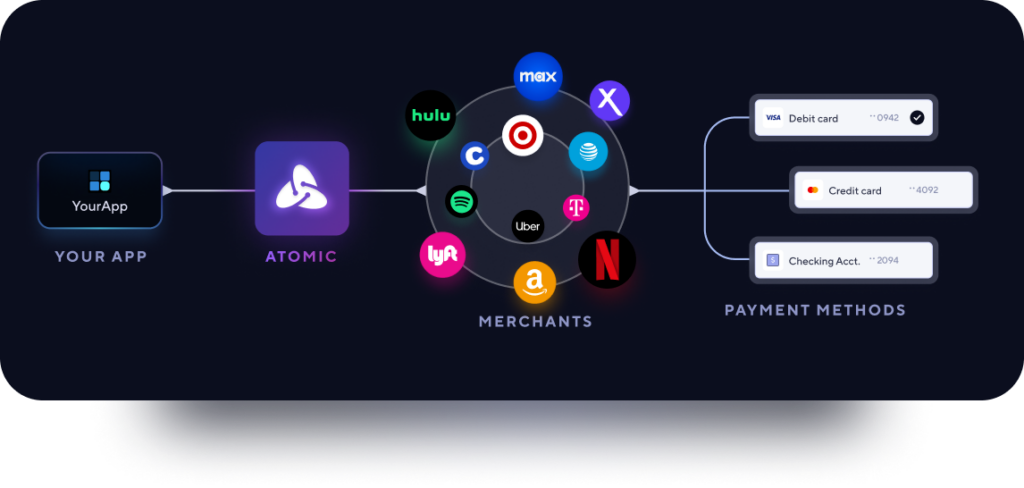

Similar to what Plaid has done for connecting bank accounts Atomic is doing for connecting external payments. Their API will take you to the login page for most major vendors, such as Verizon or Netflix, and then Atomic will do the account switching in the background for you.

I caught up with Atomic CEO Jordan Wright last week to talk about this new development. He was quick to point out that given the current regulatory environment, this is a product whose time has come.

“In the near future it is likely that banks are going to be required to make it easier for consumers to switch to another bank”, said Wright. But there is a lot of inherent friction in that process. PayLink is about removing that friction via direct connectivity to a merchant account.

Here is how it will work. A user of a bank or fintech that has PayLink will be able to login to their account and select a recurring payment, for example Netflix. Within the workflow, they will be asked to login to their Netflix account and Atomic will prepopulate the new bank account information and be able to update this in the background.

Atomic will tokenize the login request and never see the user’s login information. Most of the update process will happen in the background. Users will be able to easily transition to new payment accounts with multiple vendors in one session.

It is very interesting timing given that we are expecting to see the final rules on open banking from the CFPB in the fourth quarter with implementation of these rules set for some time next year. Because of this Wright said, “We are seeing a lot of inbound interest from their large banking clients.”

For Atomic clients that already have their SDK for direct deposit switching there is no upgrade needed, it will all be incorporated into their existing SDK. This is initially only available for mobile phones but eventually a desktop browser-based version will be available.

Everything is driven by Atomic’s proprietary TrueAuth technology that allows a user to authenticate directly on their mobile device without sharing login credentials.

From the press release, here is a quote from Atomic CTO Scott Weinert:

PayLink is revolutionizing financial institutions’ operations by offering a unified solution that accelerates account primacy through streamlining direct deposits and payment switching, making Atomic the top choice for consumers’ banking needs. At the same time, we’re empowering consumers with seamless switching, simplified payment updates, and secure transactions, aligning with the CFPB’s vision for open banking.

This is a logical next step in the evolution of open banking and something that will be popular with consumers. Anything to reduce the friction of changing bank accounts will be a hit with just about everybody.