I discuss Citi's roboadvisor launch and why it took the firm 12 years to get to the party. We break down the difference between financial services ingredients and the organizations that combine those ingredients to manufacture and distribute financial products. We also look at how that consumer prerogative is defining the asset management industry, and the consolidation towards monolithic passive indexing providers. Last, we talk about how people prefer mass produced Twinkies to expensive artisanal desserts. Yummy!

JoinedMay. 30, 2017

Articles5,303

Comments63

This piece was created by one of our content team members. Reach us at [email protected]

The long time secretive bank is now opening up on future plans in an effort to win over investors. Today,...

If you ask around the fintech community what regions are up and coming when it comes to fintech you will...

I examine the rising relevance of Central Bank Digital Currencies. We look at the World Economic Forum policy guide to understand different versions of CBDCs and their relative systemic scale, and the ConsenSys technical architecture guide to understand how one could be implemented today. For context, we also dive into a very different topic -- Lithium ion batteries -- and show how a change in the cost of a fundamental component part (e.g, 85% cost reduction in energy, or financial infrastructure) opens up a massive creative space for entrepreneurs.

The digital banking space in Europe has been fascinating to watch. Customers seem much more engaged and willing to move...

Over the past decade we’ve seen consumers warming up to buying everything with multiple payments. It is a phenomenon that...

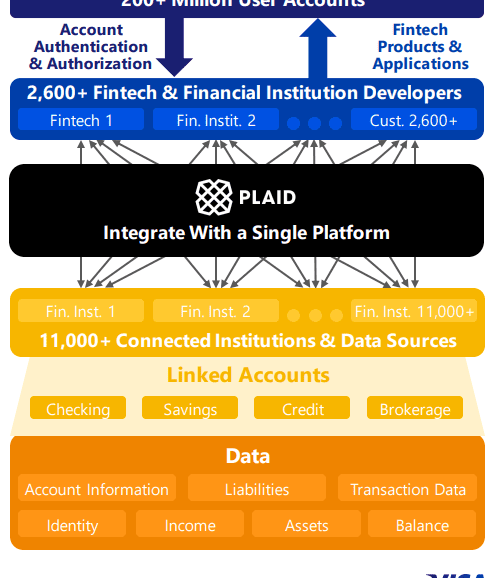

I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.

There have been no shortage of bank partnerships in fintech, but this might be the most unique. Last week we...

[Editor’s note: This is a guest post from Brian Korn, Neil Faden, Benjamin Brickner and June Kim of Manatt, Phelps...

Fintech companies continue to attract interest from traditional financial institutions and now we have a significant acquisition to start off...