A blowout in the cryptocurrency market sparked a wave of layoffs, punished valuations and drove some companies to bankruptcy. Now firms that still have capital are gearing up for a shopping spree.

JoinedMay. 30, 2017

Articles5,303

Comments63

This piece was created by one of our content team members. Reach us at [email protected]

The cryptocurrency rout has spread to startups that offer users digital tokens, dragging down digital asset prices and driving away a lot of users.

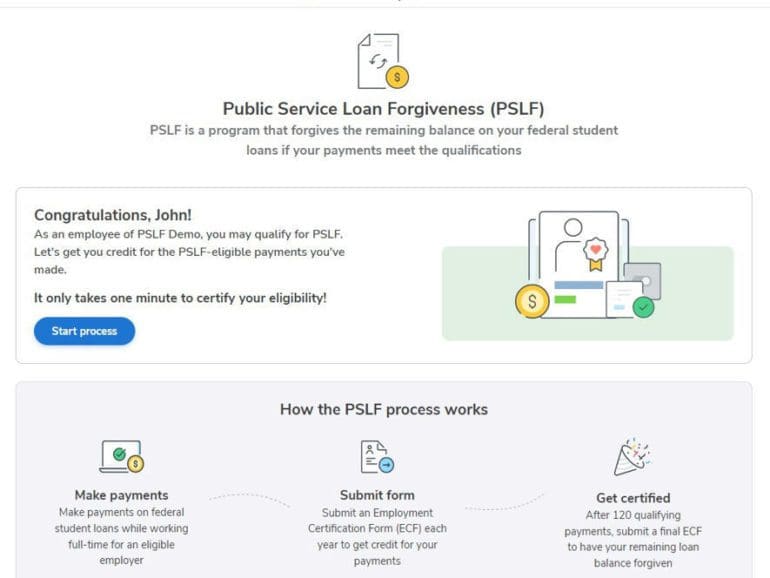

This fall's looming student debt crisis will bring the worst environment we've seen in decades. There's a way out for many, but few people are aware of it.

The troubled crypto lender Celsius started to make good on the $258 million debt on the decentralized lending protocols Aave and Compound – possibly in an attempt to reclaim collateral it had posted as guarantees.

In this episode we sit down with Matt Oppenheimer, the CEO and founder of Remitly, to discuss remittances, the financial challenges of immigrants and how fintech is serving them better.

The way forward is to make tokens work within a regulated environment where transactions are private but not anonymous. Secure against unreasonable search and seizure, but subject to reasonable search and seizure.

Companies from across the industrial spectrum often rely on a migrant workforce, with data from the International Labour Organization indicating that some 169 million workers travel abroad for employment.

Wyre, a crypto infrastructure provider, announced an integration with the global on/off-ramp service for digital wallets launched by MoneyGram.

GoHenry, the U.K.-based financial education app and pre-paid debit card provider for kids, has expanded into Europe for the first time with the acquisition of French startup Pixpay. Terms of the deal were not disclosed.

Making news this week is the bankruptcy of a crypto platform, Meta gives up on Novi, Upstart hits some headwinds, startup funding is down, the US Treasury develops a framework for crypto and more...