On episode 35 I talk with Sergei Terentev of B9, a fintech company that offers a full suite of app-based financial services to unbanked workers

JoinedAug. 16, 2021

Articles3,126

John has been in communications since graduating from Creative Communications at Red River College Polytechnic in Winnipeg in 1992. He launched one of Canada's first digital-only local news sites called Winnipeg First in 2007, which led to digital editor postings with the Winnipeg Free Press and Edmonton Journal. In 2012 he joined Bankless Times as managing editor, later becoming president and CEO. He and the Bankless Media co-founders completed a sale and exit in August 2021.

jaris an embedded finance platform called HoneyBook Capital, built in partnership with the gig management company HoneyBook.

Russia's central bank on Thursday proposed banning the use and mining of cryptocurrencies on Russian territory, citing threats to financial stability.

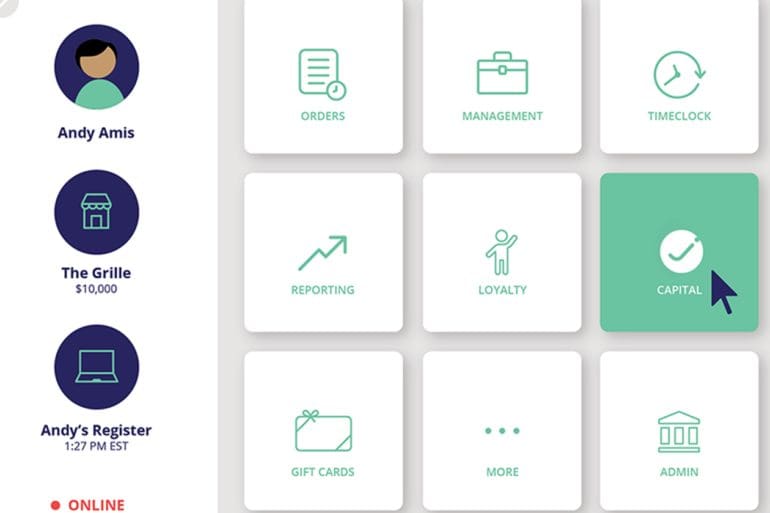

DoorDash has made its way into the small business financing game. DoorDash Capital, as the financing arm is so named, claims to provide merchant cash advances to DoorDash partners against future sales orders placed through the DoorDash app. The DoorDash website explains the product in detail. “There is no interest rate because a merchant cash […]

Personetics, an Israel-based fintech that uses AI to help financial institutions boost customer personalisation and engagement, has raised $85m in...

Google has hired former PayPal executive Arnold Goldberg to run its payments division and set a new course for the business after it scrapped a push into banking.

A new study found that bank-fintech partnerships are falling short of financial institutions’ objectives. Here are some ways that bank-fintech partnerships can be fixed.

The deal is the latest example of a mainstream bank buying a point-of-sale lender focused on financing home improvement projects.

Robinhood’s Struggles Continue: Its Cofounders Are No Longer Billionaires, Shares Down 60% Since IPO

Robinhood shares have lost more than half their value since the company’s IPO last summer.

The Rhode Island bank estimated that its revised overdraft practices will cost $40 million each year, but it noted that complaints to call centers are down 40% since the policy change.