Companies must capitalize on increasing the quality of the experience for their legitimate customers reaching out to call centers.

JoinedAug. 16, 2021

Articles3,126

John has been in communications since graduating from Creative Communications at Red River College Polytechnic in Winnipeg in 1992. He launched one of Canada's first digital-only local news sites called Winnipeg First in 2007, which led to digital editor postings with the Winnipeg Free Press and Edmonton Journal. In 2012 he joined Bankless Times as managing editor, later becoming president and CEO. He and the Bankless Media co-founders completed a sale and exit in August 2021.

Crypto exchange FTX Trading Ltd. has launched a $2 billion venture fund, one of the largest vehicles to date aiming to tap into the crypto market’s startups.

The company, formerly known as Square, wants to make bitcoin mining more efficient.

Challenger banks like Chime and Dave have been helping customers avoid overdraft fees for years. As traditional banks start to do the same, the fintechs say they still offer consumers a better deal.

OneUnited's new installment-loan product is meant to break customers out of a cycle of debt. It will compete with similar offerings from heavyweights like Wells Fargo, Bank of America and Huntington.

The card brands are pursuing partnerships with banks, government agencies and merchants, with a goal of building networks and services to accommodate the rise of central bank digital currencies.

The Covid pandemic hit the American populace hard. Banks that assisted their customers the most walked out on top. They fared better on satisfaction rankings and gained higher customer retention rates.

Steven Uster, CEO, FundThrough “I know it might seem sudden for you, but we’ve been engaged in discussions since the Summer, and [BlueVine] has been in discussions internally for certainly longer than that.” FundThrough announced their acquisition of the factoring division of BlueVine on Thursday. A deal that has been long in the works will […]

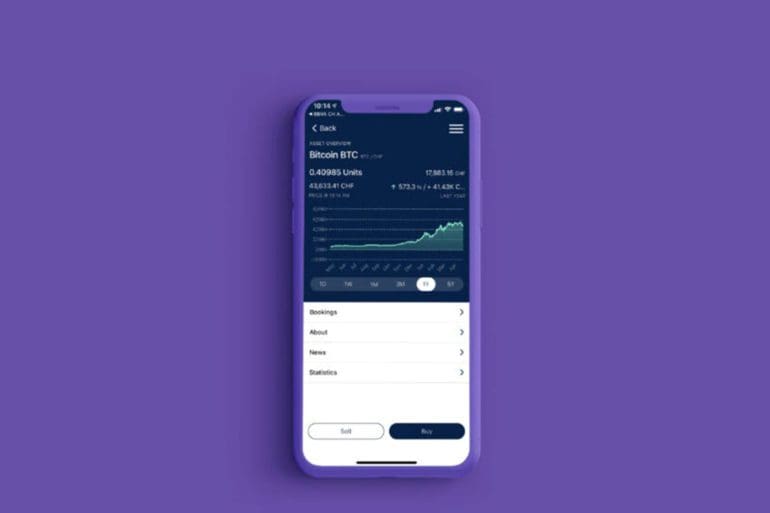

BBVA Switzerland’s crypto asset service, rolled out to cater for growing demand from wealth management clients, has been developed with Avaloq’s proprietary Crypto Assets solution.

Revolut has launched operations as a bank in 10 Western European nations, allowing it to provide its customers in these markets deposit protection.