Marcos Cavagnoli, Digital Cash Management & Open Finance Director at Itaú Unibanco and Itaú BBA, provides key insights about Open Banking in Brazil and the paths goin

JoinedAug. 16, 2021

Articles3,126

John has been in communications since graduating from Creative Communications at Red River College Polytechnic in Winnipeg in 1992. He launched one of Canada's first digital-only local news sites called Winnipeg First in 2007, which led to digital editor postings with the Winnipeg Free Press and Edmonton Journal. In 2012 he joined Bankless Times as managing editor, later becoming president and CEO. He and the Bankless Media co-founders completed a sale and exit in August 2021.

2TM wants to enter Chile, Colombia, Mexico, and Argentina through strategic acquisitions.

Mexico is one of the fastest-growing economies in the world, but its local businesses still struggle to access credit without super-high fees and tedious paperwork. Mastercard (NYSE: MA) and Jeeves, the financial partner for Mexican businesses, have teamed up to address this issue by introducing

Open banking presents new capabilities for business lenders. One of the most notable: Secure, immediate access to financial insights using automation. As data availability and technology advances, bank and non-bank lenders must improve how they assess credit worthiness.

TikTok creators in some parts of the world will now be eligible to receive direct tips from viewers.

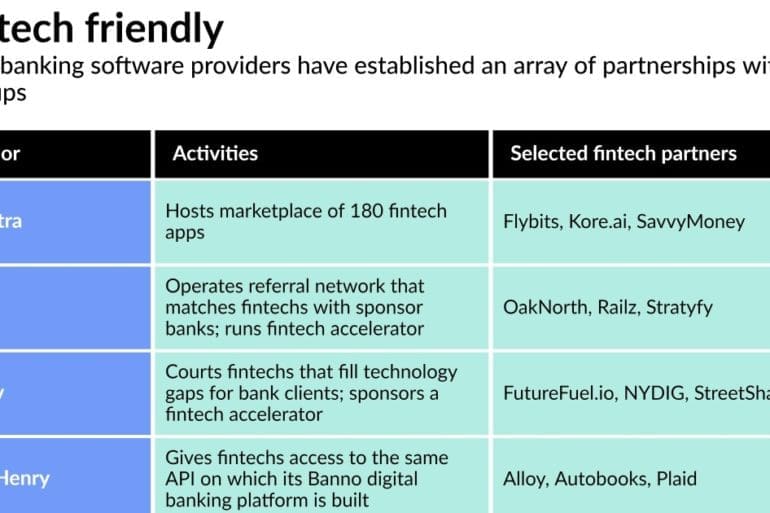

Fiserv, FIS, Jack Henry and Finastra, the top U.S. core banking software providers, are stepping up efforts to let banks plug innovative technology from younger fintechs into their legacy systems.

"Financial institutions that have a higher share of frequent overdrafters or a higher average fee burden for overdrafting should expect us to be paying them close supervisory attention," bureau Director Rohit Chopra said.

Through the partnership, companies will be able to launch credit cards using Marqeta's open APIs, while embedding within their app ecosystem.

Financial education is one of the best investments in our children’s future

The gig economy may be flourishing, but its rapid expansion is also giving rise to new challenges related to cross-border payments that businesses and employers must overcome so they can continue to onboard competitive global talent and avoid high turnover.