A recent report from banking regulators says the digital assets pose too big a risk to the financial system to be issued by state-chartered entities that don’t have deposit insurance. Stablecoin issuers and others reject that claim and say regulators are discouraging competition.

JoinedAug. 16, 2021

Articles3,126

John has been in communications since graduating from Creative Communications at Red River College Polytechnic in Winnipeg in 1992. He launched one of Canada's first digital-only local news sites called Winnipeg First in 2007, which led to digital editor postings with the Winnipeg Free Press and Edmonton Journal. In 2012 he joined Bankless Times as managing editor, later becoming president and CEO. He and the Bankless Media co-founders completed a sale and exit in August 2021.

PayPal (NASDAQ:PYPL) has announced its Q3 earnings results with an EPS beat of $1.11 (non-GAAP) and total payment volume of $310 billion and 416 million accounts. Net revenues were reported at $6.18 billion an increase of 13% versus year prior and net income arrived at

Ocrolus, a financial document automation provider, and end-to-end cloud-based lending platform Blend, announced a strategic partnership which will embed Human-in-the-Loop (HITL) document analysis into Blend's digital mortgage applications, according to a press release.

Monument Bank, a digital banking startup targeting affluent professionals, is cleared to launch in the UK following the Financial Conduct Authority removing regulatory restrictions from the neobank, according to a press release.

The bank is partnering with Anthemis to match investors with female entrepreneurs, who according to Findexable research attract just 1.5% of investment in the sector.

Overdraft fees are criticized as unfair penalties for lower-income customers, but they are often better for consumers than getting purchases rejected.

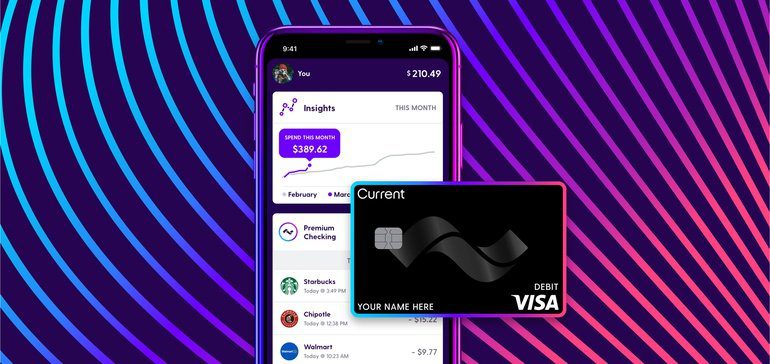

Curbing the need for a third-party processor helps money move faster, said the fintech's CTO, Trevor Marshall. "When I think of a checking account, I think of a parking lot," he said. "Current is about movement."

QED's first investment in the region was Nubank, a deal that is set to pay off handsomely.

The fintech community's one-stop-shop for all things lending and digital banking. Conferences, podcasts, news, webinars, & white papers showcasing the latest in fintech.

This week saw three fintech payments, debit, and credit firms post results: each saw momentous growth year over year but it was not enough to outpace expectations after a bull run of a year for fintech.