Please clicRecent ‘unicorns’ like Brex, Paxos, and Chime are unique in that their innovation extends to internal functions, like risk management. This survey aims to identify the connection between innovative risk management and business growth. Could a dynamic approach to handling risk actually accelerate progress?k the link to complete this form.

JoinedAug. 16, 2021

Articles3,126

John has been in communications since graduating from Creative Communications at Red River College Polytechnic in Winnipeg in 1992. He launched one of Canada's first digital-only local news sites called Winnipeg First in 2007, which led to digital editor postings with the Winnipeg Free Press and Edmonton Journal. In 2012 he joined Bankless Times as managing editor, later becoming president and CEO. He and the Bankless Media co-founders completed a sale and exit in August 2021.

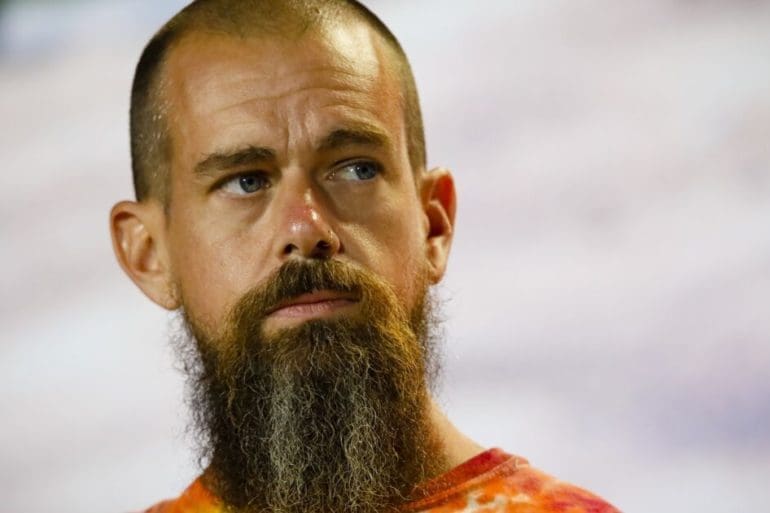

Jack Dorsey's payments company wants to reach a younger demographic while also giving adults more reasons to use its peer-to-peer service.

Latam Fintech PayU says it will hit $8 billion and 300 million transactions in 2021. PayU says it has experienced an 80% user growth since 2019. PayU is a is the payments and Fintech business of Prosus and a leading online payment service provider, operating

African FinTech Chipper Cash closed a $150 million Series C extended funding round at a more than $2 billion valuation, according to media reports.

The Jiko app is still available for consumers to download, and the company plans to keep enhancing its features, but its main use will serve as a "showroom" for Jiko's technology, CEO Stephane Lintner said.

New York City mayor-elect Eric Adams plans to take his first three paychecks in bitcoin, in the politician’s latest move to give Miami a run for its money as one of the country’s top destinations for crypto enthusiasts.

The ultimate goal is for Visa Direct to become “the de facto most efficient, secure money movement network on Earth”.

As installment lending becomes more popular, regulators in the U.S., Europe and Australia are considering new restrictions or taking action against lenders.

A full-scale, multiple central bank digital currency (mCBDC) network could potentially save global corporates up to $100 billion in transaction costs annually, according to a joint research report from Oliver Wyman and JPMorgan.

The City regulator is working on leveraging data to create new tools that will allow it to detect consumer harm and intervene more quickly, amid its growing scrutiny of high-risk investments. Speaking at the CDO Exchange for Financial Services, Jessica Rusu, chief data, information and intelligence officer at the Financial Conduct Authority (FCA), said that...