“This partnership allows us to continue building our suite of carrier-first tools and offer the small carriers on our platform — the mom and pop shops and new authority carriers just starting their businesses — the opportunity to take advantage of lightning-fast payments, fuel discounts, and other...

JoinedAug. 16, 2021

Articles3,126

John has been in communications since graduating from Creative Communications at Red River College Polytechnic in Winnipeg in 1992. He launched one of Canada's first digital-only local news sites called Winnipeg First in 2007, which led to digital editor postings with the Winnipeg Free Press and Edmonton Journal. In 2012 he joined Bankless Times as managing editor, later becoming president and CEO. He and the Bankless Media co-founders completed a sale and exit in August 2021.

The digital money, called Squid, began trading last week for a penny. It soared spectacularly, before the money vanished.

Western Union Company touted its upcoming Germany and Romania digital banking pilot in its third quarter earnings results. The bank should launch this year.

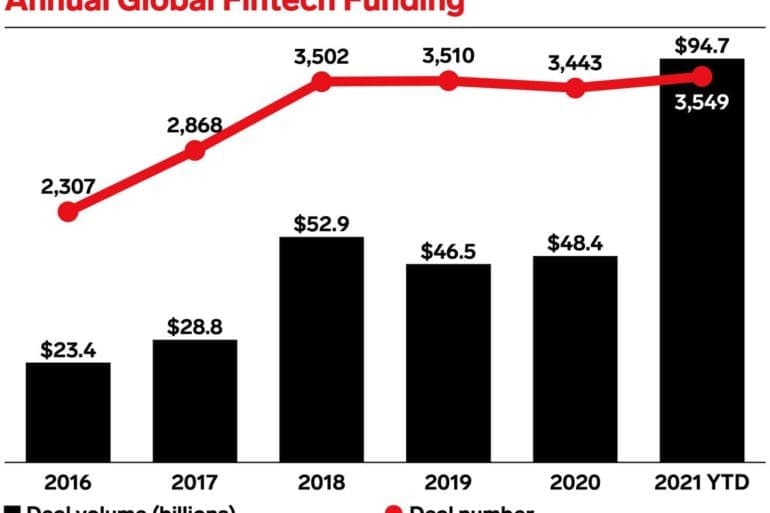

Fintech funding smashes records, raising $31.1 billion across 1,185 deals in Q3 as record adoption fueled the investor flywheel.

The inherent transparency of blockchains or distributed ledger tech (DLT) networks makes crypto-related investigations a lot easier for law enforcement agencies, when compared to financial investigations involving fiat currency. Blockchains or DLT networks serve as a permanent, publicly viewable ledger of almost all crypto transfers,

Digital banking services provider Railsbank is betting on ‘experiences’ being the gateway to a boom in brands embedding financial services.

Mortgage lending titan Rocket Mortgage is bringing its tech straight to financial institutions. The lender announced Friday a partnership with Salesforce to deliver Rocket's mortgage origination capabilities directly to banks, credit unions and other FIs through Salesforce Financial Services Cloud.

The Sandbox, a Hong Kong-based gaming platform that allows users to build a virtual world using non-fungible tokens (NFTs), has raised $93 million from investors led by SoftBank’s Vision Fund 2, the company told Reuters on Monday.

I was thinking about this article in The Telegraph saying what a rotten job supermarkets have made of competing with banks. Tesco sold its mortgage book to Lloyds two years ago owing to “challenging market conditions” and is now closing all personal current accounts. Marks & Spencer this year decided to …

The state joins Illinois and Massachusetts in subjecting nondepository companies to state-level Community Reinvestment Act requirements.