As LendKey celebrates $500 million in funded loans, there are plenty of other reasons to celebrate too, co-founder and CEO Vince Passione said. Passione said as the country is coming off a pandemic year there are plenty of encouraging signs. Education loans are bouncing back,

JoinedAug. 16, 2021

Articles3,126

John has been in communications since graduating from Creative Communications at Red River College Polytechnic in Winnipeg in 1992. He launched one of Canada's first digital-only local news sites called Winnipeg First in 2007, which led to digital editor postings with the Winnipeg Free Press and Edmonton Journal. In 2012 he joined Bankless Times as managing editor, later becoming president and CEO. He and the Bankless Media co-founders completed a sale and exit in August 2021.

The U.S. consumer watchdog said on Thursday it has demanded information from tech giants Amazon, Apple, Facebook, Google, PayPal and Square on how they gather and use consumer payment data, in a broad effort to protect consumers from privacy breaches, fraud and anticompetitive behavior.

Regular readers of the news.lendit site were greeted with the newly redesigned LendIt Fintech News website as of noon Eastern time.

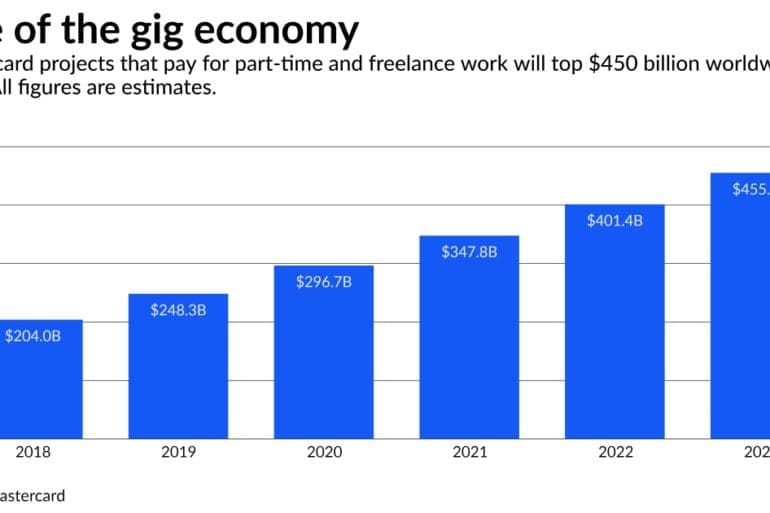

The collaborators found there is plenty of room for fintech companies to innovate and improve the lives of Americans, a nation in recovery still facing inequality.

In April, Alviere secured a $20 million cash injection through a Series A round followed by a further $50 million investment in a subsequent Series B round.

The technology from the San Francisco loan software company will pre-populate loan applications with payroll and tax data from multiple sources.

Goldman Sachs, one of the largest investment banking enterprises in the US and the world, is partnering with American Express to upgrade its digital cash management offering, according to CNBC.

Bitcoin notched a fresh all-time high Wednesday as investors cheered the successful launch of the first U.S. bitcoin futures exchange-traded fund.

Fixed-income giant Pimco has dabbled in cryptocurrencies and plans to gradually invest more in digital assets that have the potential to disrupt the financial industry, according to chief investment officer Daniel Ivascyn.

Alloy, the recently named unicorn, has expanded its identity decisioning platform to include credit underwriting, with the intention of building comprehensive views of customers in line with their onboarding and transaction monitoring products.