Jason Gardner, founder, and CEO of Marqeta, took to the main stage to announce the launch of banking as a service.

There is still too much friction involved in switching bank accounts. But a new tool from Atomic called PayLink is addressing this friction by making it easy for users to move their recurring payments.

Fintechs lose 50% of new accounts within the first year, according to Digital Onboarding SVP Adam Westley: Money walks right out the door.

Latin America's neobanks showed growing profits and robust customer acquisition in the quarter, a sign of resilience amid economic troubles.

Inflation rates hitting all-time highs strain the economy with SMEs as "the backbone." Experts weigh options to weather the storm.

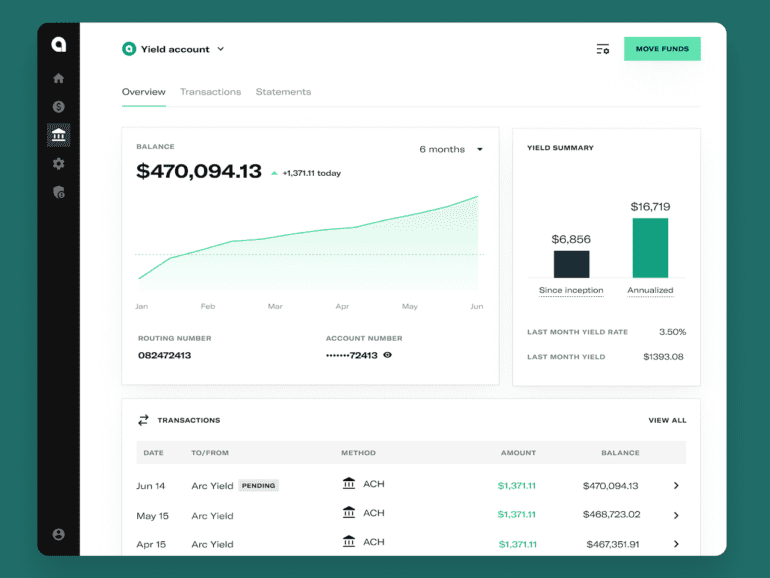

The day after The Fed announced yet another (albeit smaller) rate hike, Arc launches a high yield account so startups can gain on idle cash.

Despite a challenging scenario for Latin American fintechs, neobanks and digital wallets in Brazil continue to sign up millions of clients.

The fintech SPAC craze continues with two big fintech names announcing deals last week. MoneyLion and OppLoans (they are rebranding...

Many neobank unicorns' attempts at international expansion have been met with varying results. Anne Boden believes B2B is the key.

With more services becoming digital, a digital currency seems to be the perfect solution to streamline the digital revolution further.