Capital Markets & Exchange

Featured

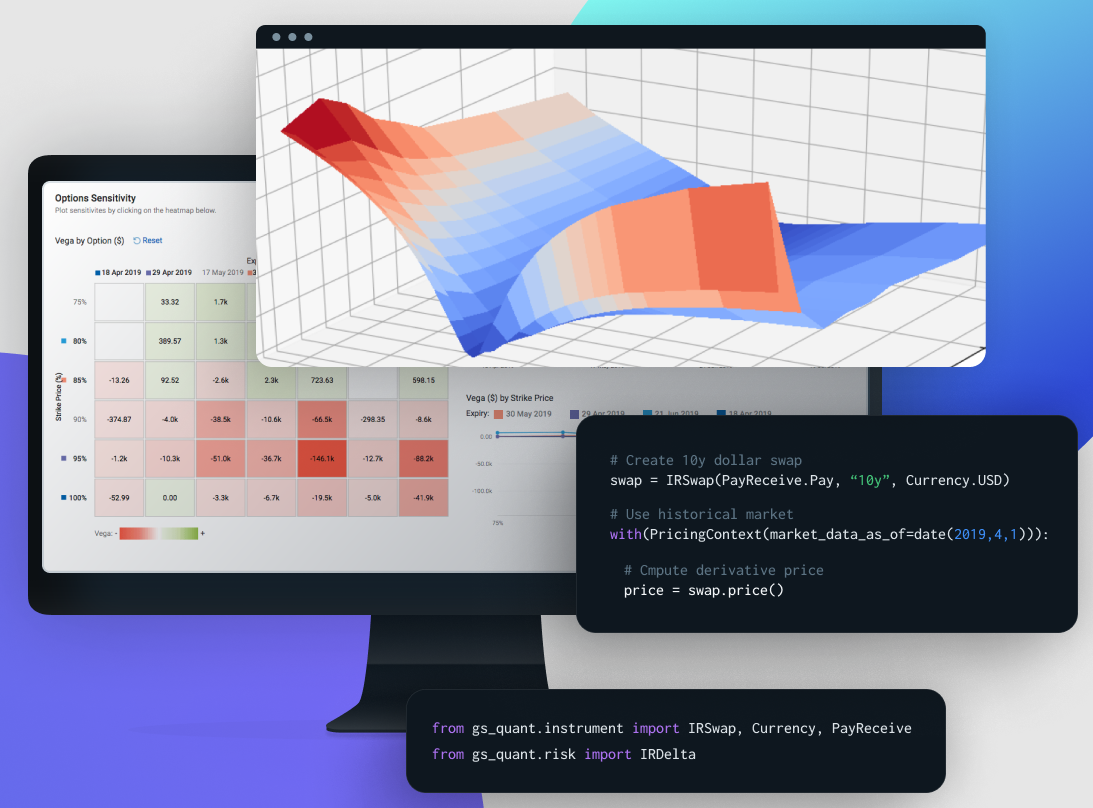

In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

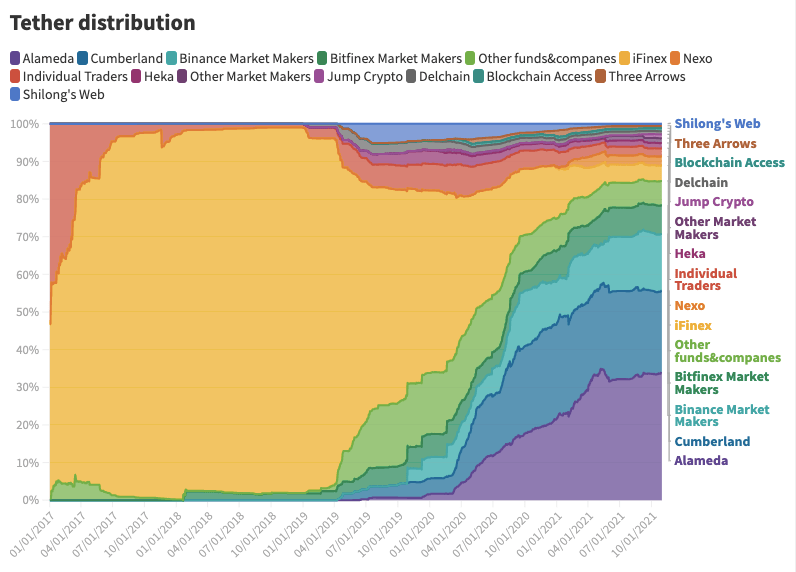

We look at a recent report from Protos that traces the issuance of USDT to the institutional players in the centralized crypto capital markets. The data reveals the market share of players like Alameda, Cumberland, Jump, and others in powering trading in exchanges. We try to contextualize this market structure with what exists both in (1) investment banking and (2) decentralized finance. The analogies are helpful to de-sensationalize the information and calculate some rough economics.

This week we continue the discussion of the shape of DeFi 2.0. We highlight Tokemak, a protocol that aims to aggregate and consolidate liquity across existing projects. Instead of having many different market makers and pools across the ecosystem, Tokemak could provide a clear meta-machine that optimizes rewards and rates across protocol emissions. This has interesting implications for overall industry structure, which we explore and compare to equities and asset management examples.

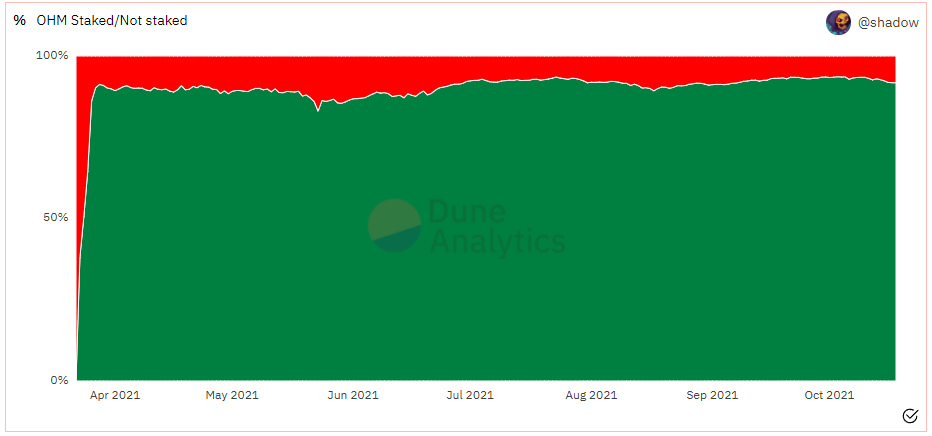

Decentralized finance is formulating new mechanisms to correct for the pitfalls of liquidity mining, yield farming, and other early token distribution approaches. This is happening both at the level of individual projects like Alchemix or Fei, and at the level of industry wide consolidation through Olympus DAO and Tokemak. We explore where this evolution is going, and potential outcomes. In this first part of the analysis, we look closely at Olympus DAO, the concept of Protocol Owned Liquidity, and whether the economics make sense.

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

The structure of capital markets precedes the innovations that come from it. High frequency trading, passive ETF investing, SPACs, and crypto assets all telegraphed their value proposition before becoming large and meaningful in scale. We are now seeing a new market shape emerge, one that starts with community and builds up into financial instruments that are cultural and social. This analysis looks at the most recent developments in the overlap between decentralized social and cultural work and related financial features.

In this conversation, we chat with Paul Rowady is the Founder and Director of Research for Alphacution Research Conservatory and a 30-year veteran of proprietary, hedge fund and capital markets research, trading and risk advisory initiatives. Alphacution is a digitally-oriented research and strategic advisory platform focused on modeling and benchmarking the impacts of technology on global financial markets and the businesses of trading, asset management and banking. This data-driven approach allows Alphacution to reverse-engineer the operational dynamics of these market actors to showcase the most vivid and impactful themes among the field of available research providers and platforms.

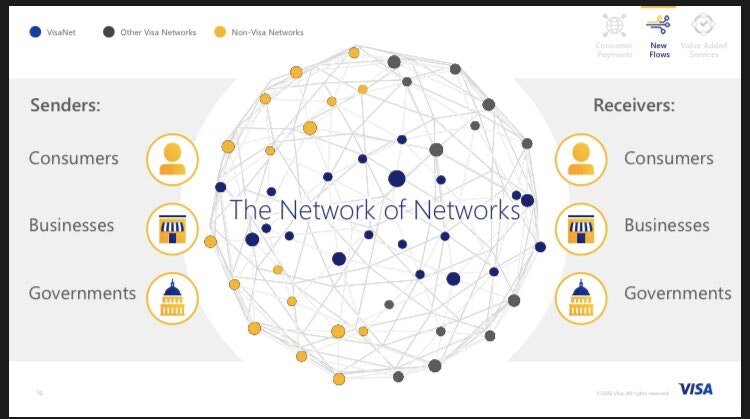

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.

We discuss the top-down and bottoms-up approaches to innovation and project building. For the former, we reference Australia’s draconian surveillance laws, and the integration of US driver’s licenses into Apple’s wallet. For the latter, we dive into the Ethereum-based Loot project and its incredible derivatives, $500MM token, and $200MM of volume. Last, we conclude by highlighting the role of creators on the coming wave of Fintech.

In this conversation, we chat with Jason Wenk, who is the Founder & CEO at Altruist. Apart from this Jason is a writer, self-proclaimed math geek, and investment systems developer. He began his career at Morgan Stanley in NYC at age 20, working on investment research and asset management systems development. After this Jason founded FormulaFolios: quantitative, computer-driven investment models based on academic research to help remove emotion from investing. FormulaFolios would later develop into a standalone asset manager and go on to rank as a fastest-growing private company by Inc. magazine 4 years in a row, reaching as high as #10 in 2017.

More specifically, we discuss all things wealth tech, as well as, serving people with financial planning, financial advice, and generally improving their financial health.

In this conversation, we talk all things Wall Street, FinTech, and Venture Capital with Patrick Pinschmidt, who’s the general partner and co-founder at MiddleGame Ventures.

More specifically, we discuss the ups and downs of sell-side research in the early 2000s, the evolution of financial technology to today’s FinTech, an insight into the Financial Stability Oversight Council at the US Treasury Department, the founding of Middlegame Ventures and its impressive investment portfolio, and the transformation of financial services fueled by the rapid innovation in FinTech.

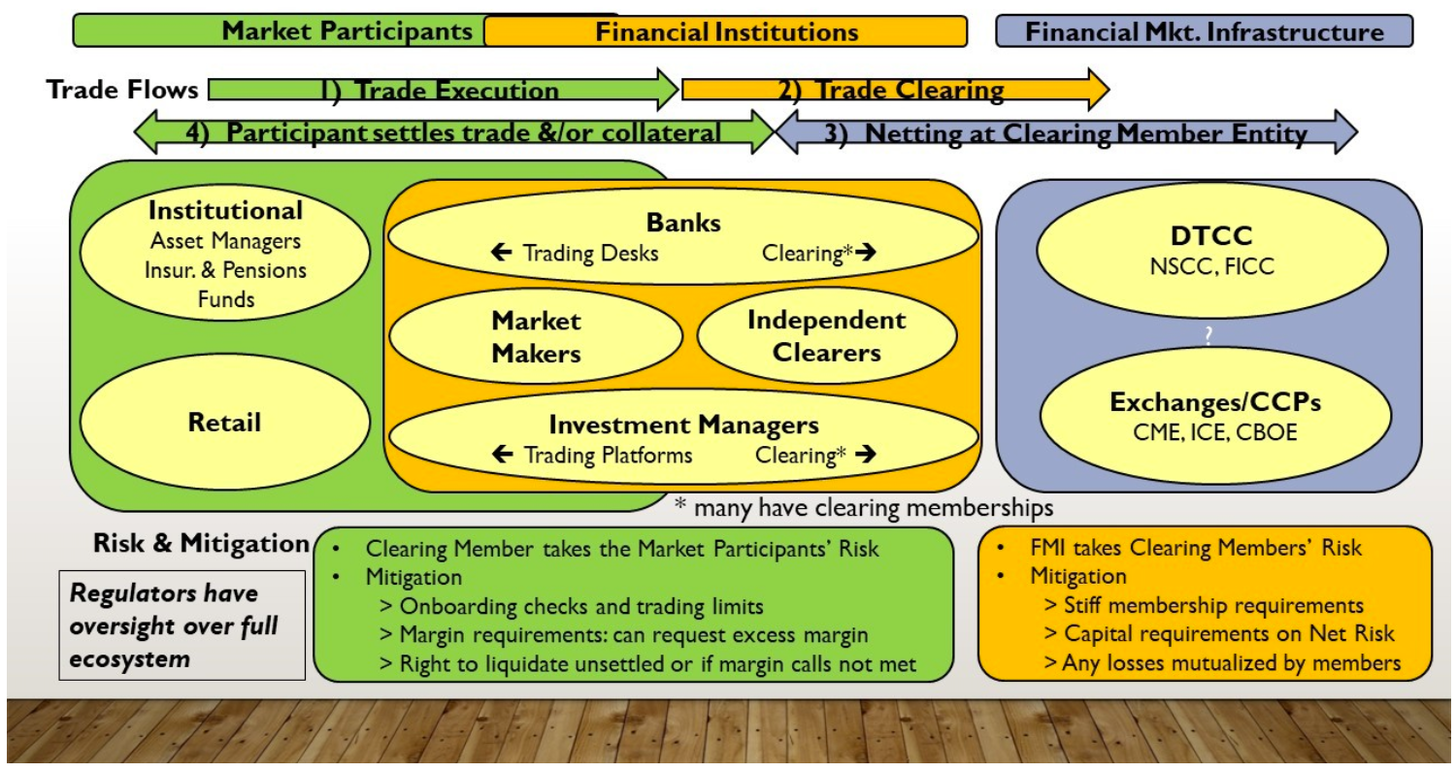

In this conversation, we geek out with Horacio Barakat, who serves as the Head of Digital Innovation for Capital Markets and the Head of DLT for the Repo Platform of Broadridge, about digital transformation, capital markets, and the role of blockchain in the institutional part of the financial industry.

Additionally, we explore the embedded complexities of capital markets and how fundamental they are to the smooth functioning of our economy, determining the growth of companies, and funding expansion. Touching on everything from the engine that powers capital markets, how that engine has evolved to becoming computational, and lastly how companies like Broadridge are leading the deep work going on in making that engine better.

This week, we cover these ideas:

-

That absurd Paul Krugman article about Bitcoin. Also Jim Cramer has things to say about financial regulation.

-

If all the prices are down, which they are, does that mean that everything is bad and wrong?

-

How timing is a personal financial planning problem, not a market value problem

This week, we cover these ideas:

-

How market structure determines the types of companies and projects that succeed

-

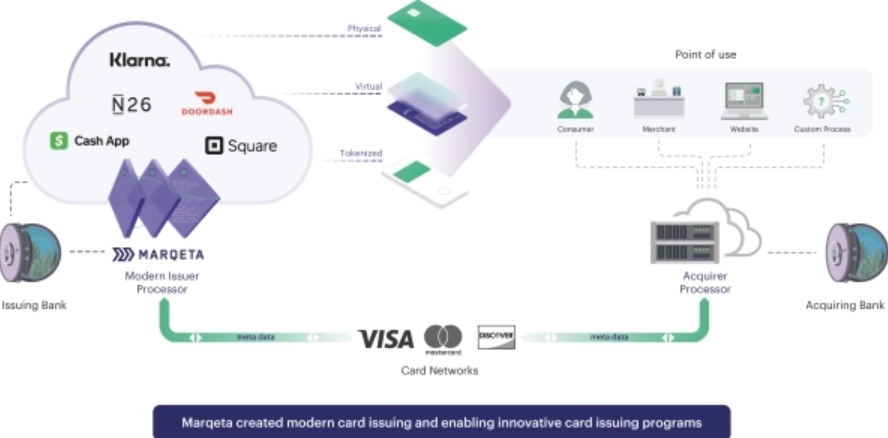

A walk through Marqeta’s economics and business model, and how Square’s Cash App and DoorDash were needed for success

-

The emerging $10B transaction revenue pool on Ethereum, MEV, and the changes to mining and gas

his week, we look at:

-

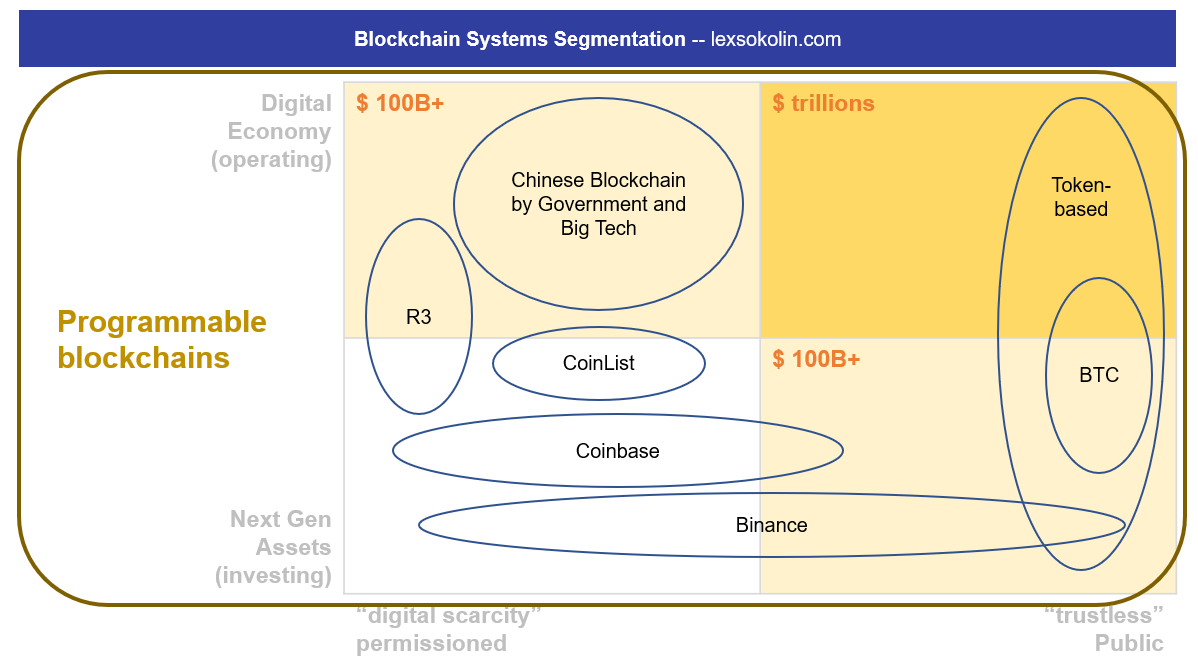

There are two very large revenue pools in the crypto asset class — (1) mining, and (2) trading. There are some large revenue pools in crypto-as-a-software, too, but those tend to be less sensational.

-

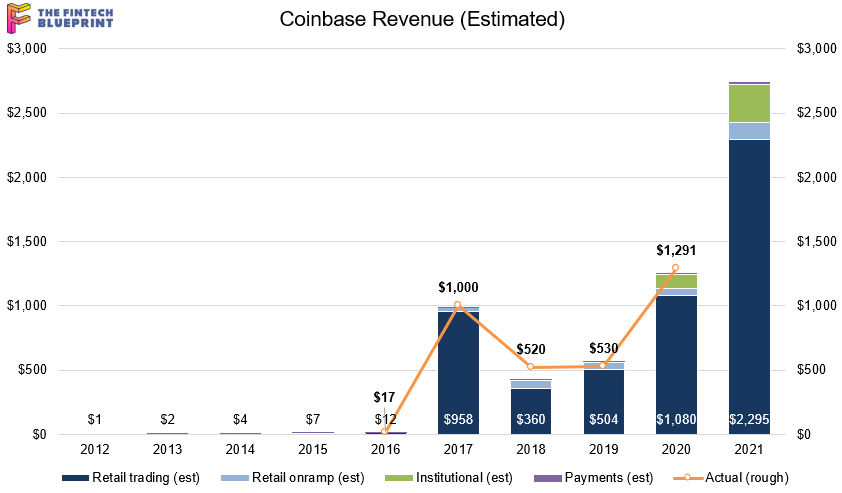

This analysis will establish a 2021 baseline for the most regulated of crypto exchanges, Coinbase, including a detailed financial model building a $100B+ valuation case

-

We then consider the valuations and multiples of capital markets protocols in Decentralized Finance of Ethereum, now making up over $60B in token value

-

Lastly, we look at Binance’s $1B in profits, its $35B BNB token, and the activities on Binance Smart Chain

In this conversation, we talk with Will Beeson of Bella and Rebank, about how the Internet/Reddit/Gamestop broke out financial market structure, the social contract, and what the new American finance structure will look like.

More specifically, we give some thought to which FinTech and Crypto companies win or lose from the GameStop adventure, the actual market structure issues that led to the suspension of Robinhood’s trading, and what’s next for the mobile broker, and finally, the social meaning of the war against hedge funds by Reddit’s r/wallstreetbets. Check out our conversation on these exciting new developments.

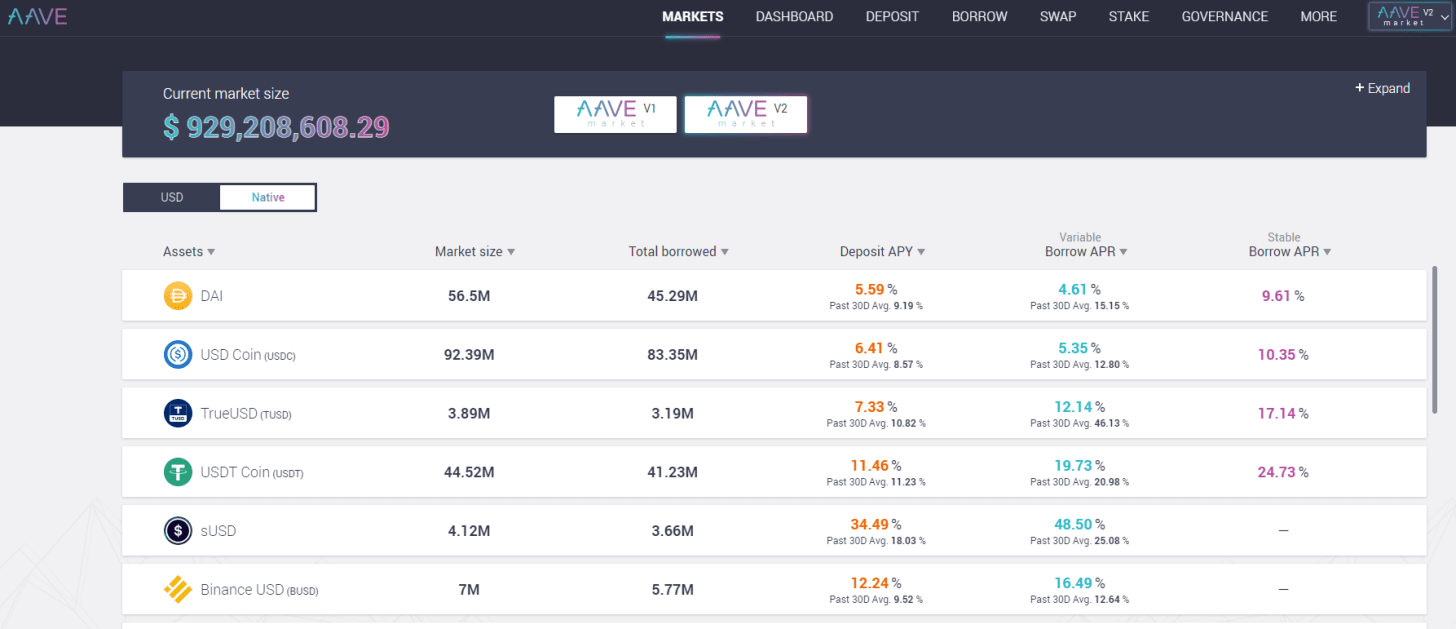

In this conversation, we talk Ajit Tripathi, currently the Head of Institutional Business at Aave and a former colleague of mine at ConsenSys, about the path from traditional finance, to enterprise blockchain and “DLT” consulting, to full-on decentralized finance.

Thinking about how to connect these worlds and different available journeys? Or the timeless risks developing in tranched DeFi that look like mortgage-backed securities? We even touch on hegelian dialectics! Check out our great conversation.

In this conversation, we talk with Paul Rowady, who is the Director of Research for Alphacution Research Conservatory. Paul has a deep background in capital markets, derivatives, and the macro structure of the industry. He has been uncovering the transformation of that structure with data driven analyses, making visible the economics of market makers like Citadel and retail order flow aggregators like Robinhood. This is a rich discussion of what trading stocks is really like. And make sure to check out Alphacution.

This week, we look at:

-

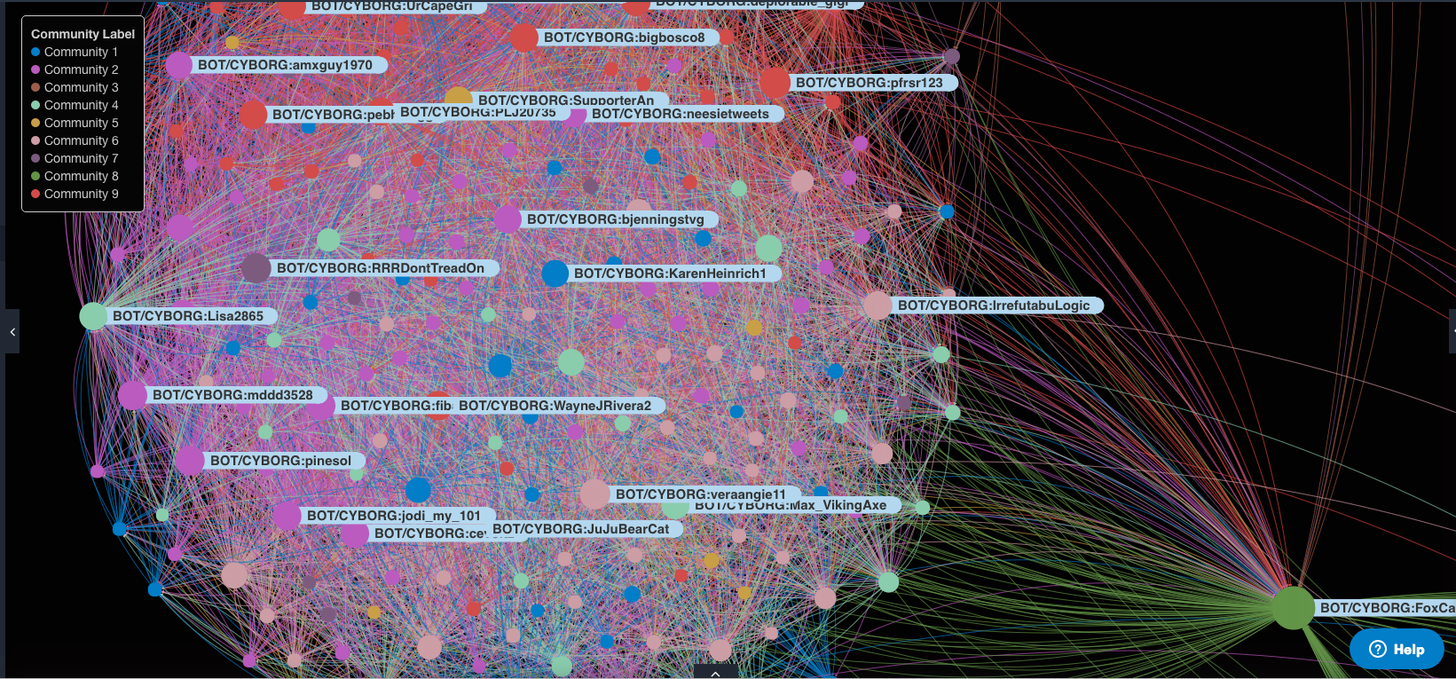

Deep Fakes behind South Park creators’ new parody, Sassy Justice

-

The AI-created author of the fake Hunter Biden intelligence report

-

GPT-3 winning the love and attention of people on Hacker News

-

How should we react to these robots and their desire to mess with our minds

Unlike equities, the crypto markets were born from machines, and are constructed from code. Hold dear the tokens in which you believe, and stay away from the stories of easy money. Nothing is easy. To win Russian roulette is not good fortune. It is, instead, a grave mistake to play a lethal game. Have you nothing to lose?

And then Brexit. And then Taiwan and China. And then Covid, again. And then, who knows.

From now on and forever, your counterparty is the data center running an AI cluster on top of the Internet. The data center that has already profiled you and knows everything about you. Bring the tinfoil hat.

This week, we look at:

-

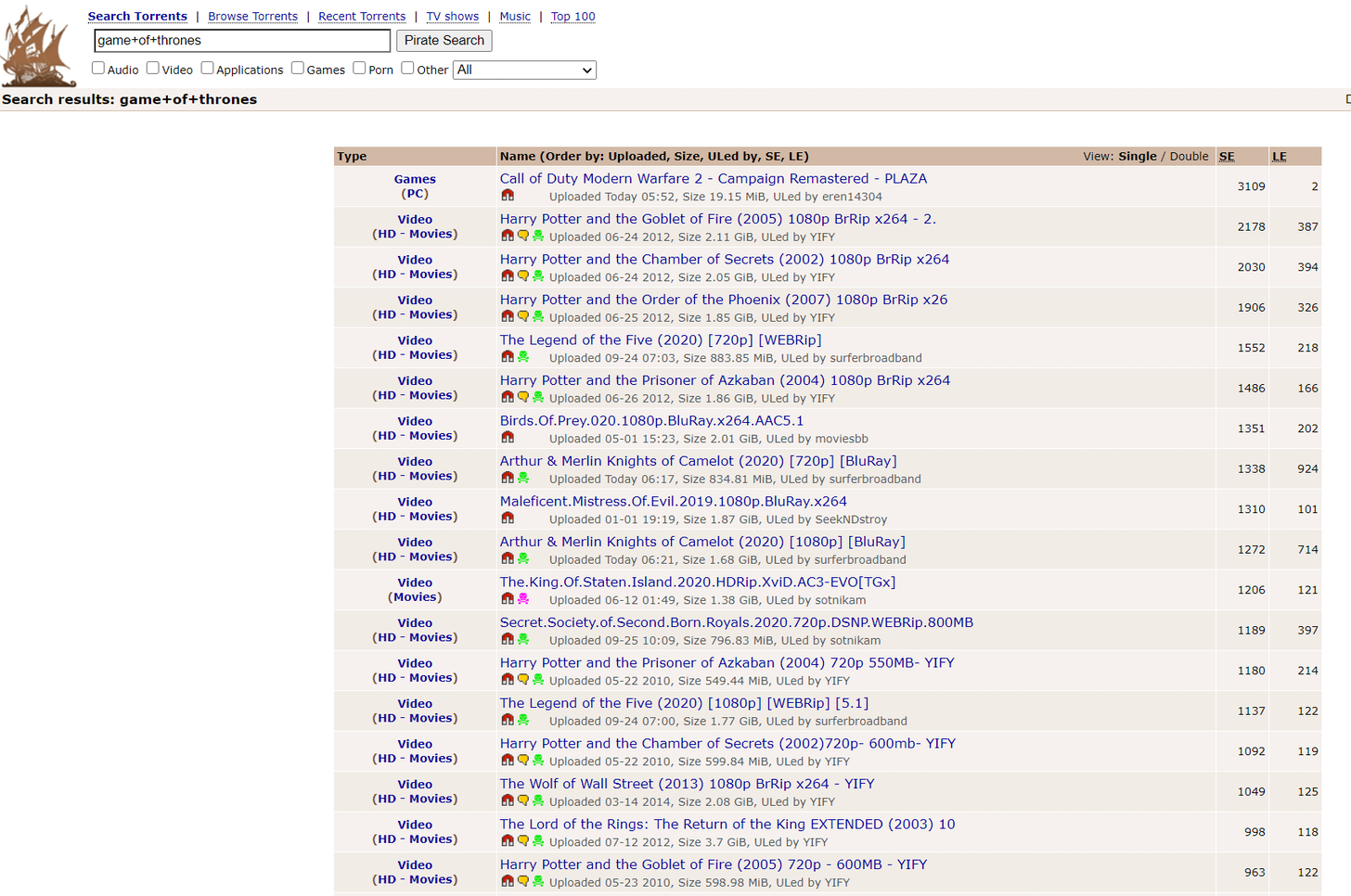

How the music industry needed The Pirate Bay and Napster

-

Why J.P.Morgan is paying $1B in fines for allegedly manipulating the precious metals market

-

Whether DeFi is flirting with self-dealing and veering towards apathy

-

Why QAnon and 8chan are a bad example for global governance

-

And how the European Commission’s proposed crypto-market rules are highly productive for blockchain-based capital markets infrastructure

In this conversation, we talk with Mike Belshe, CEO of BitGo and expert technologist about custody, prime brokerage, and the evolution of the institutional digital asset industry.

I often mention that crypto is still all about capital markets trading (i.e., manufacturing) and not about wealth management (i.e., distribution). This conversation touches on where we are in the maturity of market infrastructure, the role of fiduciaries, and the path forward. If you are sitting in a RIA, investment fund, or other asset manager, pay attention!

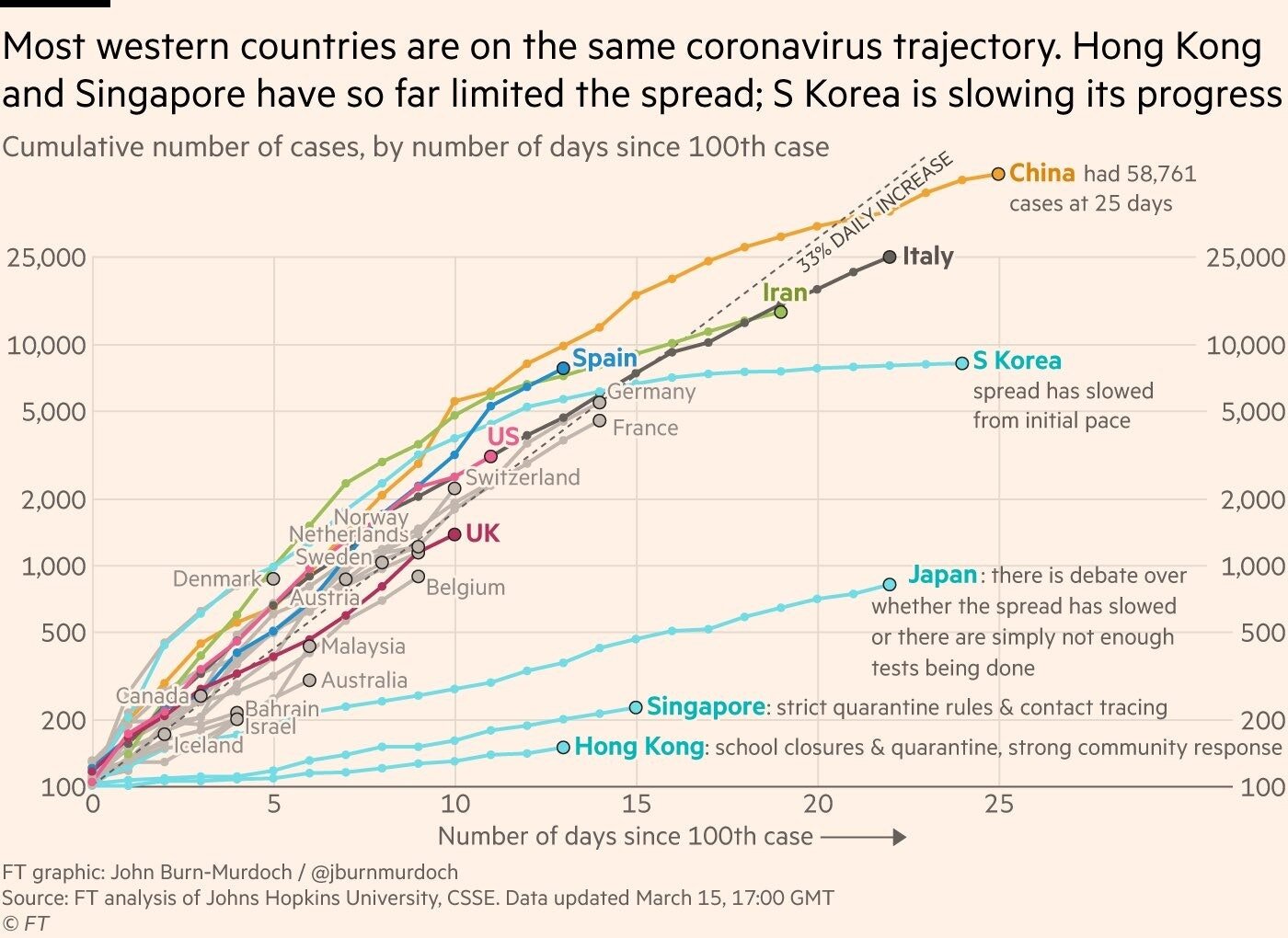

I hope that you and yours are OK, socially distanced and stocked on essentials. Whether you feel it yet or not in daily life, the world is bracing for coronovirus impact. In this week’s analysis, I look at the difficult trade-offs between health and economy, and try to quantify the impact of the likely slow-down. We look at some grim but useful concepts, like (1) the value of a statistical life, (2) what happened to the Soviet economy and life expectancy after perestroika, and (3) how our financial machines (NYSE, Robinhood, Maker DAO) are cracking at the edges. If you can do one thing — be kind and gracious with each other as some things inevitably break.

I look at how the news about the spread of the coronovirus are cracking the global economic machine. Some may argue that the number of people effected is still low — but that misses the entire point. The shock of a global pandemic has revealed weakness in the financial machine, sending the stock markets falling 10% year-to-date. Gross domestic product growth is expected to slow by billions of dollars, governments and central banks are unable to implement policy to compensate with rates at historic lows and borrowing at historic highs, public market valuations will tumble arithmetically, and private Fintech companies will lose a path to exit. At least that’s what the conspiracy theorists want you to think!

I look at the similarities between the NYSE building out direct listing products to augment or replace IPOs, and Central Banks considering launching consumer-facing digital currencies. In each case, the value chain of the respective financial sector is compressing, as the underlying manufacturers of financial product move closer to the consumer. I also highlight how a few blockchain-native alternatives to trading and rebalancing software are developing, and the reasons to get excited about things like Set, Uniswap, and Aragon.

Look at the difference between (1) building out the crypto asset class, and (2) operating infrastruture for a blockchain-based digital economy. There are so many little logic pot holes into which you could fall! There are so many things one could believe that make the whole thing make no sense at all! I am anchoring around two primary data points — a Multicoin report about Binance’s financial progress and its massive (though unaudited) $180 million profit in Q3 of 2019, and a post by supply chain company Centrifuge about marrying cashflow financing with the decentralized web.