Financial exclusion is a global issue, affecting people in the global north and developing countries.

Affecting the population as a whole, financial inclusion has been identified as an enabler for seven of the UN’s 17 sustainable development goals. The World Bank considers financial inclusion a key component in reducing extreme poverty.

“We will all benefit from that the more people we have involved in the financial system,” said Helen Disney, Director of The Realisation Group, in a webinar hosted by The Digital Pound Foundation on the importance of CBDCs for financial inclusion. “We know we’re going to become wealthier. We will have access to more people’s skills and talents, and people will be able to use their money in the best way.”

Financial exclusion refers to the lack of access for individuals to basic financial instruments such as a bank account. Although in some areas, geographic location plays a big part in instigating exclusion, in others, it can be due to various factors.

“I think a lot of the time when you’re talking to people in the Global North, they don’t really understand financial exclusion, said Richard Ells, Founder, and CEO of Electroneum.

“Actually, there’s vast swathes of the world who are excluded for many reasons. Could be political, could be the location of limitations, ID, credit history, all sorts of things.”

The move of financial services to digital platforms has addressed the issue and improved conditions for millions of individuals.

However, according to the latest Findex data, 1.7 billion people, close to one-third of adults, remain unbanked.

The potential of digital

For many, the shift to digital is the critical point for serving the financially excluded. Ells explained that CBDCs and stablecoins would increase its effect.

“There are tremendous skills throughout the world, and they become available to the global economy when we unlock it with digital ways to pay,” he said. “CBDCs are going to change it further still.”

“If people have access to something like a digital currency, they will also be able to earn. You want something you can put your earnings into that will be completely locked into a stable value. This is where a very stable, stable coin will be really powerful in the global markets. The CBDC that gets this just right will be a hugely powerful tool worldwide.”

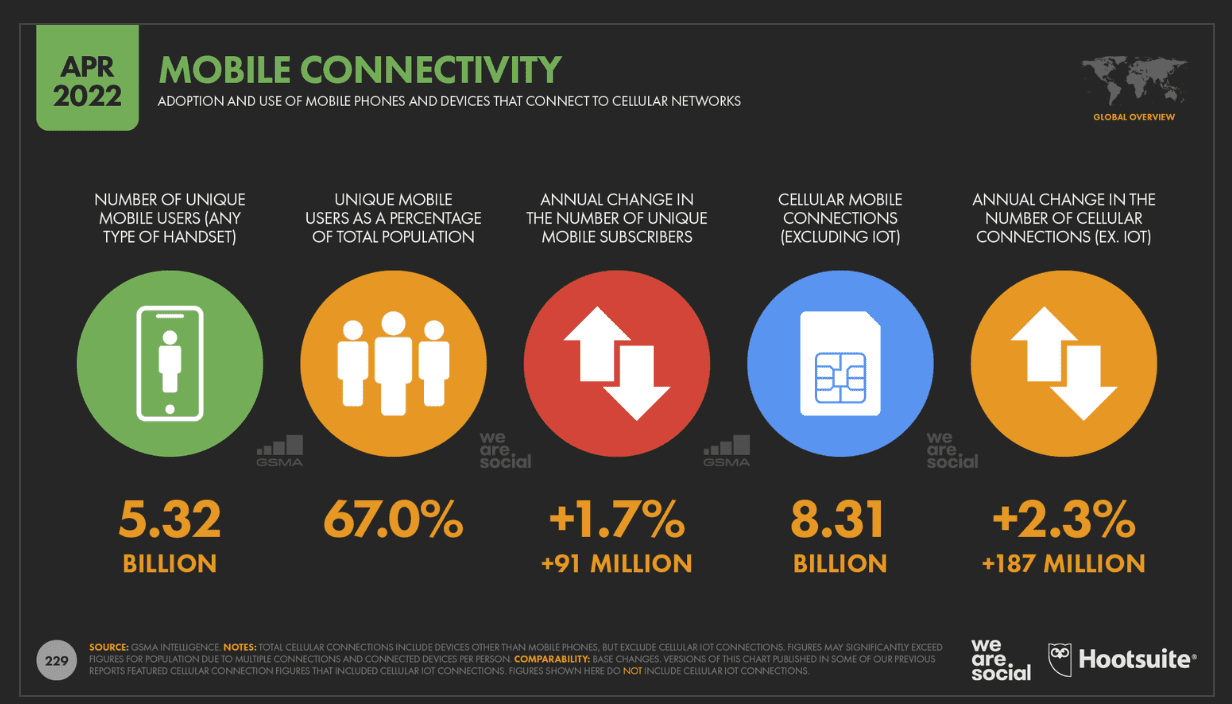

Global access to mobile phones is widespread. According to GSMA Intelligence, there are 5.32 billion unique mobile users today, growing by 91 million over the past 12 months. Many see mobiles as a critical tool for solving the issue of financial exclusion.

Already there have been success stories such as Kenya’s adoption of mobile financial services. Using M-PESA, among others, the percentage of the population over 15 who used a formal financial service rose from 18.5% in 2006 to 74% in 2013.

It was reported that access to M-PESA increased consumption levels, enabling an estimated 186,000 families (2% of Kenyan households) to move out of poverty.

“Mobile phone technology is becoming more and more accessible to people. We can see it is going to facilitate joining in a global digital economy, even though they’re distant.” continued Ells.

Victoria Thompson, the founder of Orora, agreed, stating the development of the technology will continue to improve access.

“We’re proving that you can redo this in an online-offline world as well, so you don’t necessarily have to have the latest Apple iPhone or Samsung phone to make this really work. This can be inclusive by design.”

A lower-cost solution

The cost of the unbanked population to governments is significant.

“In the UK, just the average annual cost of just being unbanked and not having a current account in any one of the big banks is £2,500. And that was pre-pandemic data,” said Thompson. The cost of living crisis and soaring inflation likely exacerbated this problem.

“A lot of people right now are stuck in a world of prepaid cards and prepaid meters,” continued Thompson.

“That creates an insane amount of cost into the financial system for those people. If we design a CBDC correctly, we can create an infrastructure better for that market segment than existing solutions.”

Sofie Blakstad, CEO and Founder of Hiveonline, explained that one of the main benefits of the CBDC and stablecoin technology is the reduced marginal cost, allowing for microtransactions.

“These can democratize a whole range of things, from music streaming to welfare payments. As well as taking out the burden on the state of distributing these kinds of payments.”

Thompson continued, “With CBDCs, we could remove the poverty premium in the UK. That’s there right now.”

“I think stable coins can be a bridge, and we can have experiments while we figure out how we eventually get to a Bank of England backed full on all singing, all dancing CBDC.”

Inclusive by design

Many CBDCs and financial inclusion experts agree the design is essential to its global success. A critical area of concern is KYC, a mandatory check conducted in creating an account.

Adopted as a method to curb money laundering and illegal activities, KYC can provide a barrier to entry for some applicants.

“Having a single bar means that somebody is always going to be left underneath,” said Blakstad. Hiveonline is an organization focused on using digital technology and blockchain to improve financial inclusion for communities worldwide.

“With KYC and identity, we have to go and look at really, what are we trying to do with that law?” commented Thompson.

“We’re trying to stop certain types of behavior and actions. And maybe if we focus more on the actions, which is what we are concerned with, and less about who that is, I think it becomes easier to solve the inclusion points.”

Already, entities are looking at how to resolve this. Blakstad went on to explain how, through work conducted by Hiveonline, they found that many of the people they worked with had a minimal identity.

“We have sliding scales of KYC, depending on how much identity people have. So rather than having a lot of people have to jump over, we lower the bar to the point where nobody has to jump, then we restrict the number of services that they can access based on the level of risk associated with identity.”

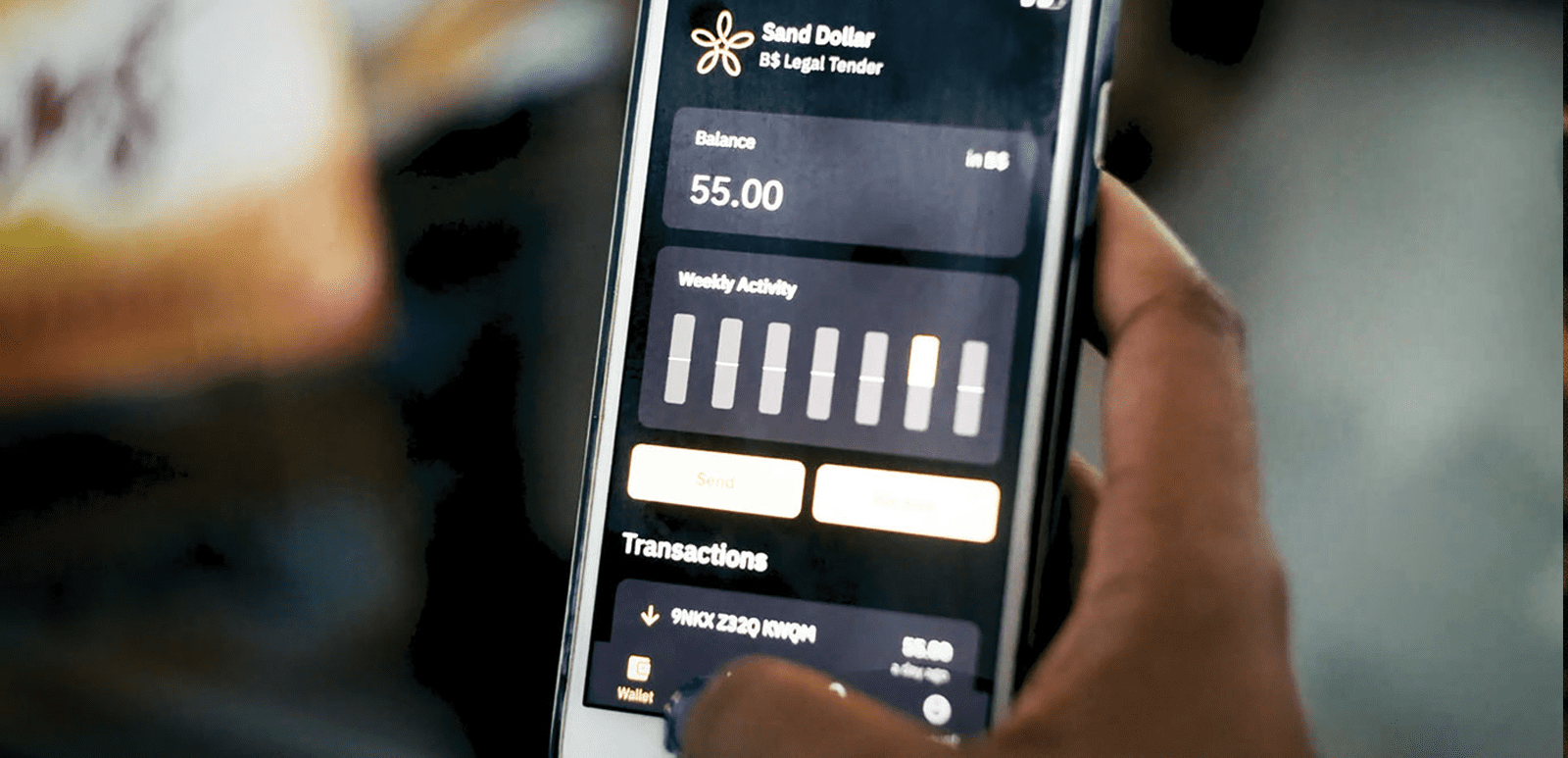

This approach was also adopted in the Bahamas within their Digital ID solution to implement the Sand Dollar.

To improve inclusion, lower-tier access only requires an email address or phone number, and the currency can be accessed via smart cards and smartphones, online and offline.

CBDCs: an opportunity for change

The design elements of a CBDC may not be enough to reduce rates of financial exclusion ultimately, and some believe adoption is an opportunity for improving financial education.

“We can have a whole different way of thinking about financial literacy and financial education,” said Thompson. “So people really understand what money is, what banks do, what good financial health looks like, and what that can do. Because if we have to think about launching a CBDC and educating people about that, i’s an opportunity to do something really, really good for people.”

Susan Friedman, head of policy at Ripple, suggested the goal of financial inclusion incorporates three key factors, “You need a well-designed policy paired with digital penetration and financial literacy.”

“If you can achieve those, I think you’ll get a higher rate of financial inclusion than you do today, given that you’ll have a wider range of people able to participate in the system.”