This past year, many fintechs have faced the question; Buy or build?

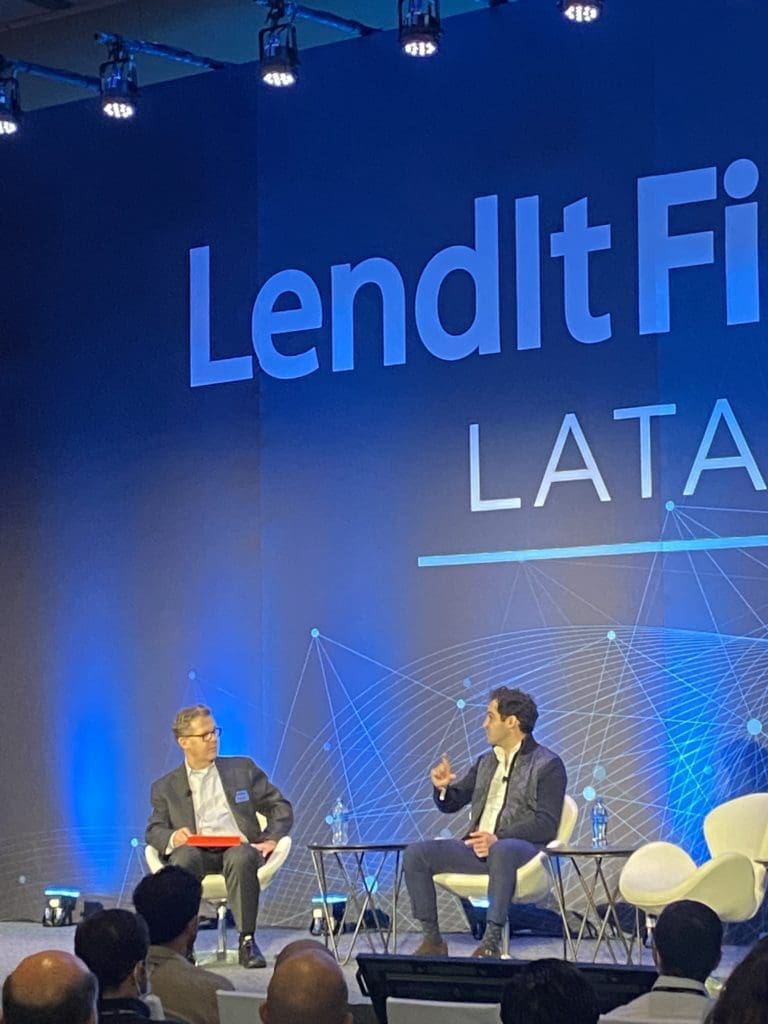

Credijusto, a leading Mexican small business fintech, chose the former, paying $50 million to buy Banco Finterra in June. Co-CEO David Poritz wrapped day one of the LendIt LatAm keynote section, discussing what it was like as the only neobank holding a banking license in Mexico.

After a short introduction, he was met with a barrage of questions from an audience filled with fintech peers, eager entrepreneurs, and jealous competitors. It’s clear why: the firm doubled its size when it onboarded the regional bank and combined the two have lent more than $2 billion to SMBs.

While fintechs have been buying banks in the US and Europe, it is a first for Mexico – but it might be the start of a trend.

“We now are able to are able to address a much wider swath of the market,” Poritz said. “Fintechs, I should say, have been required or needed to offer products that are higher on the cost spectrum. That’s part one.”

The transaction took well over a year, and the challenges took the Credijusto team by surprise but paid off. Having the clout and cost of capital that only banks can have Credijusto has also become an embedded finance leader by building payment services on top of working capital solutions.

“Uber Eats came to us and said, Oh, my God, we’ve got about 200,000 restaurants in Latin America, they all need a working capital solution,” Poritz said. “When you’re dealing with the partners, whether it’s Oracle or Microsoft, or Monsanto, having the cost of capital as a bank, having the credibility of the bank, and the technology of the fintech is a major differentiator that we’ve seen pay tremendous dividends very early on in our process.”

Banco Finterra is an agriculture and SME-focused lending bank, and capturing more of the Mexican agro-business market is just in line with Credijusto’s long-term plans. The aim is to promote cross-border services between Mexico and US businesses, with one day expanding up north.

“We’re incredibly bullish on the US Latin America trade corridor,” Poritz said. “Many in this room are probably well aware of it, Mexico teeters between being the largest trading partner to the United States, larger than China larger than Canada, and given the increasing importance of manufacturing in an agro space in Mexico, it is a critical trading partner.

Banks, historically, have stayed away from cross-border finance, given the jurisdictional differences, Poritz said, but they are going against the grain to support cross-border growth. He said Credijusto was growing an international team to expand into a US presence based in Texas or, of course, Miami.

“I think our first foray into international expansion is building out a US presence to support US businesses that are selling into Latin America, as well as Mexican businesses that are selling in the United States. We started with building a team, and it’s just starting to grow.”

Addressing rumors that expanding across the US-Mexican border might take the form of purchasing a small bank in the US, Portiz and moderator Peter Renton joked that one bank purchase was enough for now- Credijusto had its hands full.

“I can tell everyone that it’s complex, not only one bank. I’m not too excited about dealing with multiple jurisdictions and multiple regulators,” Poritz said.

Jokes aside, Poritz shed some light through a prediction-— after dealing with the regulatory nightmare to get a bank in his home country, he thinks fintechs breaching international borders will use a hybrid model. Catering their build to the specifics of that new countries rules, fintech’s may choose a less reg-heavy path than before, Portiz said.

“I also think this all seriousness, as we expand our business regionally, whether it be to the US or other Latin American countries, I think there’s a hybrid model that we’re gonna start to see,” Poritz said. “Say they own a bank in Mexico to address specific pain points, but as they go to other markets, they may take a regulatory light approach or capital-light model.”