According to new data released by Plaid today, interest in crypto remains high, despite the ongoing “crypto winter.”

In fact, among consumers within the US, the number of those who hold crypto has remained consistent, keeping a steady 19%, while in the UK, the number has increased.

Much like any other winter, it seems crypto activity is far from dead in the eyes of consumers. Instead, it could be simply dormant, allowing time for learning, which many are taking advantage of. The survey also indicated that of the American respondents who didn’t hold crypto assets already, 21% were planning on learning more.

Related:

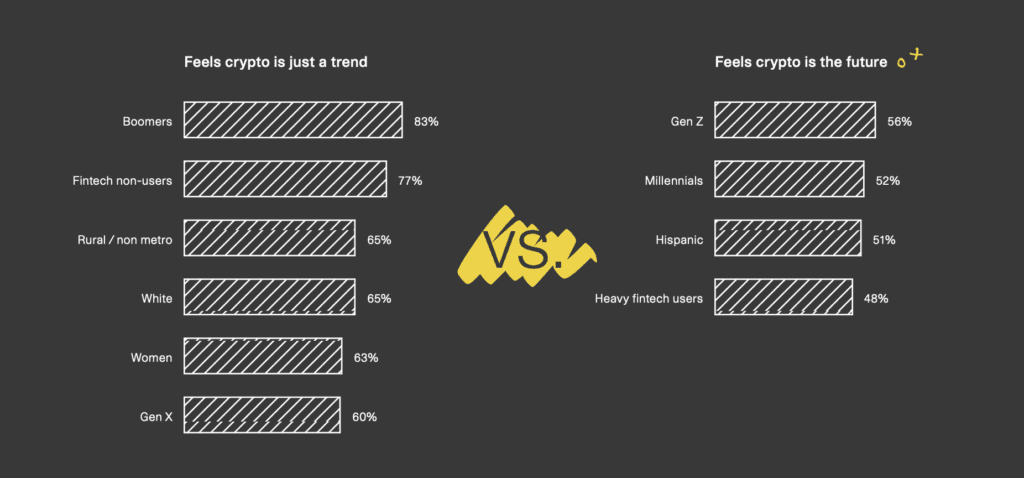

In the UK, despite widespread skepticism, 15% of respondents felt that crypto was likely to impact them in the future. In both jurisdictions, younger generations were more accepting of the technology and thought it would become an essential part of the financial system.

This could bode well for the industry. Already, professionals in the DeFi space see benefits to the ongoing bear run.

“The crypto winter could also be a good thing,” said Ayelen Denovitzer, Co-Founder and CEO of Solvo. “In general and for cleaning up the space. There are fewer projects with higher quality. You have more time to think through and build valuable projects. When you’re in a bull run, you’re building against the clock and needed to launch yesterday.”

This, coupled with the sustained interest and increased understanding of consumers, could spell the industry’s maturation into a structure of increased day-to-day usage.

Increased regulation could push the crypto curious into action

However, adoption could be significantly affected by regulation. Almost 8 in 10 (79%) of UK consumers and two-thirds (67%) of US consumers think the industry needs more regulatory oversight.

The report found that building trust through increased legislation will be critical for consumers to understand the industry’s value. For now, most consumers say they want crypto to remain separate from traditional finance. Still, even though they see fintech and crypto as distinct, six in 10 fintech users would like to connect their crypto accounts to other traditional accounts, such as budgeting and investment apps, to track their overall finances.

As crypto evolves, more regulation combined with increased clarity on the intersection between the two could bring more consumers into the fold.

“Regardless of swings in the crypto market, awareness is at its highest ever – and developer interest in Web3 continues to grow in parallel,” said Keith Grose, Plaid’s Head of Open Banking, Europe. “Our data shows that while consumers are still figuring out where crypto fits into their financial lives, curiosity is growing.”

“For those already crypto-savvy, demand is there to incorporate it into their financial lives by connecting crypto assets to their traditional finance accounts and using DeFi applications. Putting the frameworks in place to establish trust will further boost confidence for people across the U.S. and UK, allowing consumers to make the leap and reap the rewards.”