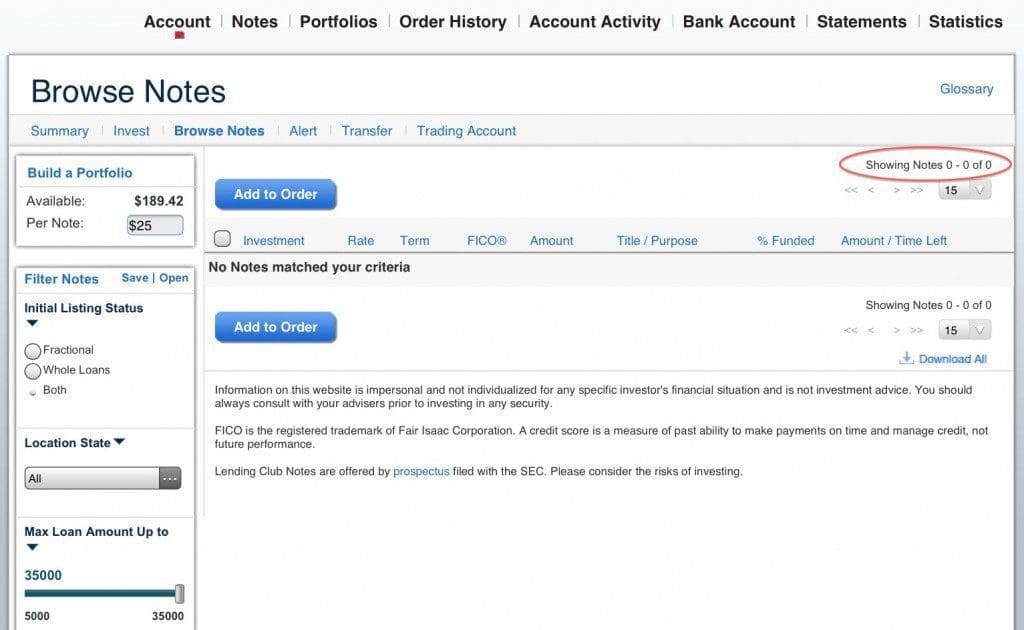

For those of us looking for new loans to invest in late on Friday night we were greeted with the screen above. Yes, that is the Lending Club Browse Notes screen showing zero notes available. What happened?

Well, first let’s preface this with a little information about recent trends at Lending Club. Three months ago I wrote about the new reality for p2p investors and how you need to adjust to this if you want to remain fully invested. Since then, even more investor money has come into Lending Club as well as Prosper.

So, as I followed along with this forum thread on Friday night I wondered whether we had reached a new level where all the loans that were being added were snapped up by investors in a minute or two.

For those of you who weren’t glued to your computer late on Friday this is what happened. At 6pm Pacific Time (to be precise at 6:02pm) just over 100 new loans were added. But by 6:04pm pretty much all these loans had disappeared from the platform. Which left us with just 40 loans of so available. Over the next several hours all these 40 loans were fully invested until we were left with the situation at around 9:45pm PT where no loans were left on the platform for investors.

A Technical Glitch

I contacted Lending Club over the weekend to find out what happened and received a prompt email back on Saturday afternoon. On Friday night there was a technical glitch with the 6pm load and the loans were removed from the site by Lending Club – it was not due to excess investor demand. These loans were slowly added back to the site late on Friday and early on Saturday morning.

Given the investor demand it is clear now that if one of these new loan additions has problems then Lending Club can run out of loans very quickly. Thankfully, it was only for a very short time and it was late on a Friday. But it does expose a vulnerability at Lending Club. With such an oversupply of investors any hiccup with bringing in new borrowers can have a dramatic impact.

Maybe one day we will have the situation where all new loans added will be fully invested immediately. But we are not there yet. Let’s just hope we don’t see any more technical glitches like this.