The move online has opened out the world of commerce. From the comfort of their home, consumers can search across borders for unique and varied products and competitive pricing. Payment products have evolved to meet the e-commerce demand, targeting pain points in a bid to maximize sales for the merchant, minimize friction for the consumer, and boost the sector further.

On 11 September, Splitit Payments announced that it was rolling out a Pay after Delivery function in the US in partnership with AliExpress and Checkout.com.

After successful launches across Europe and Australia, Splitit CEO Nandan Sheth said the company was “thrilled” at the results, and consumers had shown strong demand for the function.

But What Is Pay After Delivery

What is Pay After Delivery? I hear you ask.

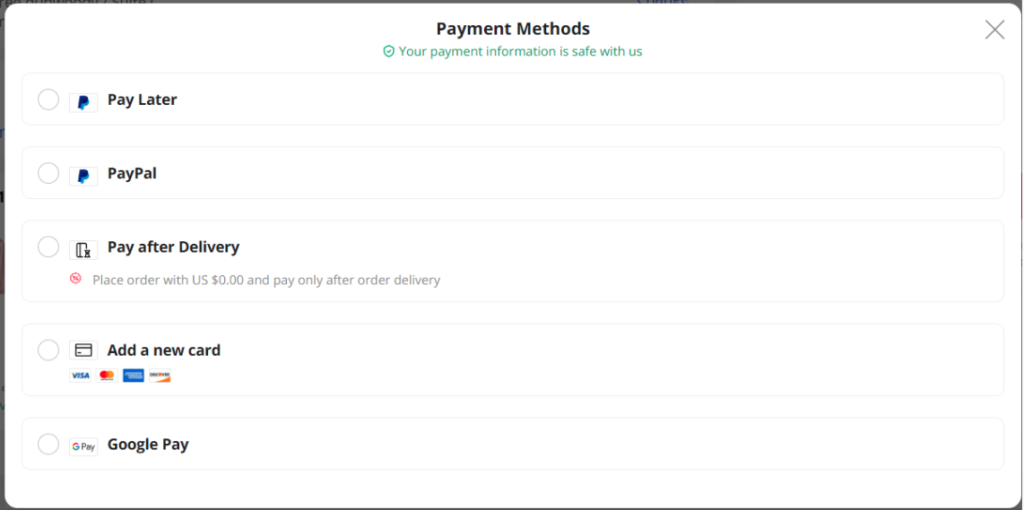

Remember the days when all deliveries were “cash on delivery” (in some areas, they still are)? Pay after delivery brings this payment option to the digital world.

While it is increasingly popular in Europe, the payment solution is fairly new to the US market and stands to bring a new dynamic to e-commerce.

Splitit has offered white-label installment products for some time. Focusing on a demographic that has high credit ratings and access to credit cards, the company has launched BNPL products that use the existing credit available to the consumer via the consumer’s credit card to make loan decisions. This lay the foundation for the pay-after-delivery product.

“We talked to some of our cross-border merchants, and they said their biggest issue is that it takes them time to ship the goods,” said Sheth. “They don’t always have logistical footprints in all of the countries that they serve, and it could take 45-75 days to get the product to customers. The consumer has to trust us, and in some cases, they just won’t buy.”

According to Statista, abandoned cart rates can be as high as 88%. Splitit found that some of the main reasons for cart abandonment include a lack of trust in the security of the online purchase, long and complicated checkout processes, and the appearance of extra costs on checkout.

Sheth explained that due to Splitit’s time in the installment loan space, the company was able to bring the pay-after-delivery product to their merchants with minimal friction.

“We’re pivoting technology that we already have in a product into a new market,” he said.

The pay-after-delivery option was particularly valuable for their cross-border merchant customers, like AliExpress.

“One of the biggest problems we were seeing was, with a pure installment solution, we just weren’t seeing the traction that we were with an in-market merchant that was not cross border,” he continued. As a result, they brought the pay-on-delivery feature.

“The consumer makes the purchase and pledges to pay. And they only pay when they receive the goods or service,” he said. “It instills confidence in the consumer. It allows the merchant to have an effective value proposition. And that allows us to use an existing installed platform which we already have, and pivot that to this new solution.”

Consumers can choose to pay the full amount or opt to pay in three installments on delivery. When the purchase is received, they can also choose to return the product before making the payment, thus avoiding the wait for a refund. Sheth also explained that the company was exploring additional functions, including allowances for “try before you buy” returns and deposits.