Being diversified across many loans is one of the keys to having a successful experience when investing in p2p lending. As with other investments, diversification will reduce the chances of your investment returns experiencing volatility.

Both Prosper and Lending Club provide statistics on owning at least 100 loans. This equates to a total investment of $2,500 investment across 100 loans ($25 per loan) and should be the bare minimum to start with when opening a Lending Club or Prosper account. Certainly adding more notes would be a wise decision as we will explore in this post and our second, more in depth post on this topic.

Below is Lending Club’s guide on diversification. Note that that the percent of investors who earn a negative adjusted net annualized return decreases significantly when you own at least 100 notes and no one loan accounts for greater than 1% of your total portfolio. It is important that if you are purchasing just 100 loans, that the investment in each loan is the minimum amount allowed of $25.

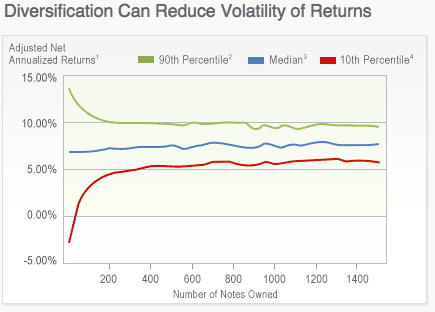

The below graph from Lending Club shows the extreme volatility with portfolios under 100 loans. At the 100 loan mark, even though returns may still be more likely to be positive, there is a wide range possible. Around the 200 loan mark, volatility begins to taper off substantially and offers the much more consistent returns that seasoned investors are used to.

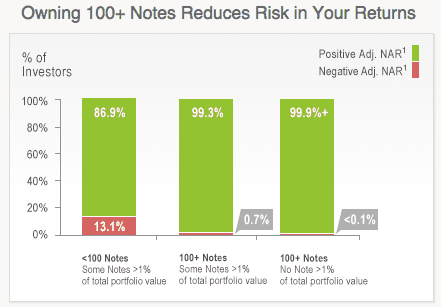

Prosper, similar to Lending Club advertises that 100 loans is the minimum amount of loans you should own when investing. However, they claim that 100% of investors that own 100 or more notes are achieving positive returns.

Can I be too diversified?

In general, having more loans will not affect your performance. Just take a look at the chart from Lending Club above. You don’t see much benefit from diversifying beyond around 500 loans, but even at 1,500 loans you are not hurting your performance.

The exception is if you have strict criteria for loans that you believe may out-perform the averages. In this case, if you are loosening your criteria in order to be fully invested, there is a chance that your returns may be affected. Given the robust volume of notes that Lending Club is originating, it is unlikely that any but the extremely large investors would run into this issue.

Learn More on Diversification

The main issue with this analysis from Lending Club is the fact that it is based on historical information, which does not include a probable increase in defaults during a recession. It is possible that during a recession that a 100 note portfolio will perform far worse than accounts that own several hundred or even thousands of notes. In part 2 of our discussion on diversification, the Chief Credit Officer of NSR Invest will shed some light on how many notes you should own for full diversification given different assumptions and economic environments.