We all know that consumers are being hit hard by the economic devastation caused by the coronavirus. With over 30 million people now out of a job since the middle of March it is to be expected that many consumers would not be making their loan payments. But there is very little data in the public domain that provides a window into how bad the situation is today.

Enter dv01. They are now on the third installment of their biweekly report, COVID-19 Performance Report, and in a short time it has become a must read publication. Their second report provided some insight into loan modifications and delinquencies, sharing that 12% of online consumer loans in early April were either delinquent or the borrower had requested a loan modification. This was roughly double the amount from a month earlier.

Their latest report is super interesting because it provides some historical context on loan performance. While the events of the past few weeks are unprecedented in modern history, we can gain some insight by looking at loan performance in areas that have been affected by a major natural disaster such as a hurricane.

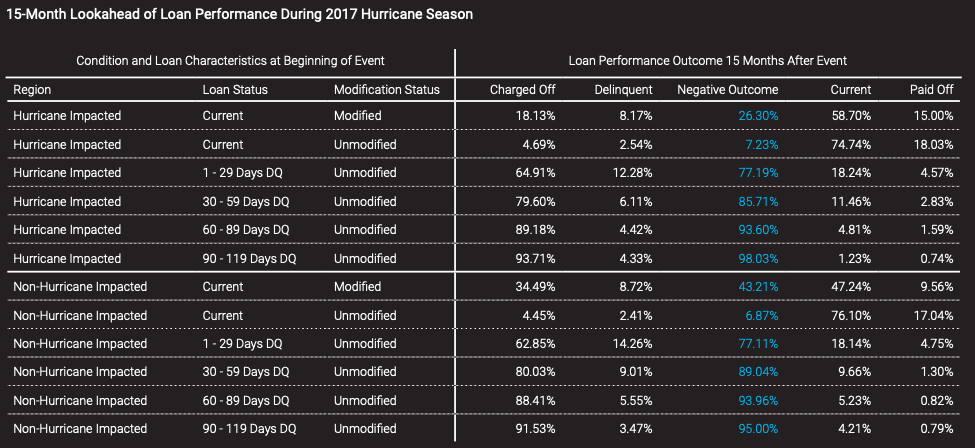

Specifically, dv01 looked at Hurricanes Harvey and Irma that impacted Texas and Florida during 2017. We obviously have a complete data set now as to what happened to the personal loans that were outstanding in the affected areas when the hurricanes hit. All the online lenders offered loan modification options to borrowers in the affected areas similar to what we are seeing now on a national scale.

Before we look into that let’s get a clear picture of where we stand today. While dv01 does not share exactly who is contributing to the data here they did tell me that it is “most major online lenders” in the personal loan space.

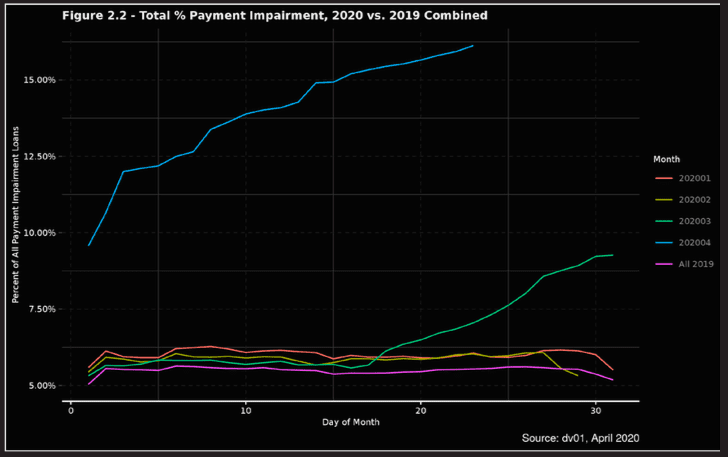

In the above graph we can see from the green line that payment impairment started spiking in the middle of March and the blue line shows month to date in April (the data is through April 23). Payment impairment has gone from less than 6% in 2019 to over 15% today.

Now, it is important to note that the impairment data includes both delinquencies and those borrowers who have been granted some kind of loan modification (typically this means permission to skip at least one monthly payment). Given the state of the economy it is not surprising at all that the impairment numbers are rising considerably.

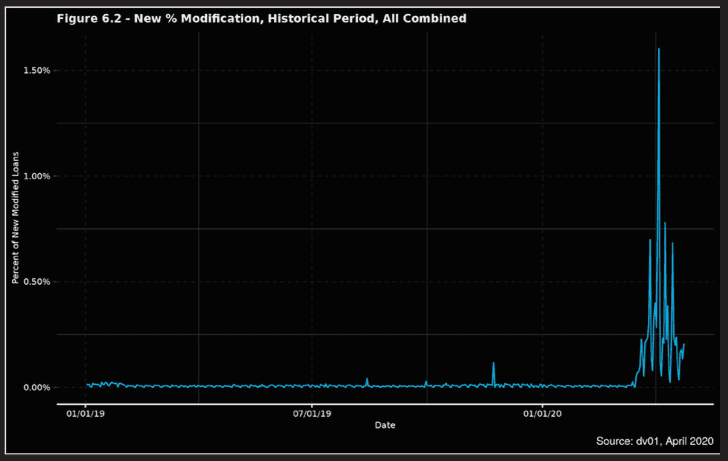

To get an idea of the number of requests for loan modifications dv01 provided this useful chart of daily activity:

We see that loan modifications started increasing on March 18 with the largest spike occurring around the beginning of April as many loan payments were becoming due. It is interesting that by mid-April the number of new loan modification requests had dropped dramatically.

The most interesting part of this report is when they go back to analyze borrower behavior when confronted with a natural disaster.

Here is what Wei Wu, the Principal Data Scientist at dv01 said about this data:

Many borrowers impacted by region-wide economic changes were able to resume repayment once circumstances improved, we observed that hurricane-related modifications were 1.6x less likely of negative outcomes versus non-hurricane modifications.

Perhaps more importantly modified loans were 3x less likely to have a negative outcome than borrowers in the earliest stage of delinquency. Now, the big caveat here is that events of today are not quite the same as a localized hurricane as the entire nation is being affected.

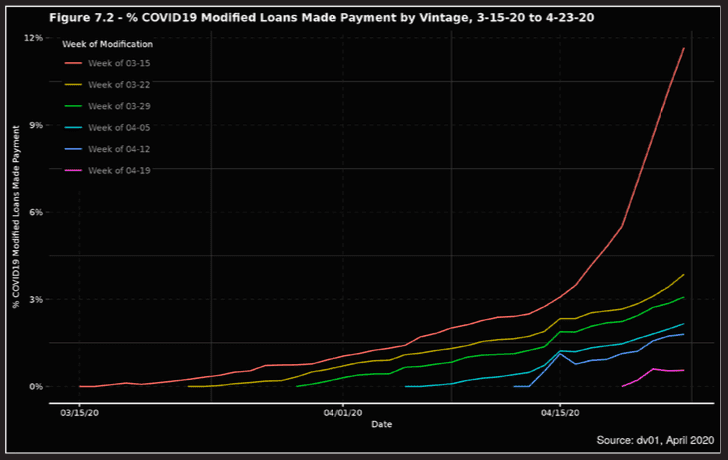

Our final chart shows some more (very early) good news for consumer lenders today. This shows very recent borrower behavior on payments that were made even though the borrower had requested a loan modification, meaning these payments were not required.

Vadim Verkhoglyad, Principal Analyst at dv01 commented:

Even with the caveats discussed above and the economic hardships in place, seeing over 10% of borrowers make their first post-modification payment (when most borrowers were not required to do so) is an encouraging sign of what post-modification performance might look like.

There are many more charts and interesting data in the report but this does provide some useful knowledge for the personal loan space as to where we are at today. The report also had a section analyzing the loan performance on non-qualified mortgages which we will not get into here.

Many commentators have said over the years that the online lenders have not been through a downturn and so we have no idea how their loans will perform when the going gets tough. We are clearly about to find out. Some have claimed that the defaults will increase at a higher rate than the unemployment increases but so far the data does not suggest that.

One of the challenges of this unique time is that so many lending platforms and investors are flying blind. No one knows exactly how loan performance is going to hold up in the coming months. So, it is critical that we get timely data that shows how recent numbers are trending. I certainly hope that dv01 continues to provide these biweekly reports, it is an important service to the industry.