Eastern Fintech

Featured

In this conversation, we chat with Richard Turrin – an award-winning executive, previously heading FinTech teams at IBM, following a twenty-year career, heading trading teams at global investment banks. He’s also the author of the number one international bestseller, Innovation Lab Excellence. One of his books is Cashless: China’s Digital Currency Revolution, which brings the story of China’s incredible new central bank digital currency to the west. He lives in Shanghai, China, where he’s had the privilege of living in China’s cashless revolution firsthand.

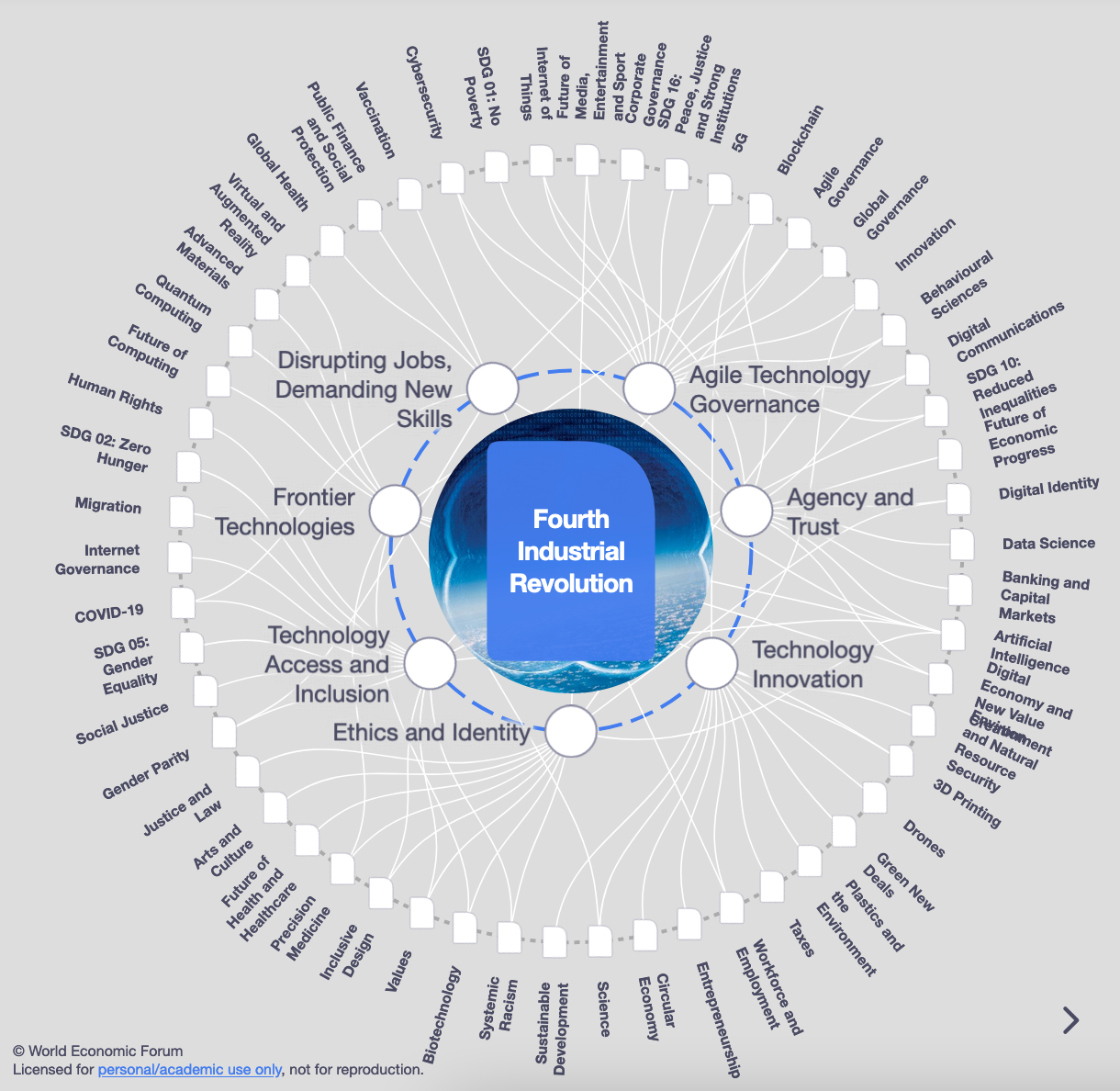

In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

This week, we cover these ideas:

-

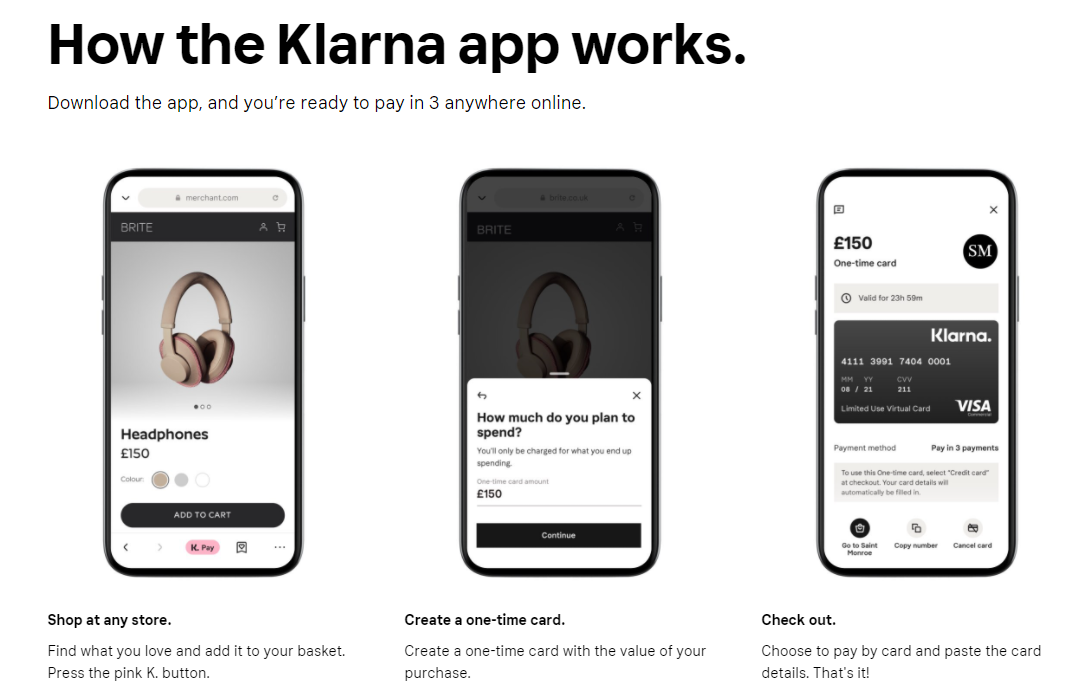

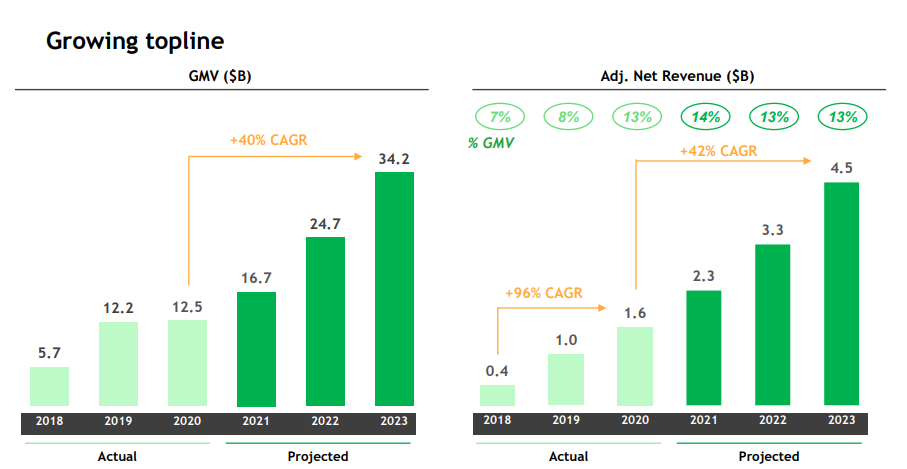

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

-

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

-

A comparison of approaches to growth and economics

-

Implications for crypto assets for capturing “the real economy”

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.

This week, we cover these ideas:

-

The nature of digital identity, and the difference between a representation at some moment of time vs. a record of your being

-

The launch of the DeFi Passport by Arcx and how it can be useful for underwriting

-

The European Digital Wallet, and the implication of such a development for CBDCs and government services

-

China’s CBDC, Sweden’s BankID, and other existential crises

If you want to go deeper on this topic, we strongly recommend our conversation with Michael Cena of the Ceramic Network here. Whereas Michael started working on the identity problem by trying to add labels to people, where he ended up is creating a protocol that tracks historic software activity and interactions between actors. In thinking about the Ship of Theseus, this is the solution that says — your identity is your journey through the river of time itself, and not any particular stop you make along the way.

This week, we look at:

-

The economics of Southeast Asia’s largest super-app and its $40 billion SPAC valuation

-

The industrial logic of building out financial features adjacent to the core business of transportation and delivery

-

Why this model has not worked for Uber, but has worked for Apple, and the broader impact on financial services.

This week, we look at:

-

China’s Five Year Plan, the industrial logic of the system, and its ramifications for blockchain and fintech in the country

-

The regulatory challenges faced by Chinese tech companies, including the resignation of Ant Group’s CEO and the anti-competition fines for Tencent

-

The growth path of the e-CNY digital currency, as well as Beijing’s enterprise blockchain powering the city infrastructure and governance

-

Footnote: Stripe worth $95 billion, closing $600 million investment

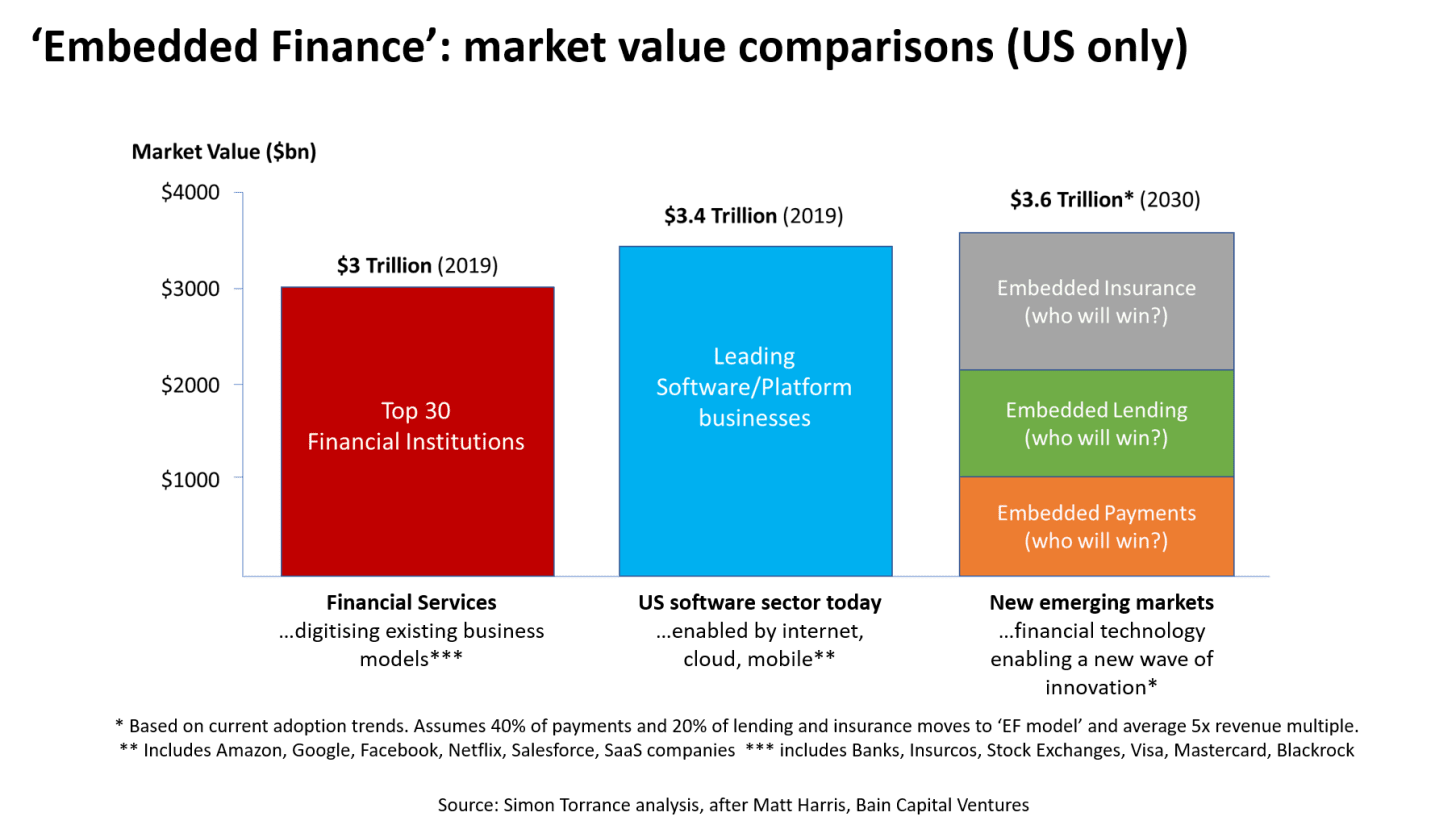

In this conversation, we talk all things embedded finance, platform banking, and APIs with Simon Torrance – one of the world’s leading thinkers on business model transformation, specializing in platform strategy, breakthrough innovation and digital ventures.

There’s an enormous gap between the financial needs of humanity and what the financial sector is able to deliver there. This gap is being filled by tech-savvy solutions and embedded finance plays which are putting into question the role of a bank in this new ecosystem.

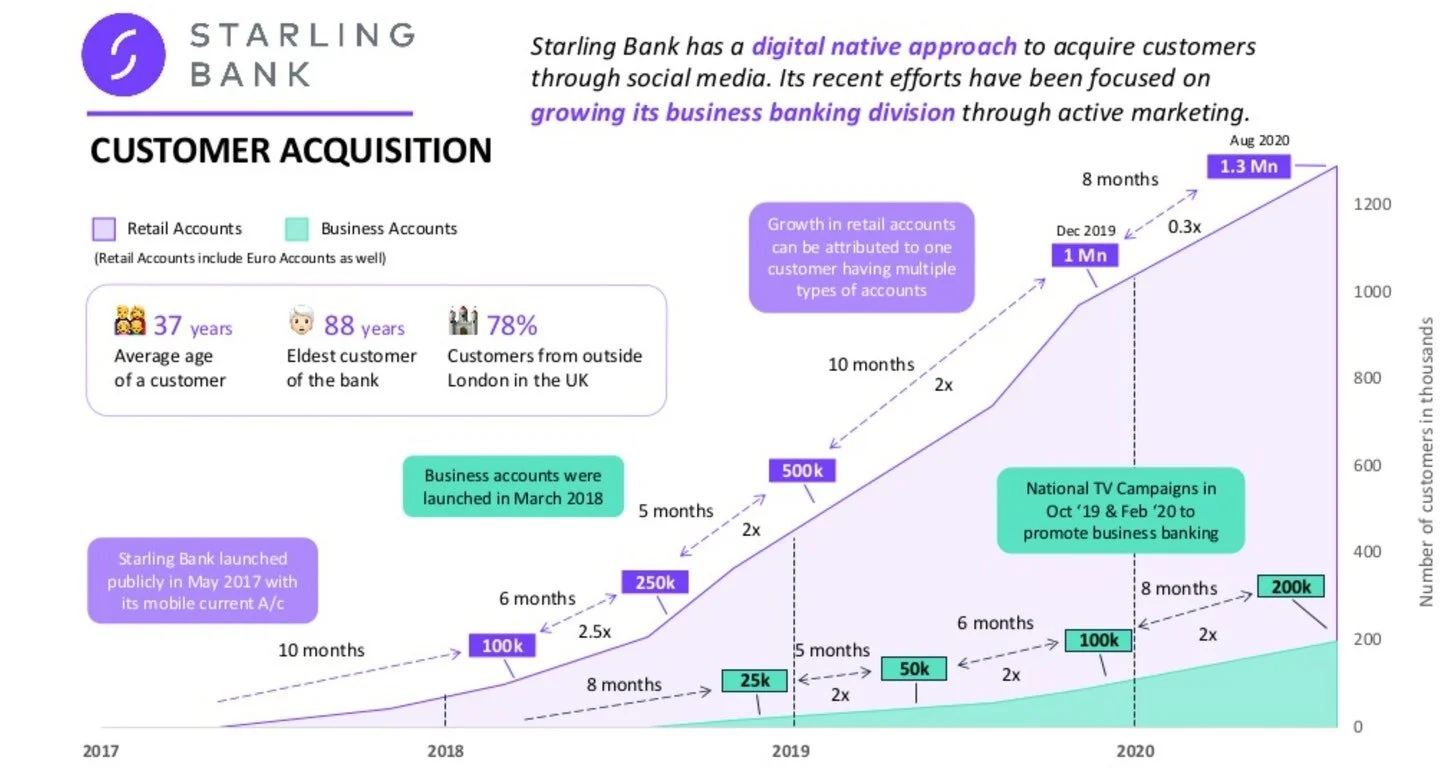

In this conversation, we talk with Anne Boden, the CEO of Starling Bank. Starling has just turned profitable, and reached several significant milestones in terms of 1.8 million clients, $4 billion in deposits, and $1.5 billion of lending.

That is quite meaningfully ahead of our model, and probably ahead of everyone’s model, of where neobanks would be in 2020. While COVID has accelerated the digital lifestyle, Anne credits deeper demographic, technology, and cultural insights and choices she has made in building Starling for success.

Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let’s walk through the features.

This week, we look at:

-

The relationship between an individual and a system, and how that applies to the power games of politics and economics. Did Trump change the system, or did the system generate Trump?

-

The difference between fighting and signalling, and what creates fragility and flexibility in governance structures

-

Why the Communist Party stopped Ant Financial’s IPO, and how Jack Ma bears a resemblance to Mikhail Gorbachev

Ant Financial, Bitcoin, Visa, Plaid, DOJ, PayPal, China, E-CNY / DCEP, Ethereum

Ant Financial, Bitcoin, Visa, Plaid, DOJ, PayPal, China, E-CNY / DCEP, Ethereum

This week, we look at:

-

The Bitcoin money supply being worth as much as the M1 of several countries

-

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

-

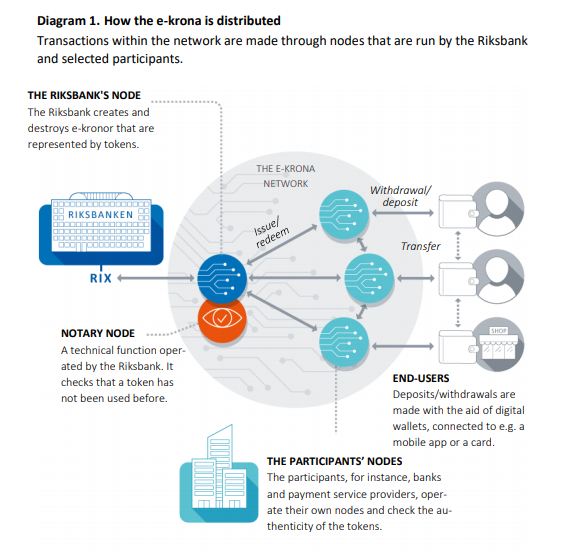

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

-

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

This week, we look at:

-

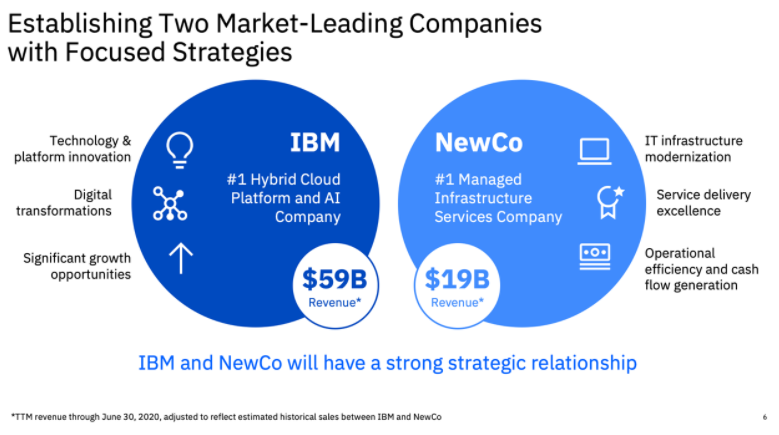

IBM spinning out its managed services division with $18 billion of revenue in order to focus on hybrid cloud and digital transformation

-

Reliance Jio, the Indian mobile telecom provider with 400 million users, contemplating financial services with backing from Google and Facebook

-

The role that technology infrastructure plays in the delivery of financial services

In this conversation, Max Friedrich of ARK Invest, Will and Lex break down Ant Group’s highly anticipated IPO.

Ant, a spinout from Alibaba and the parent of Alipay, one of China’s leading payments companies, filed papers to IPO in Shanghai and Hong Kong.

Max, Will and Lex dig into Ant’s business, from the origins to today, discuss growth opportunities and potential headwinds and explore the multi-faceted relationships between Ant and other big tech companies and national governments.

We cannot understate how impressive Ant Financial has become, connecting 700 million people and 80 million merchants in China, with payments, savings, wealth management and insurance products integrated in one package. The company also highlights the likely road for traditional banks — as underlying risk capital, without much technology or client management.

This week, we look at:

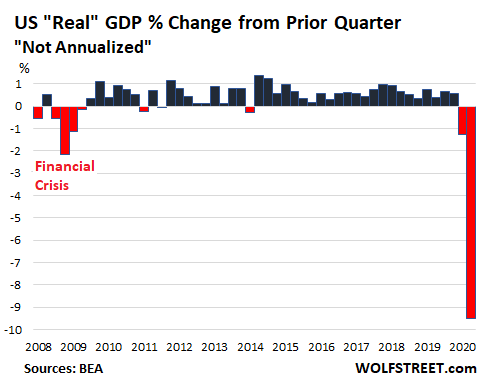

The 10% collapse in GDP across the US & Eurozone, and how it compares with China’s second quarter

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion

The fintech world is not taking the summer off. New developments are coming fast and furious, from fundraisings to product launches to government intervention.

Banking for brands startup Bond raised $32 million to capitalize on the exploding trend of B2B2C banking.

Samsung Money launched, leveraging SoFi’s infrastructure. As SoFi again seeks a national banking charter, they could become the de facto leader in this space.

Kabbage and Intuit launched small business bank accounts as extensions of their already deep relationships with SMBs.

And WhatsApp is trialing all sorts of financial services in India just as Chinese fintech super apps are being banned from the country.

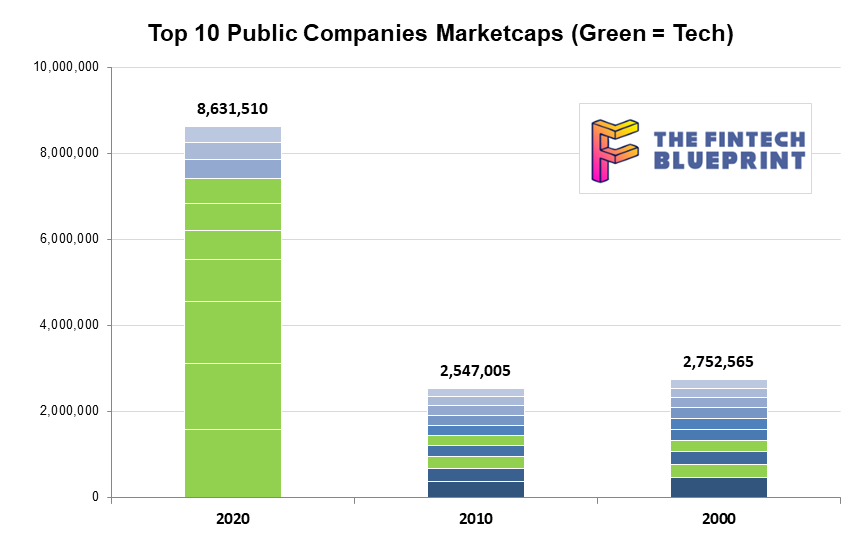

This week, we look at a breakthrough artificial intelligence release from OpenAI, called GPT-3. It is powered by a machine learning algorithm called a Transformer Model, and has been trained on 8 years of web-crawled text data across 175 billion parameters. GPT-3 likes to do arithmetic, solve SAT analogy questions, write Harry Potter fan fiction, and code CSS and SQL queries. We anchor the analysis of these development in the changing $8 trillion landscape of our public companies, and the tech cold war with China.

If you are in finance and only looking at banks, you are missing out on the real change agents. Here’s some cross-industry action that we will unpack this week.

Amazon selected Goldman Sachs to be the lender of choice for small business loans. TikTok maker ByteDance is working with a Singaporean business family to get a financial license. And small business bank Starling is integrating Slack, energy switching service Bionic, and health insurance provider Equipsme into their marketplace. And we might as well talk about the Plaid Exchange launch, and end on the computational economy of Ethereum.

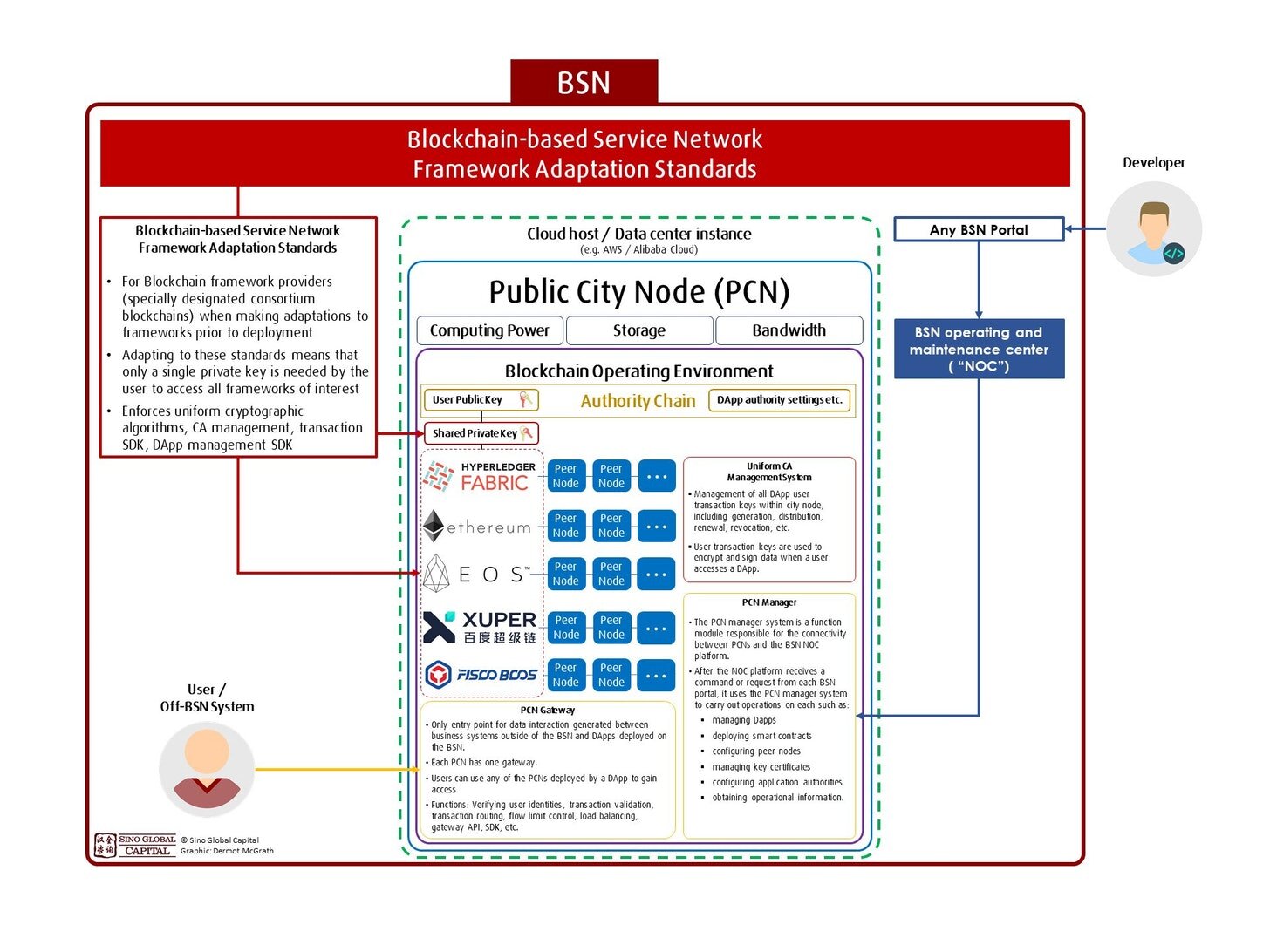

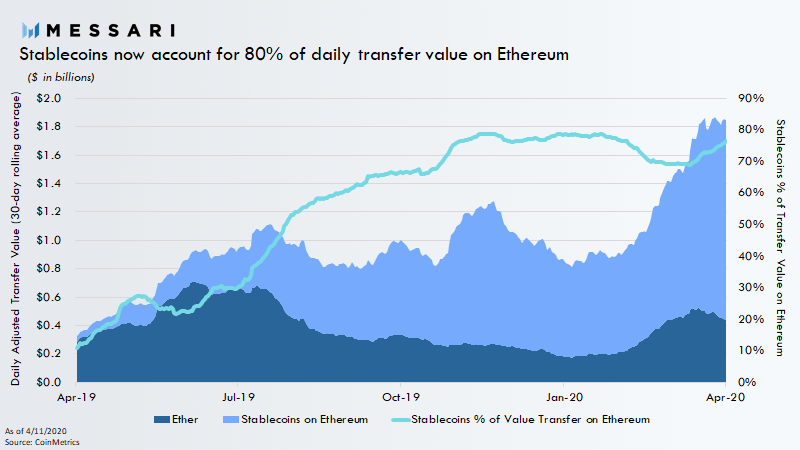

This week, we look at cash — blockchain cash. The war for money is just starting to ramp up, as Facebook Libra explains its new regulated plan, the Chinese national Blockchain Service network goes live, Ethereum stablecoins reach historic market caps in the billions, and the Financial Stability Board recommends to go heavy on global stablecoin arrangements. In 2008, Bitcoin threw a rock through the window of the financial skyscraper, and today we are starting to see the cracks. As the US government runs out of $350 billion in small business bail-out money and gets ready to print more, where do you stand?

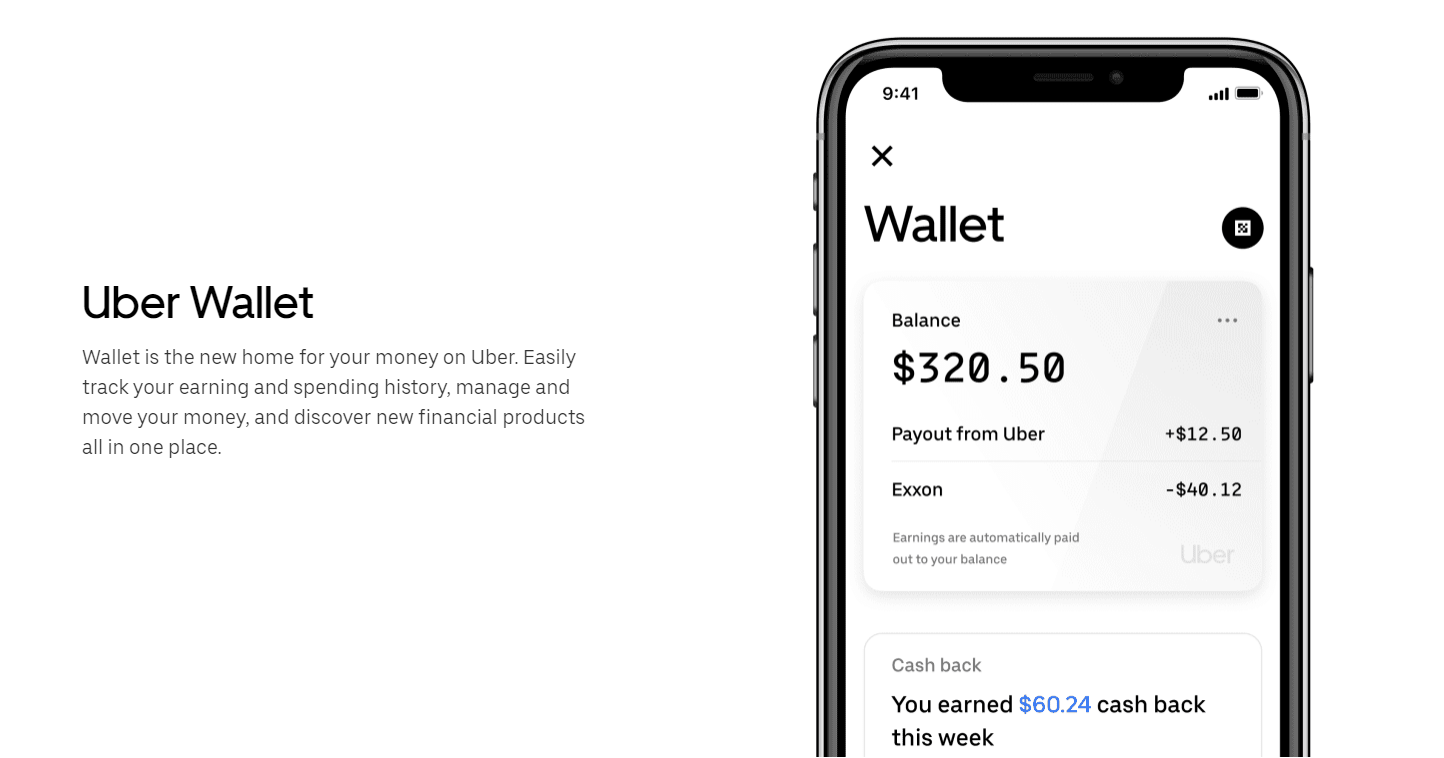

Uber has entered finance! The end is nigh! The boogeyman is here!

Oh. So what’s involved? There’s a debit card and a “debit account” powered by Green Dot, the same bank that’s behind Apple Pay’s person to person service. That means that Uber isn’t a bank, but is renting shelf space on one. There’s a wallet that will be integrated into the Uber app, within the driver’s experience. So tracking your earnings and spending will be a feature that is part of the app — not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there’s a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!

I look at the boundaries that Telegram and EOS have crashed into in the US with recent SEC actions and lawsuits, and the melting of Facebook Libra. There have been a number of interesting regulatory moves recently, and the positive headlines of 2017 have become the negative headlines of 2019. How does SEC jurisdiction reach foreign institutional investors? We also touch on the $1.5 billion NBA distribution deal now on the fence in China, and how US companies are under the speech jurisdiction of a foreign nation. How does China reach American protected speech? Through pressure, boycott, and economics.

I’ve seen a whole bunch of headlines this past week about how Facebook is launching its version of the “Supreme Court”, as if that were an app feature. The oversight board is meant to police controversial content decisions, and have the power to overrule Zuck’s judgment on political matters. Its charter is drafted as if Facebook’s 3 billion users were citizens of an Internet nation. Add to this the insanity over WeWork’s failing IPO plans, where the CEO has been personally named in the amended filing documents with clear checks on demonstrated abuses of power. We are drifting into a Twilight Zone episode where modern corporations act as if they were feudal states run by divine kings negotiating with their nobility over a Magna Carta. Which is actually sort of where we are.

How do the Americans and the Chinese have such different ethical takes on privacy, self-sovereignty, media, and the role of government? We can trace the root cause to the DNA of the macro-organism in which individuals reside, itself built over centuries and millenia from the collective scar tissue of local human experience. But there is more to observe. The technology now being deployed in each jurisdiction — like social credit, surveillance artificial intelligence, monitored payment rails, and central bank cryptocurrency — will drive a software architecture into the core of our societies that reflects the current moment. And it will be nearly impossible to change! This is why *how* we democratize access to financial services matters. We must be careful about the form, because we will be stuck with it like Americans are stuck with the core banking systems from the 1970s. But the worry is not inefficiency, it is programmed social strata.

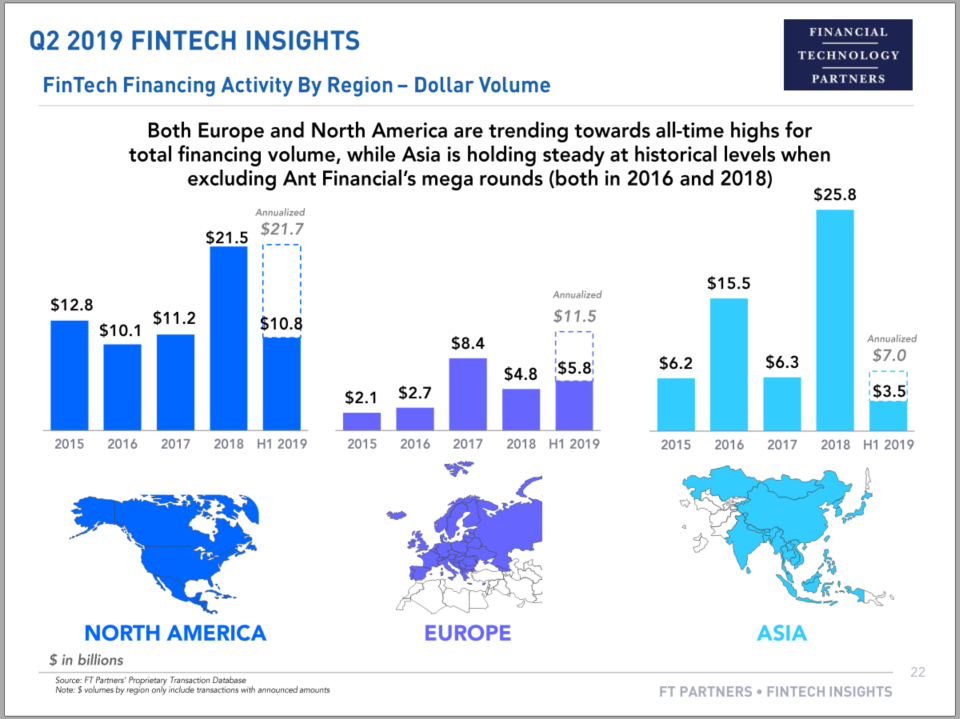

Fintech is expensive. Fintech is everywhere. If you are a thinking about starting a financial services company, and it does not have technology at its core — don’t. You will lose to someone similarly positioned building a more augmented business. Fintech is the global competition for regulation, talent, and macroeconomic supremacy. Fintech is the trade war between the US and China. Fintech is Facebook and Amazon. Fintech is the next bubble to burst. Fintech has burst already.

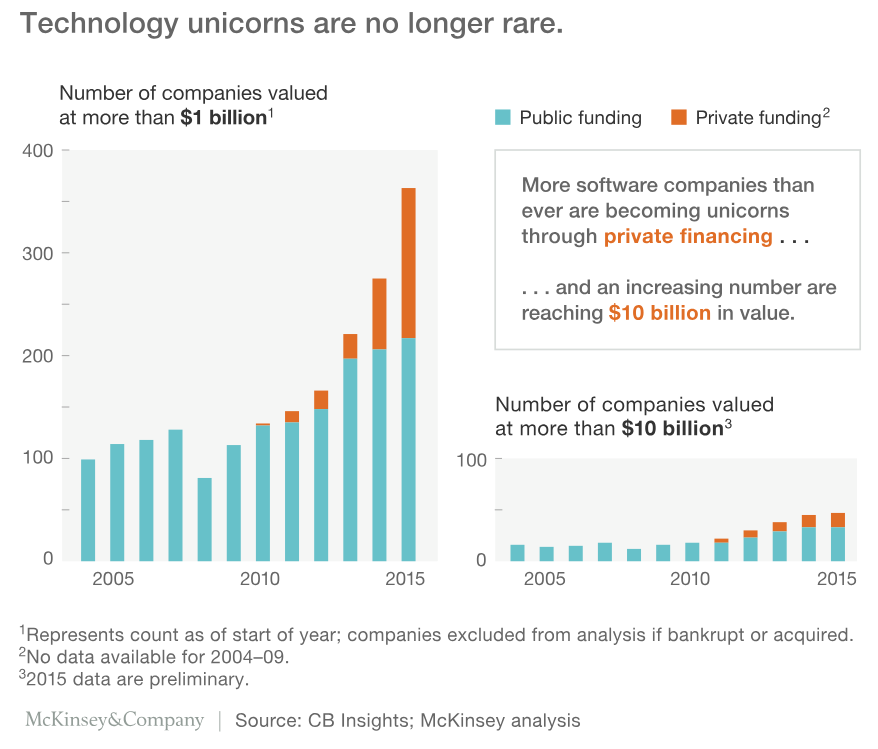

The world is on fire with talk about Uber going public. First, let’s talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers — not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment’s index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.