Economics

Featured

We anchor our writing around the World Economic Forum 223 page report on CBDCs and stablecoins. The analysis highlights the key conclusions across several white papers in the report. We then add a layer of meta analysis around the language in the report, and question what it is trying to accomplish, and whether that will work with the Web3 revolution. This leads us to think about the tension between populism, as represented by crypto, and institutionalism, as represented by banking structures. We discuss theories of cultural and national DNA, and the rise of populism, as difficult problems to solve for any global alignment.

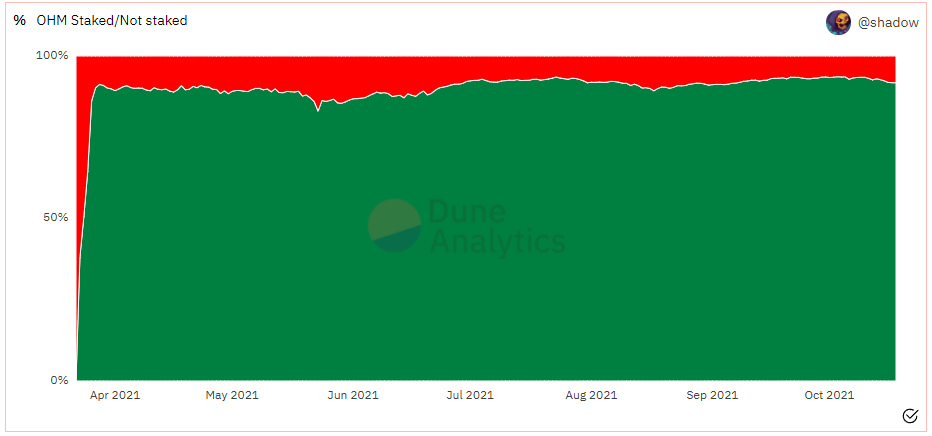

Decentralized finance is formulating new mechanisms to correct for the pitfalls of liquidity mining, yield farming, and other early token distribution approaches. This is happening both at the level of individual projects like Alchemix or Fei, and at the level of industry wide consolidation through Olympus DAO and Tokemak. We explore where this evolution is going, and potential outcomes. In this first part of the analysis, we look closely at Olympus DAO, the concept of Protocol Owned Liquidity, and whether the economics make sense.

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

The macro and crypto economic thesis for 2021, building out the linkages between “Risk-On” assets, flows into and valuation of Bitcoin and Ethereum, and the interplay between value locked, the growth of decentralized application revenue, and the volumes around digital objects. We bring it all together.

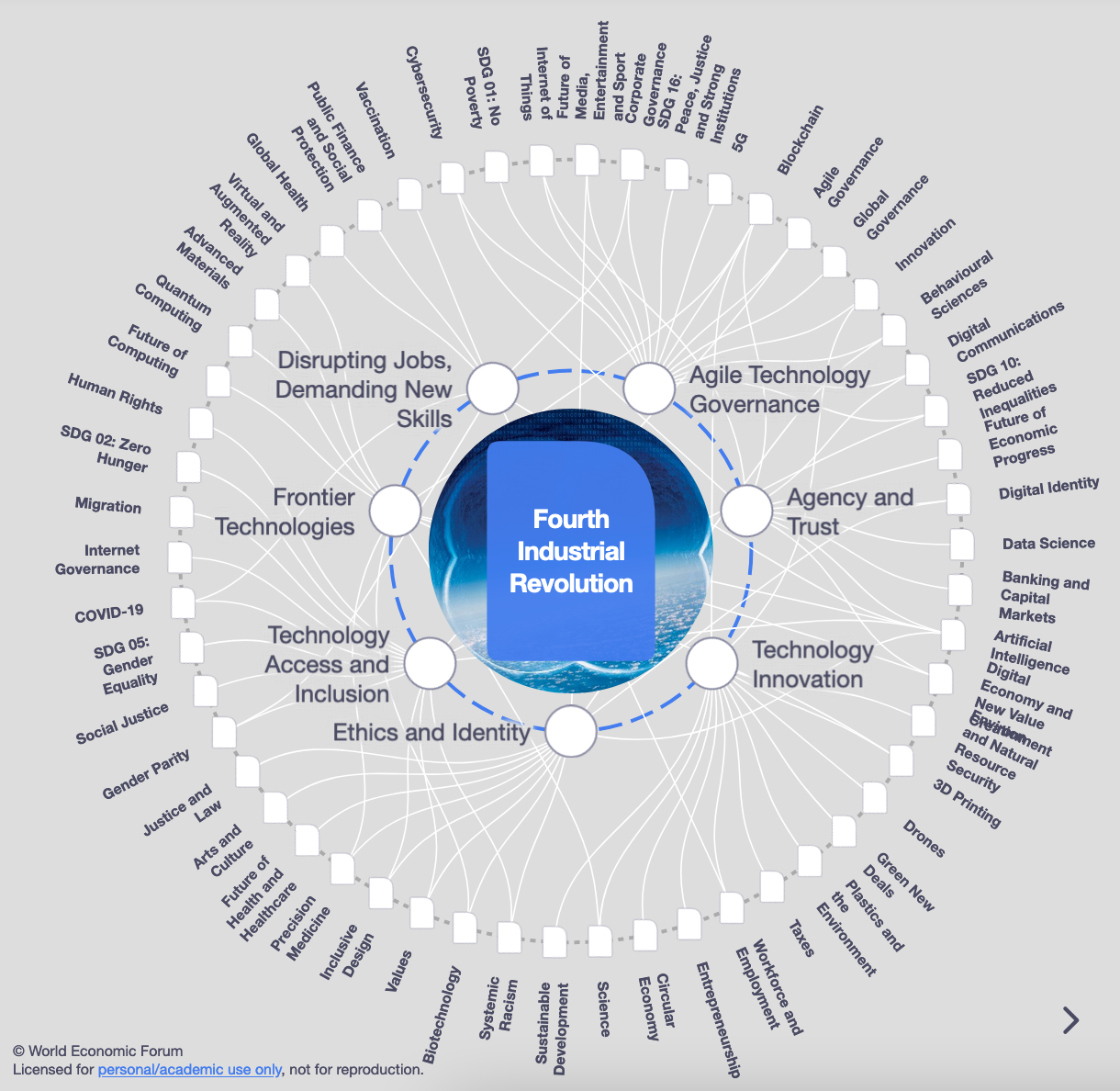

In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

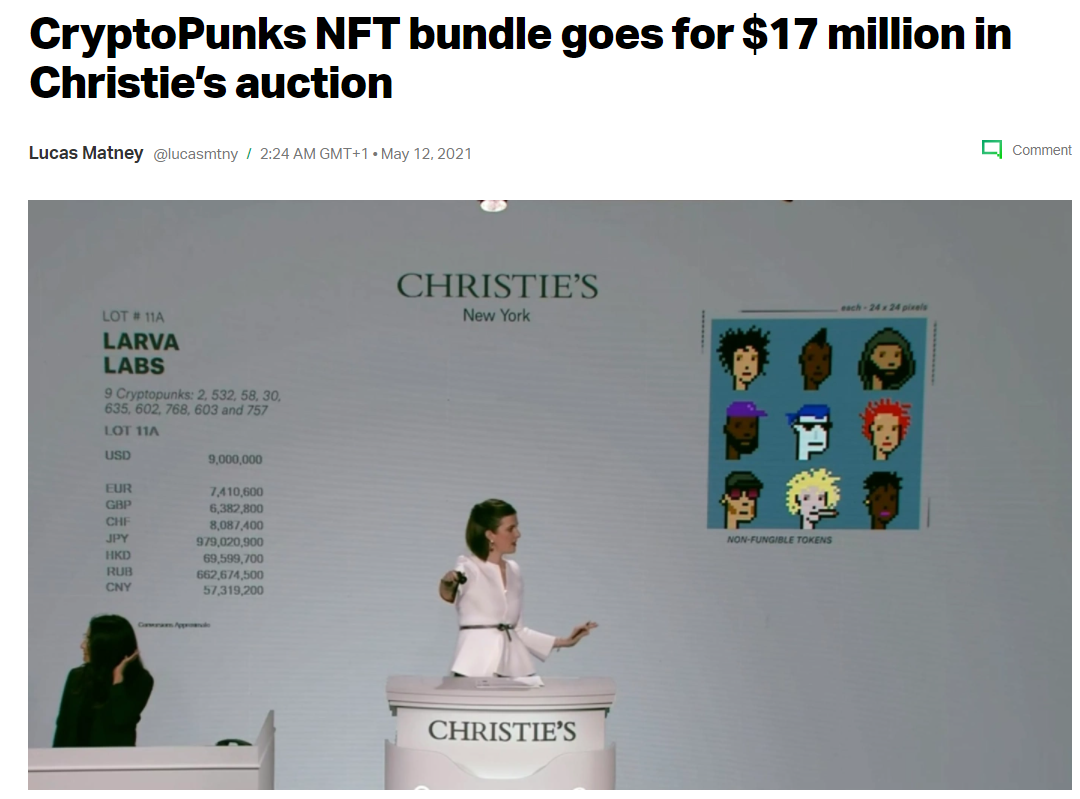

Luxury and fashion markets are structurally different from finance or commodity markets in that they seek to limit supply in order to generate value. This increases price and social status. We can analogize these brand dynamics to what is happening in NFT digital object markets and better understand their function as a result.

We’re not cool. That’s why we’re in finance.

But people want to be cool. As highly social and intelligent animals, we want and need to belong, differentiate against each other, and negotiate for status. We create signals and hierarchies to create pockets of relational capital, which we then cash in for real world benefits.

Such mammalian realities are contrary to the economic rendering of the homo economicus, the abstracted rational agent making choices in financial models. In 2021, our financial models are waking up and instantiating themselves, becoming Decentralized Autonomous Organizations (DAOs), spun up by DeFi and NFT industry insiders, and implemented into commercial actions onchain.

This week, we cover these ideas:

-

Crypto prices show increasing correlation in market swings, which hides the large substantive differences between projects

-

The core narrative of Bitcoin, and its fundamental indicators

-

The core narrative of Ethereum and Web3, and its fundamental indicators

-

A sanity check on potential market caps relative to gold, equities, and other assets

This week, we cover these ideas:

-

That absurd Paul Krugman article about Bitcoin. Also Jim Cramer has things to say about financial regulation.

-

If all the prices are down, which they are, does that mean that everything is bad and wrong?

-

How timing is a personal financial planning problem, not a market value problem

In this conversation, we talk with Robert Leshner of The Compound Protocol about the early days of crypto and how a fascination with Ethereum smart contracts drove him to build one of the largest DeFi projects to date.

Additionally, we explore the nuances of lending and interest rates, consumer privacy software and data monetization, floating interest rate pools of capital across different token pairs, DAO evolution and its influence on mechanism design, the role Compound plays in chain interoperability, and the discovery of yield farming as a means for user incentivisation.

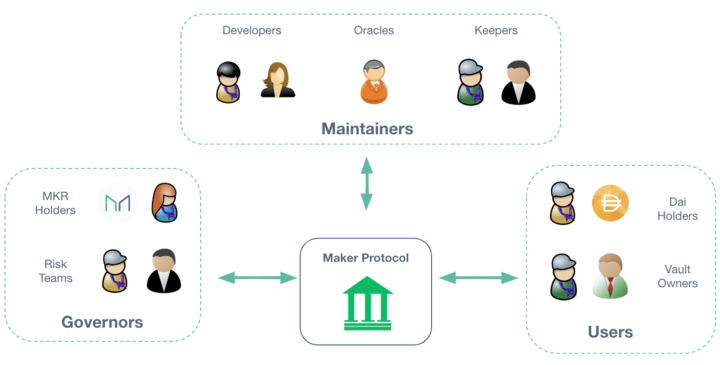

In this conversation, we talk with Rune Christensen of Maker Foundation about how he became one of the most influential builders in the DeFi ecosystem. Additionally, we explore the creation, experiences, and evolution of Decentralized Autonomous Organizations (DAOs), the nuances of stablecoins, the interaction between Maker and DeFi with traditional finance and traditional economies, and Maker’s approach to leveraging layer 2 solutions to aiding scalability and transaction throughput.

Crypto isn’t magic. It’s math. Two trillion dollars worth of math.

We are still, often, asked incorrect questions about the crypto currency markets. Questions like — “but what is the fundamental value?”

You have to unpack the word “fundamental”. That word signals a Warren Buffet view of the world: there are companies out there, they have equity shares well specified by corporate law in a particular jurisdiction, some are expensive while some are cheap, and that bargain shopping can be determined by a spreadsheet analysis of their cashflows relative to others. It’s so fundamental!

The story of such fundamental truth is anchored in our cultural and social history. We can point to the intellectual tradition of rationalism and classical economics, and talk about the theory of the firm, and its production function. We can point to how these things grew out of governance by religion, and natural rights as granted by a deity, and all sorts of other non-empirical hand waving.

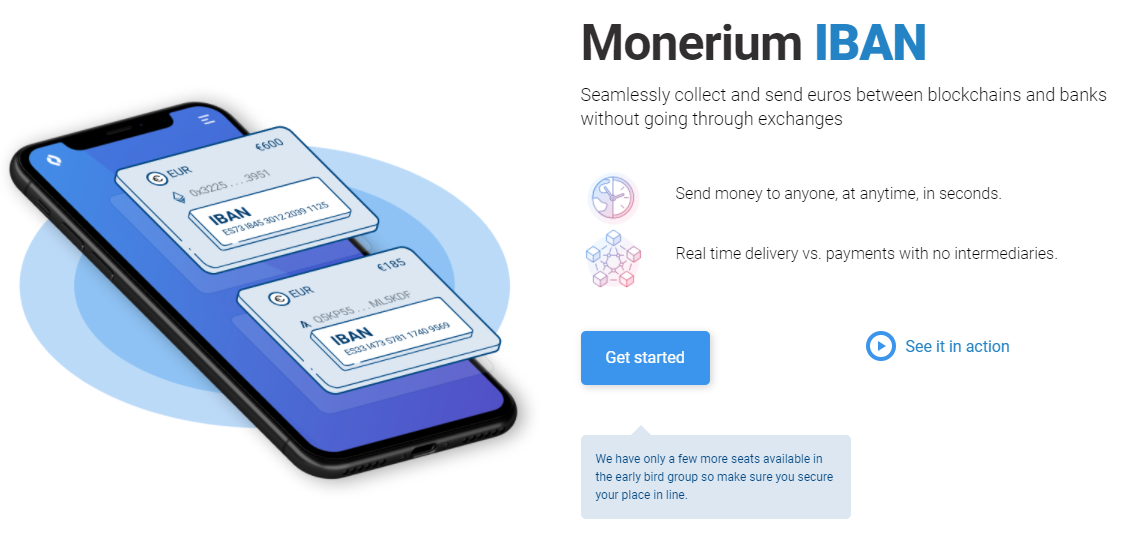

In this conversation, we talk with Jon Helgi Egilsson about his incredible journey to becoming Chairman and a co-founder of Monerium.

Jon is a former chairman and vice-chairman of the supervisory board of the Icelandic Central Bank, a former adjunct professor in financial engineering and MBA lecturer at Reykjavik University, a visiting scholar at Columbia University, and co-founder of four software companies. Additionally, we explore the various concepts of digital money in the framework creating a competitive yet unified environment between fiat money, banking based on fractional-reserve, and the token economy.

This week, we look at:

-

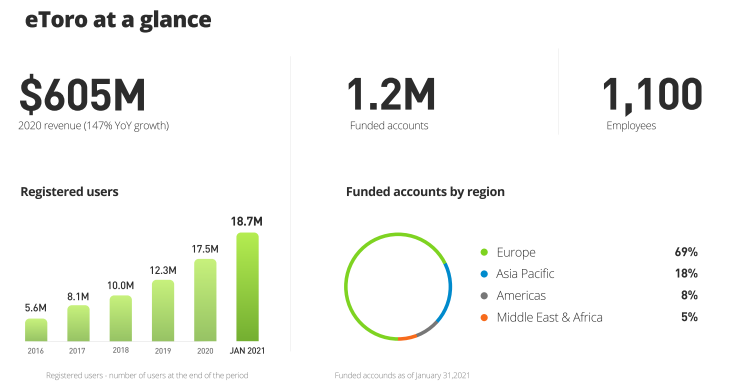

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

-

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

-

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

-

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give

In this exciting conversation, we talk with none other than Joe Lubin of ConsenSys and Ethereum, about his journey from being exposed to advances in artificial intelligence at Princeton to becoming the household name in programmable blockchain. Additionally, we get an insider look into his founding of Ethereum and ConsenSys, and how the technology and individuals behind these two companies are transforming the very fabric of financial institutions that exist today and how new products/services are started for the betterment of humanity.

This week, we look at:

-

The spectacular price increase in crypto assets, hitting new records for Bitcoin, as well as the comparable statistical situation around Covid cases

-

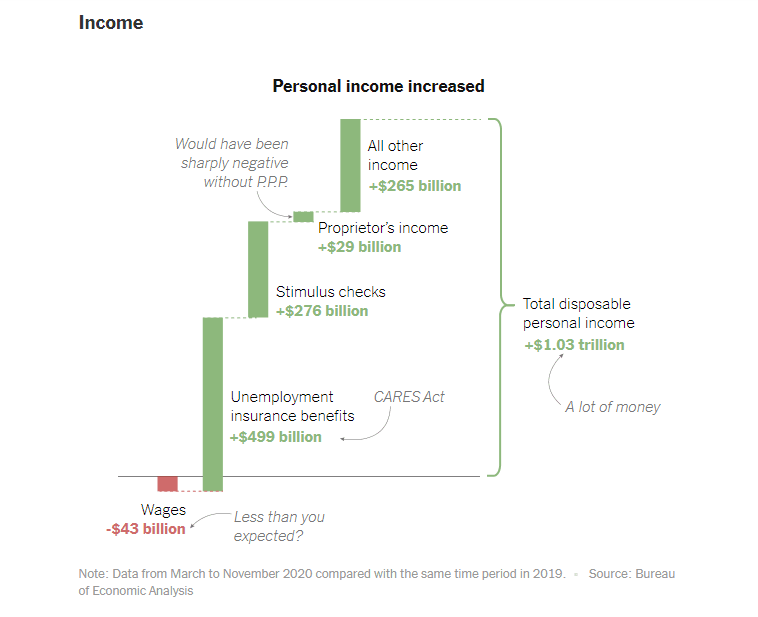

An explanation of the $1.5 trilion income effect in 2020, and how it has led to both capital acumulation and inequity (thanks NY Times!)

-

A discussion of all-time-highs and all-time-lows, why we need them, and their connections to the macro-economy, computer code, music, and the universe itself

One wonderful takeaway from Watts, which of course is not his, but beautifully plagiarized into the English language, is the duality of experience. The need for polar opposites, in a clock-like cycle. To have black, you must have white. To have the top of the wave, you need the bottom of the wave. To have a melody, you need equally the presence of the notes, and their absence in silence. To breathe in, you need to breath out. It is meaningless to have a data point without the context in which it exists.

Ant Financial, Bitcoin, Visa, Plaid, DOJ, PayPal, China, E-CNY / DCEP, Ethereum

Ant Financial, Bitcoin, Visa, Plaid, DOJ, PayPal, China, E-CNY / DCEP, Ethereum

This week, we look at:

-

The Bitcoin money supply being worth as much as the M1 of several countries

-

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

-

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

-

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

This week, we look at:

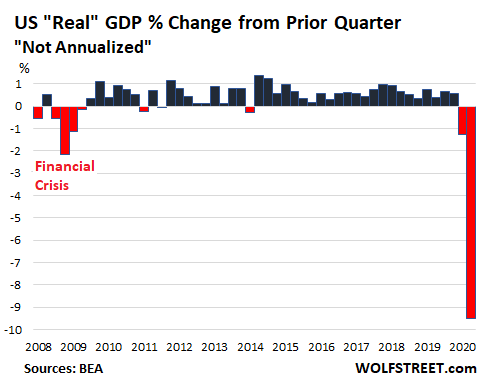

The 10% collapse in GDP across the US & Eurozone, and how it compares with China’s second quarter

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion

If you are in finance and only looking at banks, you are missing out on the real change agents. Here’s some cross-industry action that we will unpack this week.

Amazon selected Goldman Sachs to be the lender of choice for small business loans. TikTok maker ByteDance is working with a Singaporean business family to get a financial license. And small business bank Starling is integrating Slack, energy switching service Bionic, and health insurance provider Equipsme into their marketplace. And we might as well talk about the Plaid Exchange launch, and end on the computational economy of Ethereum.

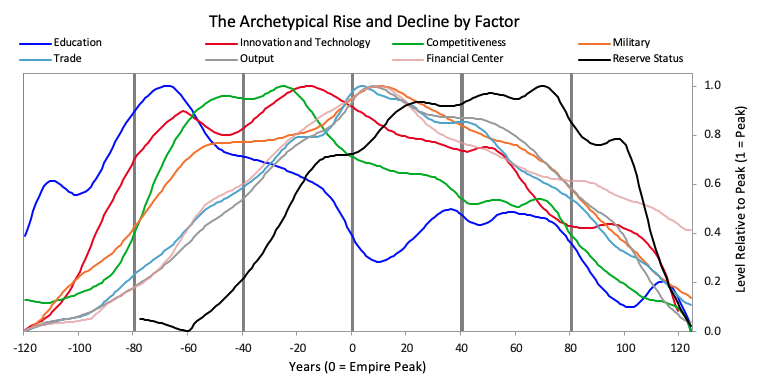

This week, we engage deeply with Ray Dalio’s economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.

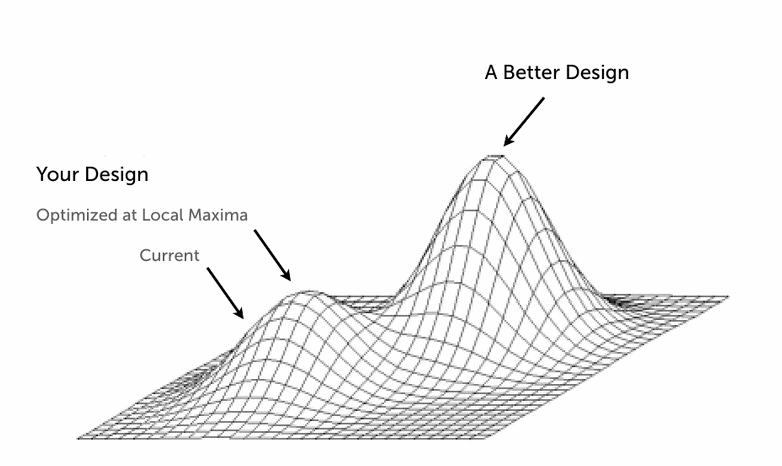

This week, we look at Betterment launching a bank account and payments feature. They are not the first, but they could be the best! Still, it feels like the world has moved on. Barriers to entry around digital finance have collapsed, and shifted industry goal posts. Hundreds of companies are integrating API-based solutions that connect to banking and investment entities. Amazon, Google, and Apple are there already. And let’s not forget the incredible pressure from the COVID recession: 20MM+ unemployed, $100 billion decrease in global remittances, 1 in 8 banks being unprofitable. Is it time for incremental improvement, or a sea change?

I came upon this announcement by Stephen Wolfram recently: Finally We May Have a Path to the Fundamental Theory of Physics… and It’s Beautiful. Wolfram is a theoretical physicist turned mathematician, computer scientist, and entrepreneur responsible for the rigorous Mathematica software. After a career of building one of the most advanced computational packages ever created, he is returning to the question that endlessly captivates geniuses — what is the equation at the heart of our universe?

Is there one unifying stroke of the pen that can connect conventional physics, general relativity, and quantum mechanics into a single whole? Wolfram is not conventional, and I cannot do justice to his thinking both given its complexity and rigor. He claims to have found one such answer, which I will try to sketch. But what drew my atten

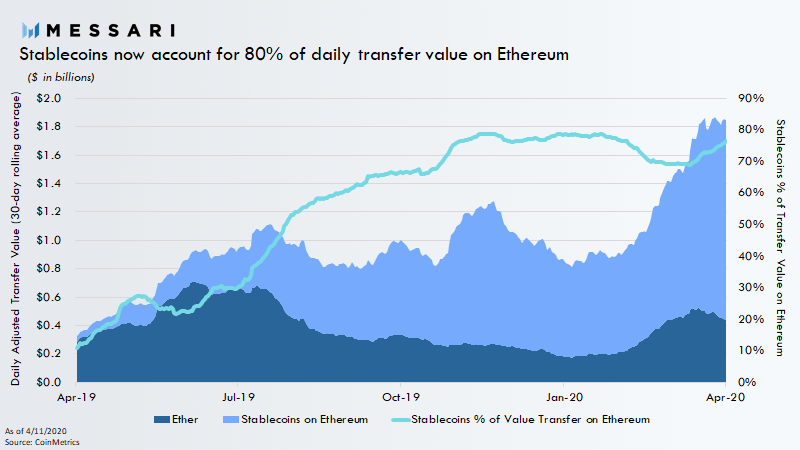

This week, we look at cash — blockchain cash. The war for money is just starting to ramp up, as Facebook Libra explains its new regulated plan, the Chinese national Blockchain Service network goes live, Ethereum stablecoins reach historic market caps in the billions, and the Financial Stability Board recommends to go heavy on global stablecoin arrangements. In 2008, Bitcoin threw a rock through the window of the financial skyscraper, and today we are starting to see the cracks. As the US government runs out of $350 billion in small business bail-out money and gets ready to print more, where do you stand?

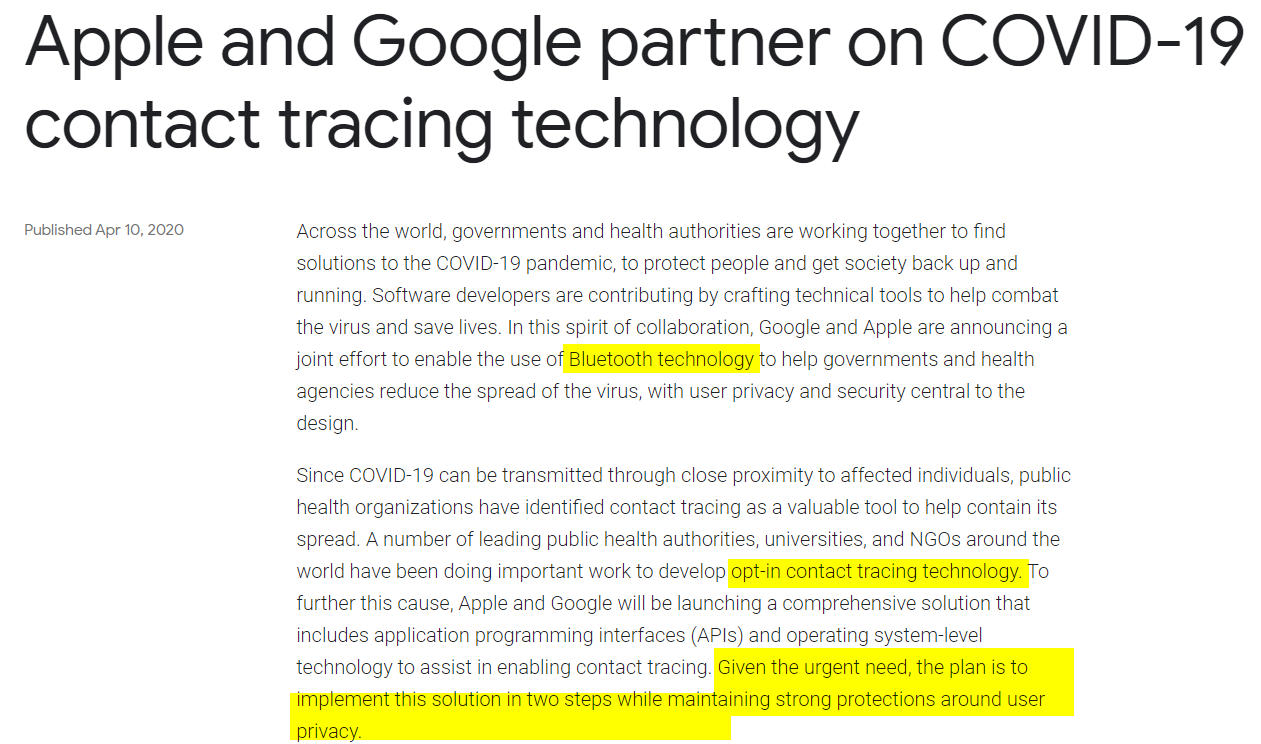

This week, we dive into the social, economic, and financial implications of data in a post-COVID world. As Apple and Google work to build out the government’s contact tracing apps to combat pandemic, what Pandora’s box are we opening without consideration? As Plaid reaches into payroll data to accelerate small business bailouts, what power do we hand to aggregators? Will dignity-preserving solutions come to market in time? The opportunity for decentralized identity and data storage is clearer than ever. Or will fear drive us to make permanent compromises?

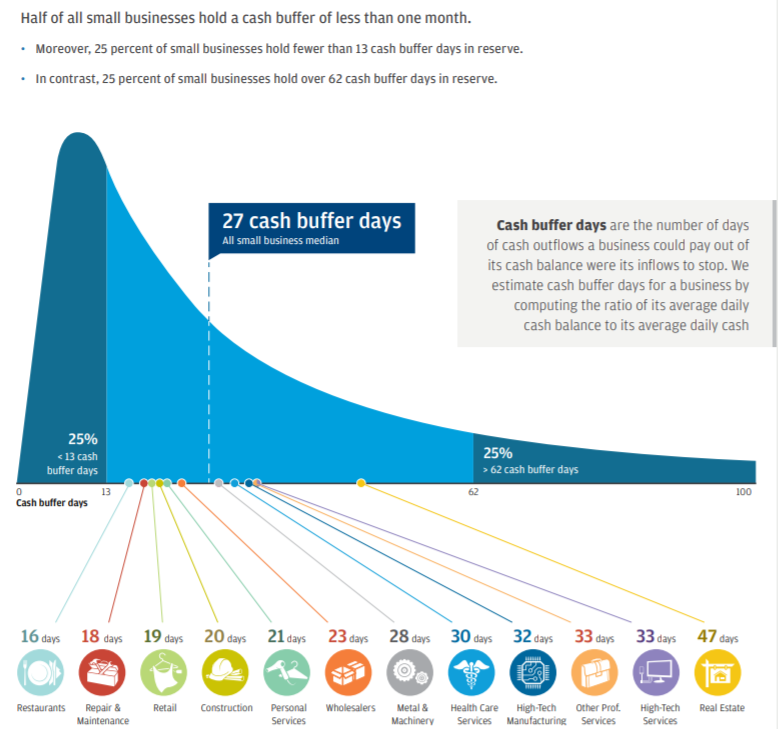

Another heavy week. It is hard to find the right, or even the interesting, thing to say. I look at why the $2 trillion in US bailouts may not even be enough to stave off the economic damage. In particular, I am alarmed by the large and fast rise of unemployment claims (higher than 2008 peak), estimates that GDP may fall by 20-30%, and the broad impact on small business. Small businesses have 27 days of cash on hand, and power half of our economies through both employment and output. So how do we meet this challenge? What strength should we draw on in the moment of doubt to become the artists of tomorrow?

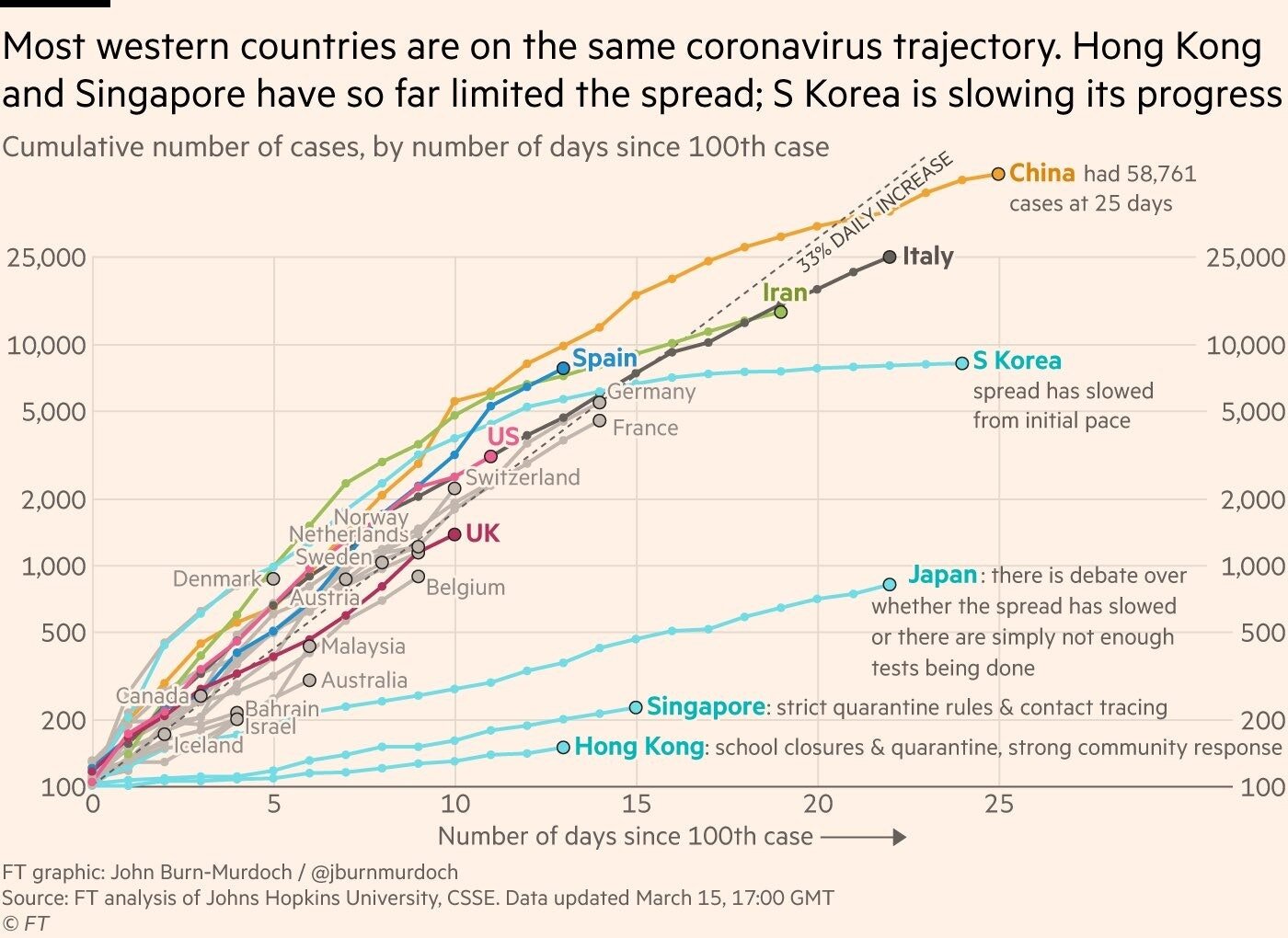

I hope that you and yours are OK, socially distanced and stocked on essentials. Whether you feel it yet or not in daily life, the world is bracing for coronovirus impact. In this week’s analysis, I look at the difficult trade-offs between health and economy, and try to quantify the impact of the likely slow-down. We look at some grim but useful concepts, like (1) the value of a statistical life, (2) what happened to the Soviet economy and life expectancy after perestroika, and (3) how our financial machines (NYSE, Robinhood, Maker DAO) are cracking at the edges. If you can do one thing — be kind and gracious with each other as some things inevitably break.

I look at how the news about the spread of the coronovirus are cracking the global economic machine. Some may argue that the number of people effected is still low — but that misses the entire point. The shock of a global pandemic has revealed weakness in the financial machine, sending the stock markets falling 10% year-to-date. Gross domestic product growth is expected to slow by billions of dollars, governments and central banks are unable to implement policy to compensate with rates at historic lows and borrowing at historic highs, public market valuations will tumble arithmetically, and private Fintech companies will lose a path to exit. At least that’s what the conspiracy theorists want you to think!

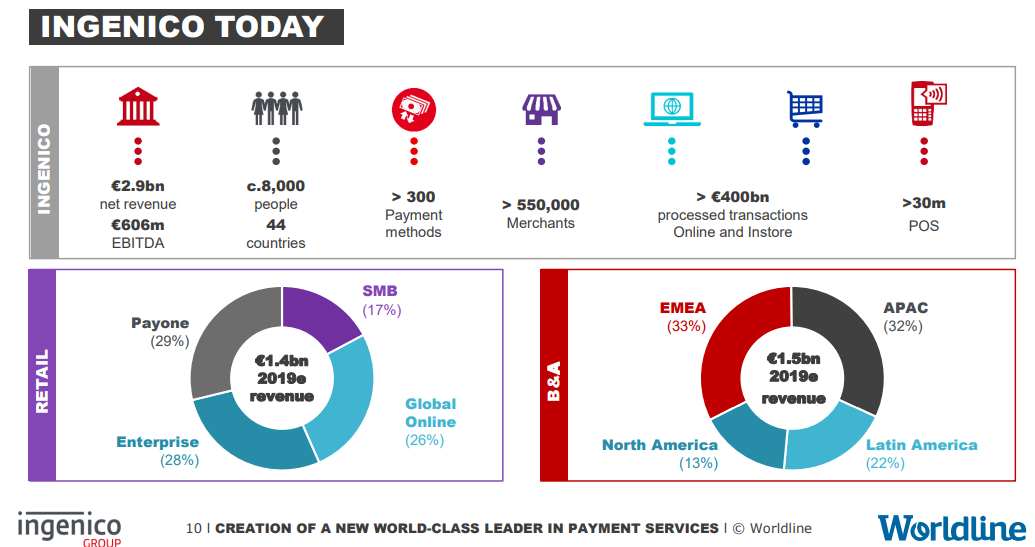

I look at how spending $8 billion can either buy you $3 billion of revenue from Ingenico, or the private valuation of Robinhood and/or Revolut. Would you rather have a massive cash-flow machine, or a venture bet on a Millennial investing meme? To articulate this question in more detail, we walk through the impact behavioral finance has had on economic rational actor theories, and why quantitative financial modeling often similarly fails to capture the underlying tectonic plates of industry. It may not be wrong to bet on Millennials. We talk about what identity economics (ala identity politics) means for market value and how to think about generational change.

Why are high valuations bad? You’ve heard me talk about how the trend of Fintech bundling, and the unicorn and decacorn valuations led by SoftBank and DST Global, are creating underlying weakness in the private Fintech markets. Of course, they are also creating price compression and consolidation in the public markets (e.g, Schwab/TD, Fiserv/First Data) across sub-sectors. But public companies are at least transparent and deeply analyzed. Private companies have beautiful websites, charismatic leaders, and impressive sounding investors. Often when you look under the hood, it’s just a bunch of angry bees trying to find something to sting.

Chlöe Swarbrick, a 25-year old climate MP was presenting her climate change case to the New Zealand parliament, and was heckled by an older audience member. Without missing a beat, she acknowledged and dismissed the challenger with a pithy “Ok, Boomer.”

The recording has since gone viral, inspiring everything from merchandise to Vogue articles. While the incident isn’t the source of the phrase “Ok, Boomer”, today it is the most well known manifestation. So what does the phrase mean? If you are inclined to more colorful language, see Urban Dictionary. But the meaning is obvious on its face — Gen Z is dismissing utterly and without consideration the judgment and protestations of society’s elders on multi generational issues like economics, climate change, and social norms.

I’ve seen a whole bunch of headlines this past week about how Facebook is launching its version of the “Supreme Court”, as if that were an app feature. The oversight board is meant to police controversial content decisions, and have the power to overrule Zuck’s judgment on political matters. Its charter is drafted as if Facebook’s 3 billion users were citizens of an Internet nation. Add to this the insanity over WeWork’s failing IPO plans, where the CEO has been personally named in the amended filing documents with clear checks on demonstrated abuses of power. We are drifting into a Twilight Zone episode where modern corporations act as if they were feudal states run by divine kings negotiating with their nobility over a Magna Carta. Which is actually sort of where we are.