Embedded finance has been on the rise, despite challenging conditions.

In the five years between 2016 and 2021, the market boomed at 26.9%. Growth has continued through 2022 by another $11.3 billion and, according to FMI, is expected to continue expanding YoY by 16.4% until 2030.

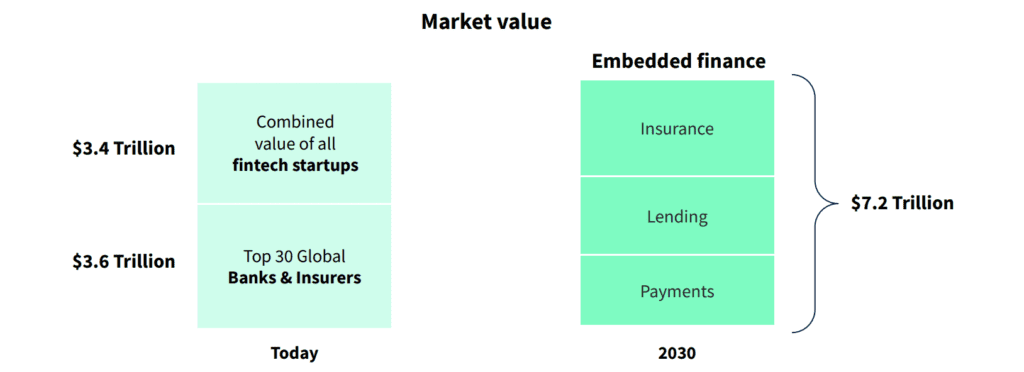

In 2021 alone, both embedded finance and banking as a service attracted billions of VC funding, their markets growing over three times over the year. Dealroom and ABN Amro expect the value of embedded finance to reach as much as $7.2 billion by 2030.

Aside from streamlining financial services between businesses and their customers, in the increased challenges of the economic environment, they could now provide a lifeline.

Adrian Mizzi, CTO and Co-Founder of Weavr.io explained that the technology could lower the entry barrier for individuals who have traditionally been left out of the financial system.

“Imagine having an innovator who’s building a solution to, let’s say, offer a mobile phone contract,” he said. “They can attach the contract to a native bank account so that customers can manage their payments, thereby unlocking and giving a solution to people who might not be able to get services from the bank, and can also get a prepaid card ready to do day-to-day finances.”

Improving inclusion for customers

A key benefit of fintech has been its ability to bring financial services to more people. In many jurisdictions where smartphone usage surpassed individuals’ access to a bank account, fintech has introduced many alternatives to continue offering financial services.

Embedded finance multiplies that reach, allowing brands to provide financial services to their customer base.

“Consumers prefer to procure financial products from brands and providers that they trust — and those providers don’t necessarily have to be banks,” said Denise Johansson, co-founder, and co-CEO of Enfuce, in a recent interview with Sifted.

Bain and Company found that already, 5% of transactions made in the US were through embedded finance.

It has been found that brands’ connection to customers comes with benefits that the technology can amplify. Insights already significantly developed by brands’ relationships with loyal customers can be acted upon. Embedded finance allows businesses to provide solutions, assisting with pain points in their financial relationships with customers.

This could be critical as the economic downturn, and possible recession takes hold. Solutions like alternative payment options could help vulnerable customers weather the storm ahead.

A win-win solution

As well as providing customer support, the turn to embedded finance could also help businesses.

“There are established businesses that see embedded finance as an opportunity for them to, rather than look for new business, increase revenue streams from their existing customers,” said Mizzi.

He explained that one of these success stories is Shopify. The company increased its revenues by adding financial services to its software-as-a-service business model.

In a webinar hosted by Weavr on the disruptive potential of embedded finance, the company showed research on this happening with other businesses such as Amazon and Starbucks.

“Let’s take a step back and ask why these non-financial businesses are investing in these new fintech capabilities,” said George Bailey, Product marketing lead at Weavr. “It’s for two reasons. Firstly, if you can find ways to remove friction around things like ordering and payments, your day-to-day user experience is much more convenient and seamless.”

“At the same time, when you add new financial features into your app, these are things that you can directly charge more for…It’s about bigger populations of users being more commercially active in your platform, and the more active they are, the more money you are making.”

While investment in startups for new development, such as integrating embedded finance, is currently scarce, it can increase existing customers’ inflows.

“It’s becoming so easy to do that,” said Mizzi. “It’s adding extra revenue you can earn from your existing customers. In today’s economic climate, that’s certainly something businesses seek.”