“In this world, nothing is certain except death and taxes” – while perhaps this quote is now a cliche, Franklin had a point. Every year, the American public fills out their tax returns in their droves. Tax day happens like clockwork, with all its challenges.

Despite its inevitability and the great leaps in American tech, little has been done to improve the process, leaving consumers to fend for themselves. With fintechs jostling to be crowned as the next super app, perhaps something as mundane as taxes could give them the edge.

Steps towards super apps

In the FT partner’s extensive report, “The race to the Super App,” published earlier this year, it was stated that “To own the customer relationship truly, Super Apps must provide greater value than the customer would receive by going to individual apps for each product.”

Critics of the concept of a western super app have said the fragmented approach of actors in the space could be redundant. Tim Mills, a managing partner at ACF Investors, told City A.M, “Unless you’re able to capture most of the incumbent services people already use, the value of a super app becomes heavily diluted. Think of a shopping mall that lacks your favorite stores.”

While the likes of Revolut quietly amount their services, spreading from financial services and e-commerce to instant messaging, they could be missing a trick by not including necessary products such as tax returns assistance.

The slog of tax filing is a necessary annual evil, met with groans, frustration, and a weekend of complicated legal terms. Solutions embedded into consumers’ everyday activities could bring valuable relief to the end of the tax year.

Current software focused on Tax Day filing

TurboTax, named the most popular tax return software of 2022, provides an online form for customers to file tax returns and the advice of experts if needed. While assisting consumers in filing, the process comprises a simple online form with live help, filled out at the end of the tax year.

The IRS found that the number of returns filled out and filed online has steadily increased over the past two decades, reaching 92% for the 2021 tax year. Despite using products like TurboTax, consumers take an estimated 13 hours to fill out their tax return forms, according to the company’s website.

Tax day’s positioning once a year can also mean decisions are made and opportunities are taken without consideration of the tax implications.

“Taxes are so deeply rooted in the US financial system that every decision you make, every time you pay for something, get a raise, it has really big tax implications,” said Daniel Marcous, CTO and Co-founder of April. “No one knows the implications until the end of the year.”

While no one particularly wants to think about taxes daily, Marcous believes it is essential to making the most out of the benefits that might be available.

“Doing the return in April is too late,” he continued. “Until that point, people have no idea if they owe money to the US government or if they should get a refund. They have no idea how much that refund should be and the implications of decisions they made throughout the year on that sum.”

Integrating taxes into daily life

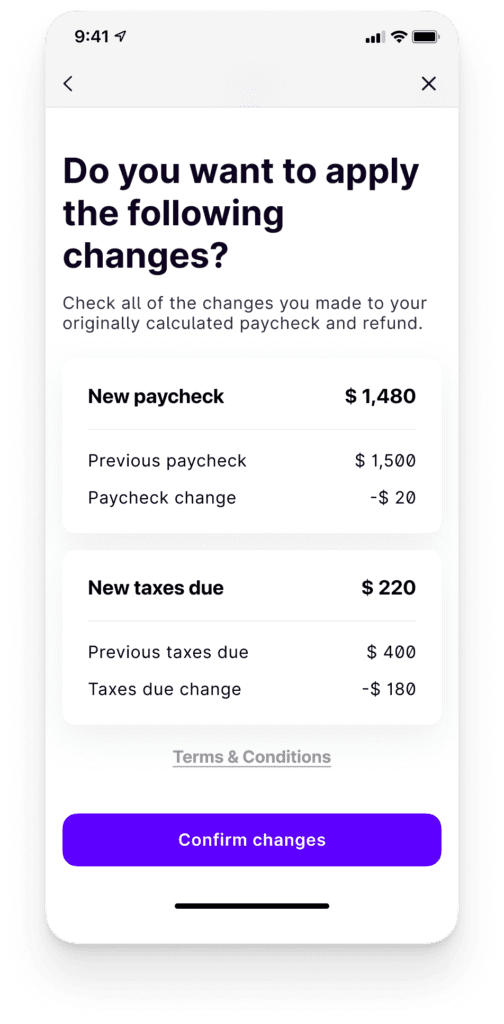

Unlike software solutions such as TurboTax, April has opted to embed into existing consumer applications daily. Linking with fintech applications, the April software can collect the data needed in real-time to assess the tax implications.

Using a system of collaborative AI, the company tackles the complicated tax system. The technology deploys algorithms to handle the heavy lifting, sorting through tax codes, with human oversight to assess the nuances of the legal language, finetuning the AI’s understanding.

In doing this, the company can advise consumers while collating the data needed to file the yearly tax return. In doing this, they claim to reduce filing time dramatically to an average of 15 minutes.

While Marcous describes the company as having a “consumer-focused approach,” he also sees embedded taxes as having benefits for fintechs.

“Fintechs can add value to their users (by embedding tax software),” he said. “It can incentivize the users to deposit the tax refund back into the originating fintech. This is a huge incentive. The average American tax refund is $3,000, and last year, we saw more than 90% of our users put it back in the originating provider.”

“There’s a lot of value in this symbiotic system between fintech, tax experts, and the user.”