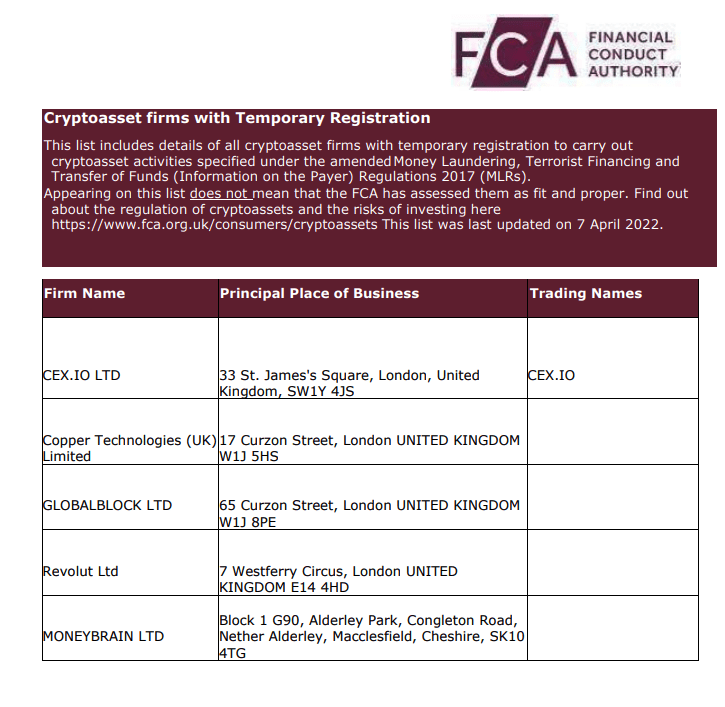

The Financial Conduct Authority (FCA) removed 12 UK crypto firms from its registration list, leaving only five companies with a temporary registration status.

According to the watchdog’s list, five additional firms can now offer crypto services to UK residents, including Revolut, CEX.IO, Globalock, Moneybrain, and Copper.

In addition to these five firms, the FCA approved 34 others in Aug 2020. Since then, they have also published a list of unregistered crypto firms that a recent assessment conducted found 110 are no longer operational.

The decision

New legislation was introduced in Jan 2020 that allows the FCA to supervise how businesses that manage crypto-asset risks manage money laundering, terrorist financing, and other risks.

Consequently, regulators told UK crypto-asset companies to comply with the Money Laundering Regulations (MLR). The deadline was set for March 31, 2022, but only 20% of the firms had completed their registration, forcing the FCA to extend its deadline.

In the lead-up to this decision, FCA held a case against Gidiplus limited, an exchange offering crypto ATM services, which wanted to continue operating despite not being compliant. And also, the FCA’s decision to ban Binance, one of the world’s biggest crypto exchanges, from conducting business in the UK.

In addition, the FCA’s warning comes at a time when concerns have been expressed that sanctioned Russian entities might try to use cryptoassets to evade sanctions.

The FCA’s recent announcement also comes during the same period in which the HM Treasury announced amending its regulatory framework to include stablecoins as a means of payment, and the FCA announced an outcome-based approach to dealing with fintech.

RELATED: UK Economic Secretary announces innovative approach to crypto technologies

RELATED: FCA pursues an outcome-based approach at IFGS 2022

Speaking to Katie Fry-Paul, a financial services and regulation associate at Taylor Wessing she clarifies, “as the regulator has not approved the registration of any crypto ATM businesses, any firm offering crypto ATM services are now doing so in breach of the Money Laundering Regulations. This does not mean that it is illegal to operate a crypto ATM in the UK: only that it is illegal to do so without the required registration (with registration seemingly very difficult to obtain).”

The impact

Additionally to its message to crypto ATMs, the FCA warned consumers about crypto-asset risks.

“We regularly warn consumers that crypto-assets are unregulated and high-risk which means people are very unlikely to have any protection if things go wrong, so people should be prepared to lose all their money if they choose to invest in them.”

However, Fry-Paul also notes, “since the FCA’s announcement on March. 11, 2022, any firm looking to run a crypto ATM business in the UK will need to obtain registration and overcome the negative connotations which now attach to that sort of business.”

It’s unclear what the impact of these negative perceptions may look like, how long CEX.IO, Revolut, Copper, Globalblock, and Moneybrain will continue to be allowed to operate under this temporary registration status, and the FCA’s new deadline for other firm’s registration to be approved or rejected.