Changing marketplace practices make it the ideal time for people with stock options to have liquidation opportunities.

Sifted has done some interesting analysis on the founders of the top 10 leading digital banks in the UK; it...

Bank holding company, CRB Group Inc., has received venture capital investment of $28 million from Battery Ventures LP, Andreessen Horowitz and Ribbit Capital; the large investment in a bank is unusual for venture capitalists which have mainly been known for early stage financing in new fintech startups; CRB Group however has been considerably growing its digital banking capabilities making the investment attractive for fintech venture capitalists; New Jersey-chartered, Cross River Bank, was founded in 2008 and has since partnered with numerous fintech startups to offer industry leading services for lending and payments; the bank is expected to use the investment to continue building on its industry leading fintech services; because the bank is FDIC regulated the VC investors will be limited in some of their investment activities. Source

The Bank of England kept its central bank borrowing rate at 0.25% and decided to continue with its $86 billion asset purchase program; while no changes were made to monetary policy, the BOE changed its guidance; with an increased focus on inflation in the region, the BOE said it would be prepared to raise rates in order to keep inflation at its 2% target rate. Source

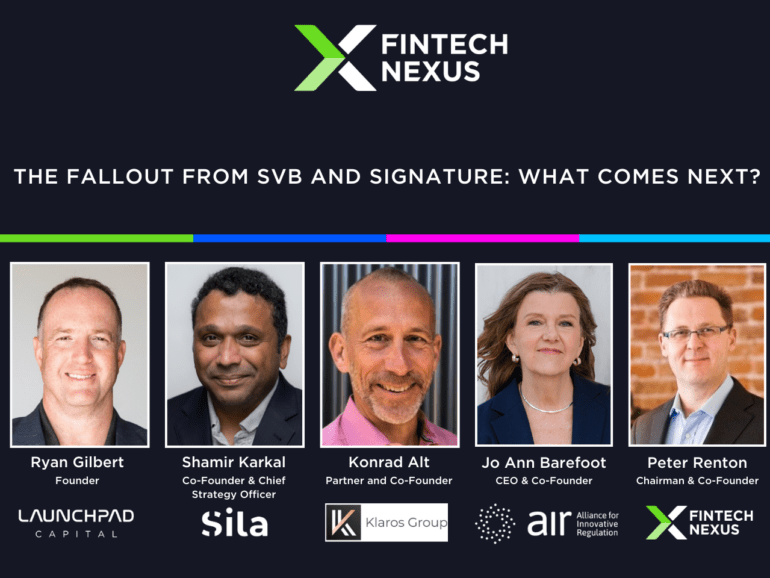

A week on from Silicon Valley Bank's fall, Fintech Nexus hosted a webinar to discuss what happened and what's next for the institution.

Santander Consumer USA Holdings describes itself as a technology-driven consumer finance company; they focus on vehicle finance, and have been originating retail installment contracts since 1997; company announced originations for the quarter of $5.2 billion; "Fewer originations are in part due to our disciplined underwriting standards as we are committed to driving originations at the right price and structure, and in part due to increased competition in the prime space," said Jason Kulas, president and chief executive officer. Source

In an interview with P2P Finance News, Adair Turner cites P2P loan securitizations and other evolving forms of structured credit as high risk, causing a potential "red flashing light" for regulators; speaks of the evolution of the asset class as securitization portfolios from P2P lenders have been increasing in 2016; discusses complex structured investment vehicles as the most high risk specifically those issuing short term debt against longer term holdings. Source

Non-bank lender Pemberton Asset Management sees a big opportunity in business lending with the uncertainty surrounding Brexit; Pemberton is confident that European banks will pull back as a result of Brexit and slow their lending practices; the sizable raise also points to the confidence in private debt funds as an option for companies unable to get financing from the banks.

Theres no size fits all in scalable innovation for legacy structures but new strategies are being developed to help.