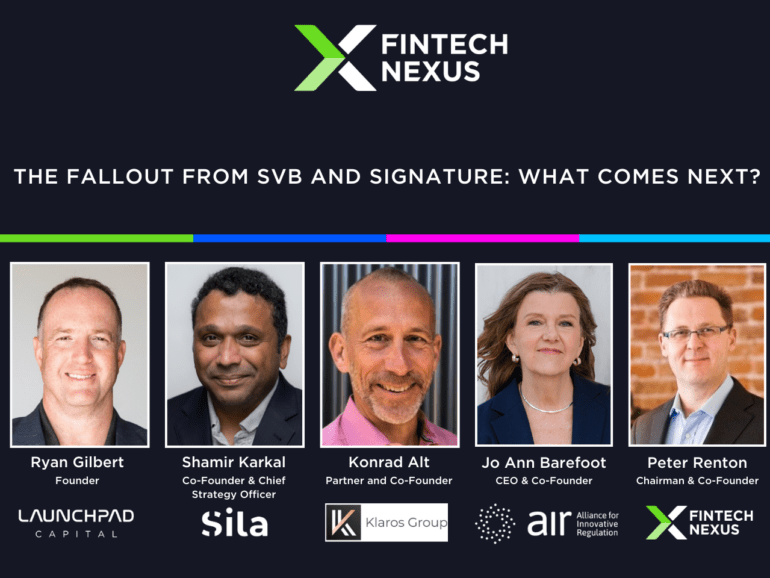

A week on from Silicon Valley Bank's fall, Fintech Nexus hosted a webinar to discuss what happened and what's next for the institution.

Tax Guard gives lenders proactive insight into hidden tax risks before liens are filed through unique links with the IRS.

Steps are being made to close the gender divide in fintech, but lack of access to funding can be crippling to female-led firms.

Upstart's Q4 earnings showed a downward trend of losses, CEO, Girouard, remains positive despite cost cutting measures.

Days after the chaos, newly appointed CEO of the SVB bridge bank urges customers to hold deposits. Meanwhile regulators investigate the fall.

The Financial Conduct Authority (FCA) has launched a study analyzing the UK's mortgage industry; study will focus on the industry's tools for consumers and the partnerships among mortgage lenders; the FCA will specifically seek to identify ways to better utilize technological solutions within the industry; the FCA will be obtaining information from a range of market participants and plans to release the results of the study in an interim report in 2017 followed by a comment period and final report in 2018. Source

Rumours have surfaced that Wall Street heavyweight, Goldman Sachs, is looking to offload its Apple Partnership.

Announced today, the MasterCard Foundation is partnering with the Center for Financial Inclusion (CFI) at Accion on a $4.4 million initiative to promote more robust consumer financial protection laws around the world; CFI's Smart Campaign has existed since 2009 and has certified the consumer protection practices of 68 financial institutions to-date; the MasterCard Foundation contribution will support involvement of more parties (such as regulators, non-bank financial institutions and fintech platforms) and more countries; a particular focus will be on sub-Saharan Africa. Source

The Senior Managing Director at Kroll Bond Rating Agency discusses trends in marketplace lending securitization. Source

Results from MoneyLion's first Personal Financial Wellness Study confirm the growing influence of digital sources in our financial lives, but the steep drop-off of knowledge among millennials and Gen Z consumers.