Financial Health Network released its Financial Health Pulse: 2022 US Trends Report last month, reporting a decline in financial health across most income groups.

In 2022, nearly 8 million people moved from “Financially Healthy” to “Coping,” a downward trend. Men and women declined in financial health, men dropped four percentage points, and women dropped three percentage points.

The report was completed with the support from the Citi Foundation and Principal Foundation, finding those making between $60-99K saw a 7% decline in health, the worst drop. The $100K earner cohort was second worse off, suffering a 4% point decline.

Erased progress

Overall, the report found spending outpaced income and savings accounts depleted.

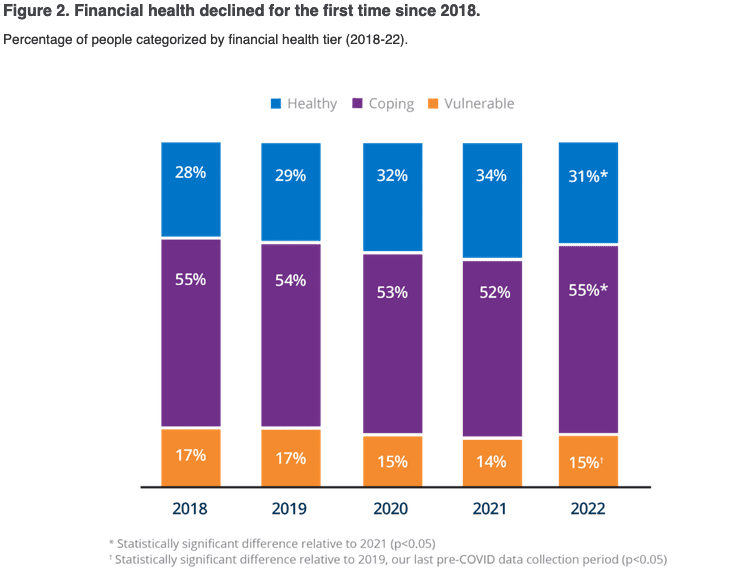

The downtrend is the first since the paper launched in 2018: the financially healthy population in the country dropped three percentage points to 31%.

Jennifer Tescher, president and CEO of Financial Health Network, said inflation and market changes caused a rare drop even for higher-income households. The report found that this change erased most financial health gains people experienced in 2020 and 2021, returning financial health to pre-pandemic levels.

“The data shows that while the combined pinch of historic inflation and market fluctuations has contributed to a rare drop in financial health for higher income households, lower income earners experienced employment-related improvements like wage increases or new jobs,” Tesher said. “However, even with modest gains, lower-income households are in a precarious position due to systemic financial barriers and wealth disparities.”

Nearly 8 million people moved from “Financially Healthy” to “Coping,” and 2 million more people are now “Financially Vulnerable.” There was a six percentage point drop in the number of people reporting they spend less than or equal to their income and a three percentage point drop in the number of individuals confident in meeting their long-term financial goals.

FinHealth by demographics

There was a three percentage point decline in the number of people with enough emergency savings to cover at least three months of living expenses.

“Employers, financial institutions, and policymakers must prioritize financial health and collaborate for better outcomes in these uncertain times,” Tesher said, “especially as economic conditions could trigger future financial health declines.”

Within racial demographics, black people experienced a notable decline of six percentage points in their financial health, to the point where only 15% of the group were considered financially healthy in 2022.

The report showed that despite a significant drop in financial health from last year, the $60 to $99k cohort is more likely to be healthy; they make up 36% of the healthy group. Meanwhile, those making less than $30kmakeupp only 10%, and between $30k and $59k (23%).

- Asian (44%) and White (35%) participants remain much more financially healthy than Black (15%) or Latinx (23%) individuals.

- Men (39%) continue to experience higher levels of financial health than women (23%).

- Non-LGBTQIA+ people (32%) are financially healthier than LGBTQIA+ (23%).

- People without disabilities (35%) still have higher financial health levels than those with disabilities (20%).

Inflation and labor market

The report found that changes in employment circumstances and perceptions about rising prices had significant implications for people’s financial lives. While people across all income levels reported being impacted by inflation, lower-income earners reported the most stress caused by higher prices.

High inflation stress was associated with a three-point drop in a person’s financial health score. Food, transportation, and utilities were reported to have at least a moderate impact on 30% or more of people’s standard of living.

At the same time, there was an association between the tightening labor market and increases in the financial health score of lower-income workers. People who made less than $30,000 per year and received a raise increased their financial health score by 7.9 points. Within the same group, workers who worked more hours rose by 8.4 points, and those who switched jobs rose by 9.1 points.

Comparably, the data showed no relationship between employment changes and changes in financial health scores for higher-income groups. Jo Christine Miles, Director, Principal Foundation and Principal Community Relations, said government intervention is critical to help people suffering.

“The entire financial ecosystem has a role to play in improving Americans’ financial health,” Miles said. “Government interventions are crucial for dampening economic blows, while products and services from financial service providers that are better designed to help consumers manage their day-to-day lives easily, securely, and affordably are crucial for building the resilience needed to ensure stability during economic volatility.”

How the survey tracks results

To assess financial health, the Pulse Trends Report scores survey respondents against eight indicators of financial health — spending, bill payment, short-term and long-term savings, debt load, credit score, insurance coverage, and planning.

In 2020, the Financial Health Pulse also began utilizing transactional data to gain an even deeper understanding of individuals’ financial health. As of August 2022, 1080 individuals had linked at least one financial account, totaling 6,628 accounts across 2,787 institutions.