“Fintech 3.0 is about the fundamental shift of the plumbing itself. For decades, you’ve had old banking technology and old rails. Money really hasn’t moved in any new formats or new ways. Stablecoins are redefining how money moves in many different types of formats.” — Jordan Leites, vice president of Norwest Venture Partners

Norwest Venture Partners, stablecoins are not a side story in finance but a linchpin of “Fintech 3.0.”

Every major shift of the first two waves of financial technology produced a new generation of giants, from card networks to API-first fintechs. According to Leites, companies like Stripe, Plaid, Chime and Dave built on top of the same old banking rails, improving distribution and user experience but leaving the underlying plumbing largely unchanged.

Instead, today’s stablecoin companies are the catalyst for the next wave.? There are some recent good examples of this: Visa expanded its stablecoin settlement to U.S. banks, an article in Forbes discussing how banks are embracing stablecoins, the stablecoin market cap reaching $310 billion this month. At the same time, SoFi and Coinbase built competing crypto trading apps. SoFi also launched a native stablecoin built on Ethereum.

“Fintech 3.0 is about the fundamental shift of the plumbing itself,” Leites said. “For decades, you’ve had old banking technology and old rails. Money really hasn’t moved in any new formats or new ways. Stablecoins are redefining how money moves in many different types of formats.”

Consumers may never see the difference explicitly, but Leites believes they will feel it in faster, cheaper and more flexible financial products that could not exist on legacy systems.

Building The New Stablecoin Plumbing

Within the Norwest portfolio, companies like Rain and Stablecore, along with other companies including Bridge and Privy are who Leites said are leading the way in building this robust infrastructure.

“Most of those companies have been around since about 2022, quietly working, but suddenly there’s a lot more mainstream attention,” he said. “These infrastructure companies are really at the forefront of this movement and find themselves at a very interesting inflection point.”

Regulation has played a pivotal role in spurring adoption. This week, the first rule came out of the Genius Act for regulated banks looking to issue stablecoins from subsidiaries.

“The Genius Act is pretty simple,” Leites said. “It is letting folks know who can issue a stablecoin, how it can be issued and how you reserve against it. More symbolically, it was the first legislation that gave a uniform stamp of approval that this stuff is permissible. We also want this innovation to happen on U.S. soil, rather than offshore.”

Examples like Cross River Bank, Lead Bank and J.P Morgan’s early work with digital-asset products show that regulated institutions are already experimenting with stablecoin-based offerings and tokenized deposits, often in partnership with infrastructure providers — for example, J.P. Morgan’s work with Connexus and its deposit token — he said.

Leites also points to Stripe as a model for the sector’s trajectory, saying the company has further legitimized the market in many ways, including by acquiring Bridge. Institutions ranging from banks to large consumer platforms are “competing at the money movement layer with PSPs, whether it be Stripe or others that want to integrate stablecoins into their offerings.”

Inside Norwest’s Fintech 3.0 Bet

Norwest Venture Partners is no stranger to financial innovation and brings a long arc of fintech experience to this moment.

Founded in the 1960s, the firm manages roughly $15 billion in assets and is investing out of its $3 billion fund — its 17th one — and has around 250 active portfolio companies. Its history in fintech includes early bets on LendingClub, Plaid, Dave and real-estate disruptor Opendoor.

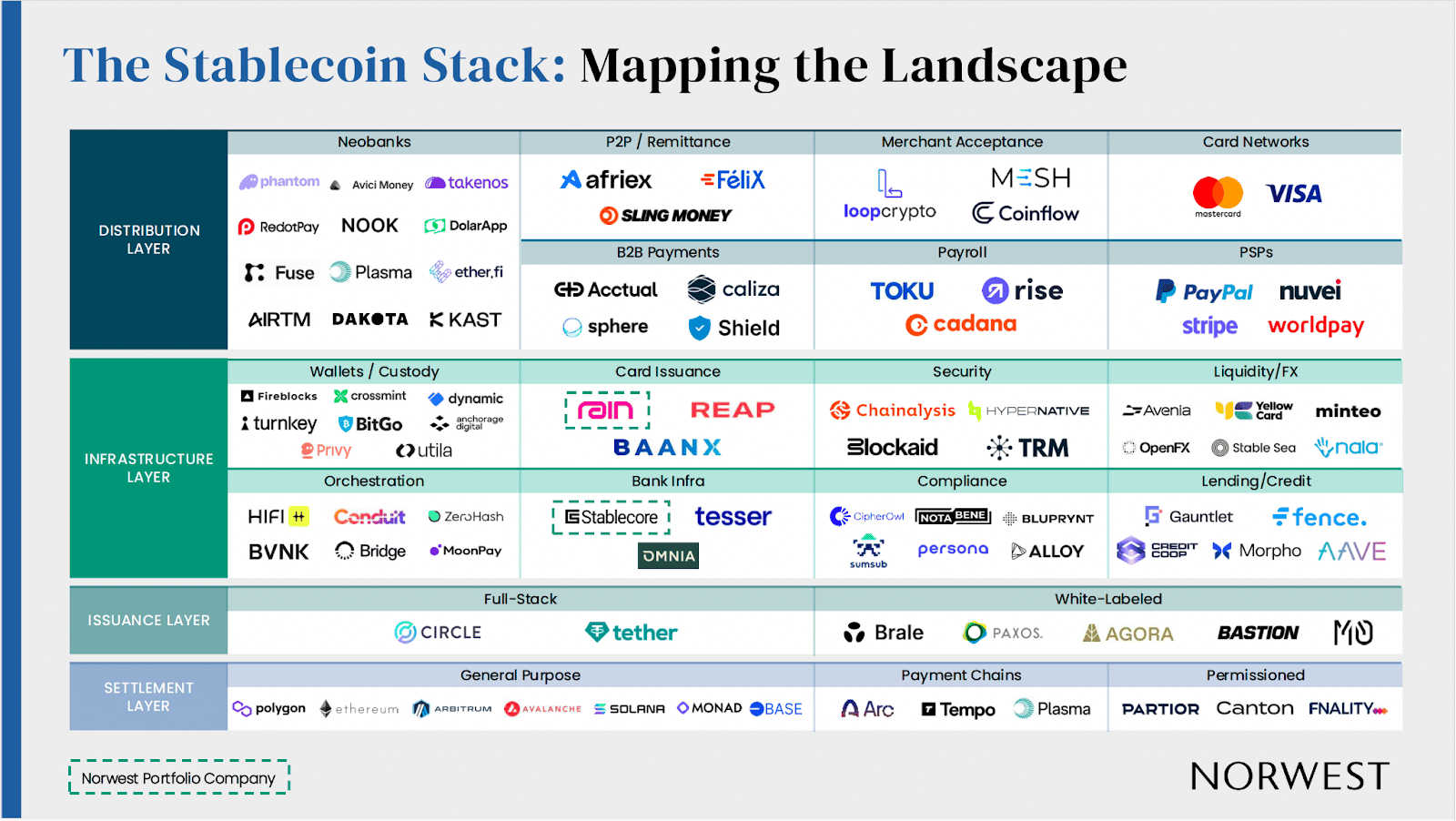

Leites created a stablecoin map to show where startups are building and said the “distribution” and “infrastructure” layers have been the focus for many years now. Not many are building yet in the “issuance” and “settlement” layers, which is where more “decentralized, permissionless token-like instruments” are, he said.

“The issuance layer is mostly a duopoly with Tether and Circle — companies that were before my time, but I would have loved to have invested in them,” he said. “We are now seeing some white-labeled players that are more infrastructure in nature, companies like Agora, Brale or Bastion, that are all very interesting, and companies that we think are doing some cool things in the marketplace.”

Norwest itself is looking at the infrastructure enablement layer. The firm led its first investment in Rain in 2022 and followed with the Series A in 2024, while also leading the first round in Stablecore in 2025, and expects to back more infrastructure and distribution-layer companies globally.

It’s that investment in Stablecore that is a direct play on the paradigm shift, Leites said. The startup, founded by veterans from Coinbase, aims to be the digital-asset infrastructure layer that lets regulated banks offer stablecoin and other digital-asset products to retail and corporate clients.

Norwest is also scanning broadly across the stack, prioritizing founding teams with a unique “right to win” rather than focusing on a single-use case.

“We’re very excited about the opportunities ahead,” he said. “We’re seeing a lot of young companies with a lot of momentum being founded by really strong founders. And this isn’t just a U.S. phenomenon. This is happening all over the world.”

Stablecoins’ Future

As global demand meets robust infrastructure and regulatory support, the possibilities for stablecoins, and those building with them, are expansive.

The first big wave of stablecoin adoption came from consumers in high-inflation or volatile markets who preferred holding dollar-linked stablecoins to their local currencies, revealing a clear product–market fit outside the United States, Leites said.

As infrastructure has matured and regulation has softened risk perceptions, that demand has spread to corporations, banks and large platforms exploring issuing their own stablecoins to capture more of the value flowing through their ecosystems.

With the foundational rails now “ready,” Leites believes the next phase will be defined by new products that were impossible in the Fintech 2.0 era. These include global stablecoin neobanks that are “global from day one;” payroll and cross-border remittances paid in stablecoins; and emerging “agentic payments,” where autonomous agents transact with each other or on behalf of humans using programmable, always-on money.

If prior eras are a guide, the companies that master this new stablecoin plumbing could cement their position on the map of Fintech 3.0 giants, he explained.

“We’re very bullish on the space,” Leites said. “There will be some really interesting, powerful and category-defining companies built that are taking advantage of this wave. We want to be the partners of choice for those companies.”