As we move through months of dropping valuations and funding rounds, the mood may be somber in the fintech community.

According to a new report conducted by QED Investors and Boston Consultancy Group (BCG), since April 2022, valuations have dropped around the globe by 60%.

While early-stage companies still see some funding, the more mature the business, the more challenging it has become to fundraise. Rising rates have made their mark, and with Jerome Powell, Chair of the Federal Reserve, announcing even further hikes yesterday, concern ripples through the industry.

However, the report dedicated only a few paragraphs to this past year’ blip, stating that it could represent only a short-term correction.

“Essentially, we are witnessing a shakeout and tempering of enthusiasm for growth-stage companies that have unclear product and/or market fits…Some of this filtering is good for the industry, as weaker business models are becoming stressed and effectively being weeded out,” the report read.

The challenging environment has caused fintech leaders to shift their focus, moving from growth at any cost to strengthening fundamentals – a move that could work wonders for the years ahead, growing sixfold from $245 billion to $1.5 trillion by 2030.

Still ripe for disruption

Fintech became a disruptor to the financial services industry, an area QED and BCG feel is still fertile for disruption.

“This report highlights something that, anecdotally, QED has witnessed firsthand: that fintech’s story is in Chapter 2, not Chapter 8, and that much of this powerful narrative is still to be written,” says Nigel Morris, Managing Partner of QED Investors and coauthor of the report.

“Fintech sits within financial services, which is a massive, profitable industry, and the opportunity ahead of us to democratize access to these services on a global scale is tremendous.”

The report stated that the financial services industry is one of the most profitable segments of the global economy. It represents $12.5 trillion in annual revenue pools and creates an estimated $2.3 trillion in annual net revenue.

However, many issues still exist where fintech could make a significant impact.

“The fintech journey is still in its early stages and will continue to revolutionize the financial services industry as we know it,” says Deepak Goyal, Managing director and senior partner at BCG and co-author of the report.

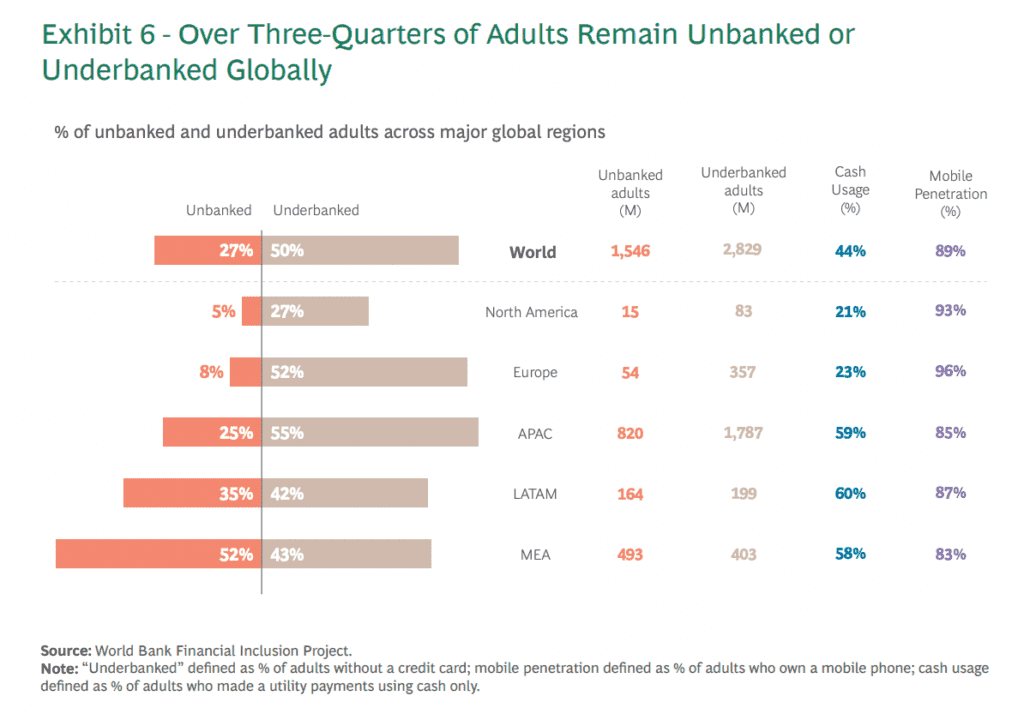

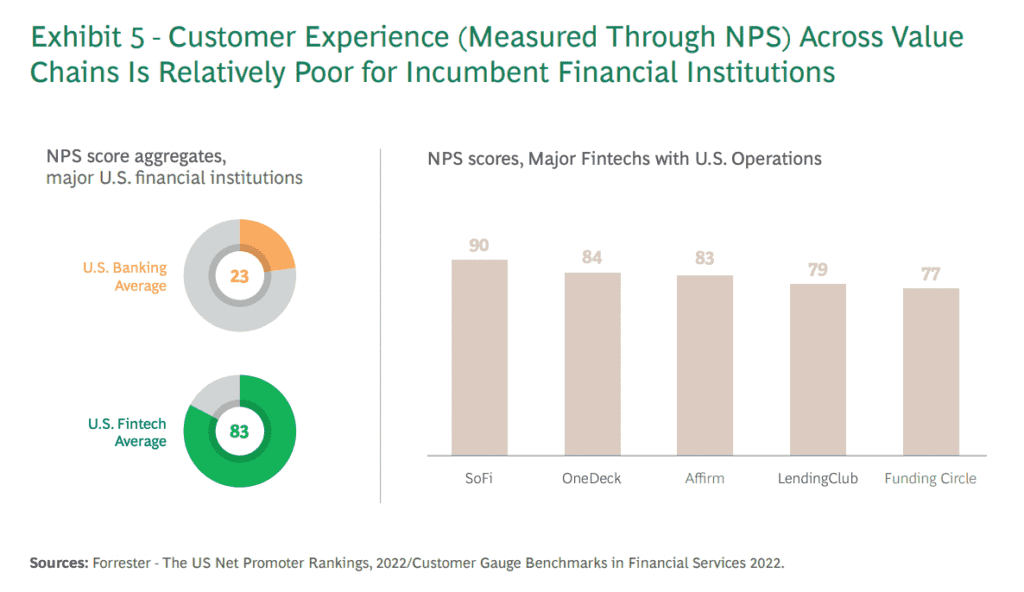

“Customer experience remains poor. Over half the world’s population remains unbanked or underbanked, and technology continues to unlock new use cases in leaps and bounds. All stakeholders must therefore seize the moment. Regulators need to be proactive and lead from the front. Incumbents should partner with fintechs to accelerate their digital journeys.”

New technologies are yet to have their full impact

To address continuing issues, technology has been constantly evolving. Emerging technologies, filled with potential, have entered the fintech space to spark new approaches or strengthen existing ones.

The report singled out generative AI; API-based open connectivity; DLT; quantum and edge computing; and embedded-hardware Internet of Things (IoT) and biometrics as having the most potential in the fintech space.

Generative AI is a buzzword now familiar to many. While currently gaining headlines as a toy of dystopian science fiction, the technology is seen by QED and BCG as a tool that could go far beyond supercharging customer service. According to the report, it “will aid incumbents by helping them leapfrog their technical constraints,” combatting fraud, boosting security, facilitating “financial concierges, ” and streamlining labor-intensive industries.

API-based open connectivity, or “open banking 2.0,” could also have significant results. Already the benefits of opening out access to financial information have impacted fintech. Its continued development could strengthen global interaction between financial institutions and improve their approach to fraud, underwriting, and risk assessment.

Blockchain and Distributed Ledger Technology (DLT) are already making waves in financial institutions, with many building infrastructure despite a cool-down in crypto. Worldwide the technology could be applied to international settlements creating a platform that is predicted to be fast, inexpensive, and secure, eliminating intermediaries using smart contracts. These attributes could give birth to new and streamlined services and financial tools. The tokenization of complex real-world assets and the regulation of digital assets continue to be key to unlocking their potential.

Quantum and Edge Computing, while the “next big thing” for quite some time, maintain their potential as formidable tools when applied to financial services. With the ability to process significant amounts of data, the technology could optimize processes and greatly influence approaches to fraud and underwriting.

Embedded-Hardware IoT and Biometrics can be used to streamline and personalize financial products. IoT’s networking capability allows information to be sent to and received from internet devices, such as kitchen appliances and smartwatches. It could be harnessed to influence insurance and personalized loans. Facial recognition can streamline checkout experiences.

Onward and upward

Given the potential for emerging technologies, financial institutions could find ways to serve customers far beyond the current scope.

Fintech has been uniquely positioned to target poor customer service. In financial services, a sector that continues to have low Net Promotor Rankings, the average score of fintechs more than triples that of banking.

In addition, over three-quarters of the global population remains unbanked or underbanked. While the levels in North America are the lowest, Asia, LatAm, the Middle East, and Africa, all show significant potential yet to be addressed.

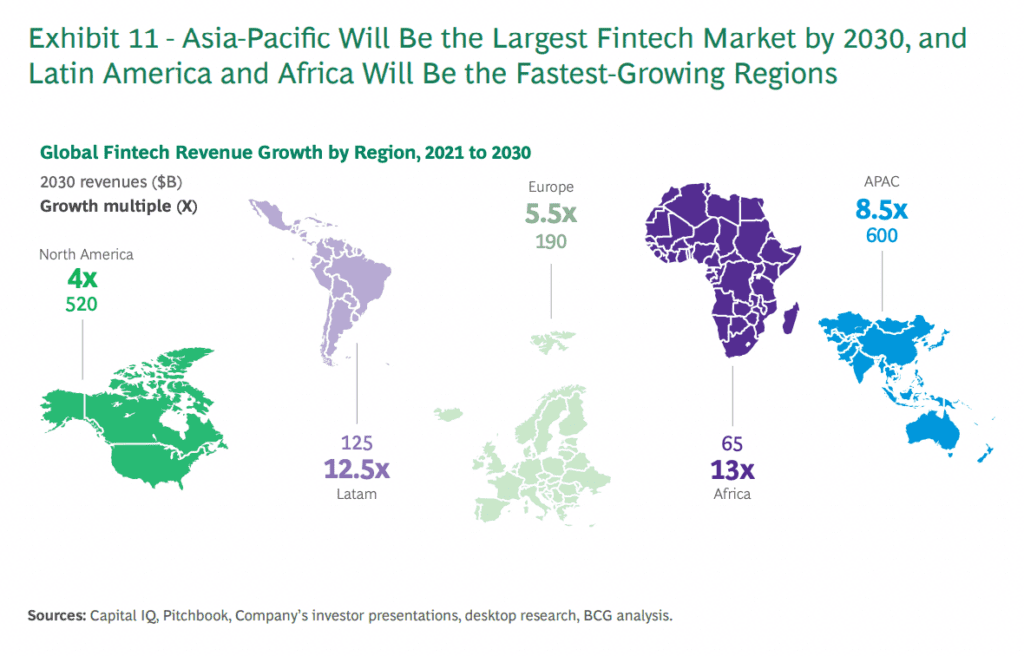

North America, the forerunner for now, generates much of fintech’s global revenue, followed closely by Asia-Pacific (APAC). However, APAC continues to be an underpenetrated market for fintech, with almost $4 trillion in financial services revenue.

The report predicted that by 2030, APAC would have overtaken North America as the most prominent fintech market, with a projected compound annual growth rate of 27%. They felt that much of this growth would be driven by local entities, solving access issues and driving financial inclusion.

Much of the growth is expected to come from China, India, and Indonesia, addressing the vast volumes of underbanked populations and high numbers of SMEs. Already leaders in the development of super apps, China is expected to lead APAC’s growth in fintech. India’s significant fintech activity, sympathetic regulatory regime, and shifts in demographics and GDP make it a formidable player.

North America is still predicted to grow significantly, accounting for 32% of global fintech revenue through 2030. This is expected to be driven mainly by B2B and B2BX solutions, the expansion of fintechs to include more services and the country’s interchange pool. Open banking has yet to take hold, potentially sparking increased innovation fully.

Europe will also see continued growth, supported by regional expansion. The report highlighted the effect of supportive regulation, boosting revenue by 21% between 2023 and 2030. Here, too, open banking is expected to have a significant impact.

In addition, LatAm and Africa are likely to see the fastest growth. While now, fintech penetration is already increasing; it is predicted to accelerate, attracting international investment while experiencing rising adoption of unbanked and underbanked populations.

Brazil, in particular, with its production of industry players such as Nubank and Creditas and systems such as the PIX instant payment system, is likely to spur this growth.

Related:

The report predicted a “leapfrogging” of African and Middle Eastern incumbents, innovating to attract a tech-savvy population, particularly in smartphone-based solutions.

Not without stipulation

However, this expected growth is conditional, and the report warns that risks and uncertainties remain.

Regulation is seen as a sticking point where a balance must be struck to foster ongoing innovation and adoption. The report read, “The future growth of fintech will require regulators to act with urgency and thoughtfulness more holistically,” shying away from the reactionary approach of yesteryear.

Trust is also a significant factor, and it was stated that the industry faces reputational risks that could compound. Data leaks were an area in particular that could cause damage to customer loyalty and ongoing adoption.

As well as this, the risk of larger incumbents with deep pockets in the face of a challenging funding environment could stifle growth through anti-competitive practices. “There are essentially four groups of stakeholders in the fintech universe: regulators, fintechs themselves, incumbents, and investors,” the report stated.

“The growth and success of the fintech sector will depend largely on how these four stakeholders can work together for the long-term benefit of the global financial services sector and the billions of customers it serves.”