The fintech space, and the tech space more broadly, is enamored with company valuations. The term unicorn arose out of that fascination.

But with most of the largest fintech names eschewing new funding rounds during the fintech valuation winter, hard data on valuations has been difficult to come by.

That is why this Forbes piece caught my eye this morning. It provides new valuation estimates based on data collected by Caplight.

Caplight, a San Francisco startup that tracks secondary-market trades of private tech companies, shared data with Forbes on valuations of 11 marquee fintech names. The estimates are based on recent secondary market transactions.

The data shows drops from the peak valuation (in 2021 or early 2022) that range from 79% (for Klarna) to 23% (for Ramp).

It should be noted that many people argue that secondary market valuations don’t reflect the actual valuation of these fintech companies.

But with no public data and few new funding rounds, it is all we have to go on.

Featured

> With Funding Down 70%, Here’s What Fintech’s High Flyers Are Worth Now

By Jeff Kauflin

The estimated value of 11 leading private fintech startups shows declines as high as 79%. But a few have started to recover.

From Fintech Nexus

> The Side of Sam Altman You May Not Know: Global Fintech Investor

By Katherine Heires

With the explosion of Generative AI Sam Altman has become one of the most famous entrepreneurs on the planet. But not much has been written about his fintech investments.

> Banking-as-a-Service is not dead and other lessons from Fintech Meetup

By Peter Renton

The first big fintech event of the year, Fintech Meetup, took place March 3-6 at The Venetian in Las Vegas. Here are some thoughts from the event.

Podcast

Adam Famularo, CEO of WorkFusion on using AI digital workers to fight financial crime

The CEO of WorkFusion discusses the role of AI digital workers in detecting financial crime and how they can augment a human…

Webinar

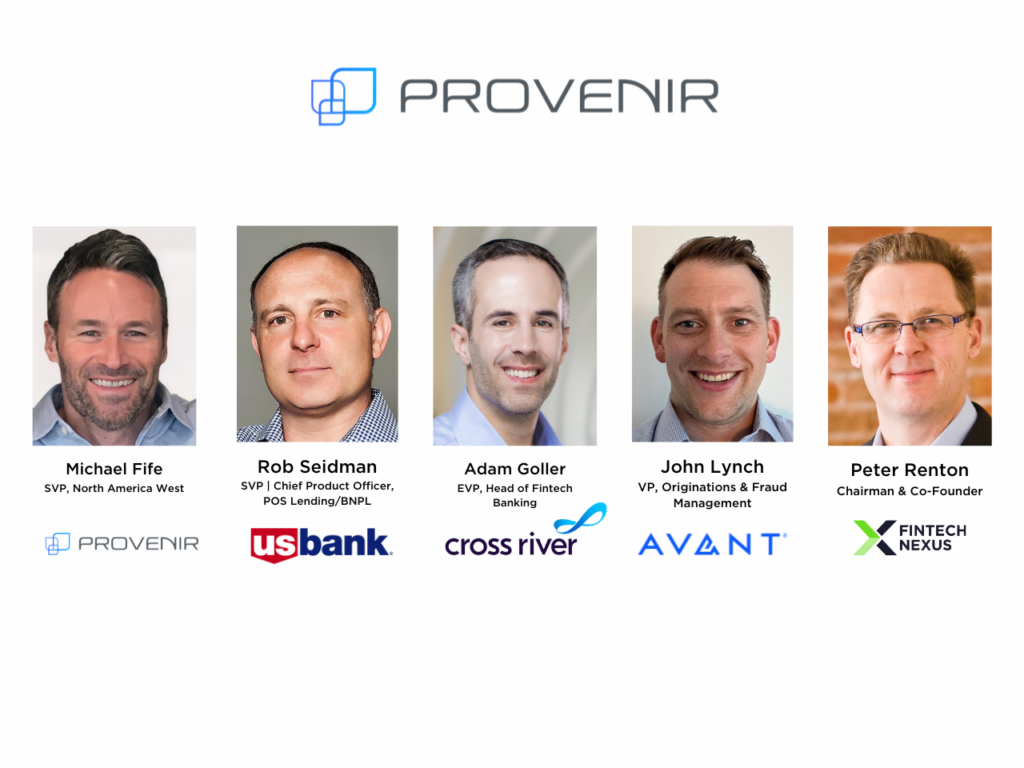

How Consumer Lenders Can Reduce Friction Without Compromising on Risk and Fraud Prevention

Mar 21, 2pm EDT

Customer experience is incredibly important to today’s discerning consumers, whether they are looking for financial services…

Also Making News

- Global: After Contactless, The Next Big Thing In Retail Payments Is A2A

As merchants begin to incentivise customers to move towards A2A solutions, I think we will see much-needed competition in the retail payments space.

- USA: From cybersecurity to failed mergers, 5 challenges facing banks and credit unions

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

- USA: Life at Regional and Small Banks, One Year After SVB Failed

Five regional-bank executives talk about their industry after a long year.

- Global: Bitcoin’s Market Cap Jumps to $1.4T, Surpassing Silver

Bitcoin rose to a record high on Monday, fuelled by continued positive momentum of spot bitcoin ETFs.

- UK: ‘Banking-as-a-Service’ startup Griffin raises $24M as it attains full banking license

Founded by former Silicon Valley engineers, UK-based Griffin Bank, has now raised $24 million (£19 million) in a fresh, extended Series A, funding round.

- USA: How To Be(come) A Great Partner Bank In The BaaS Space

New research from Cornerstone Advisors and BaaS provider Synctera helps points to banks’ growing interest in BaaS and the path forward for banks and fintechs.

- USA: US neobank Oxygen switches focus from banking to health insurance in new strategy

San Francisco-based digital banking platform Oxygen says it has “temporarily suspended” its banking services as it looks to redirect its focus towards health insurance solutions.

- Europe: Nexi Picks Mastercard for European Open Banking Partnership

Nexi has chosen Mastercard to help it support open banking account-based payments throughout Europe.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.