TransUnion, one of the big three credit bureaus, has launched a new data analytics platform called OneTru.

The new platform will offer banks and fintechs AI and ML tools for addressing a variety of credit, anti-fraud and marketing needs.

There are four key layers in OneTru:

1. Data management layer – providing access to compliant credit and non-credit data.

2. Identity layer – matches online and offline personal identity fragments.

3. Analytics layer – uses AI to generate actionable insights across credit, fraud mitigation and marketing.

4. Delivery layer – leverages a unified data governance framework to ensure regulatory compliance.

This new product leverages the AI platform from Neustar, a company TransUnion acquired in 2021.

TransUnion made it clear that this new platform is just the start. Tim Martin, Chief Global Solutions Officer, said, “OneTru provides us with a global chassis upon which we will deploy products and share expertise across the world in a cost-effective and compliant way. It is a game-changer for our customers and for the industry.”

The whole idea is “to drive a more complete and persistent picture of a consumer.”

Featured

> TransUnion launches new data analytics platform powered by AI

By Frank Gargano

The credit bureau’s data analytics portal, OneTru, hosts all previously offered products on a hybrid cloud-based platform and uses guides powered by artificial intelligence to streamline query processes.

From Fintech Nexus

> Could AI have stopped the SVB crash?

By Tony Zerucha

Could AI have prevented the SVB crisis? Maybe not completely, but consumer sentiment analysis could have dramatically reduced its impact.

Podcast

Dan Arlotta, Senior Vice President of Garnet Capital Advisors on fintech loan portfolio sales

The secondary loan market has played an important role in the history of fintech lending. There are few people who know more…

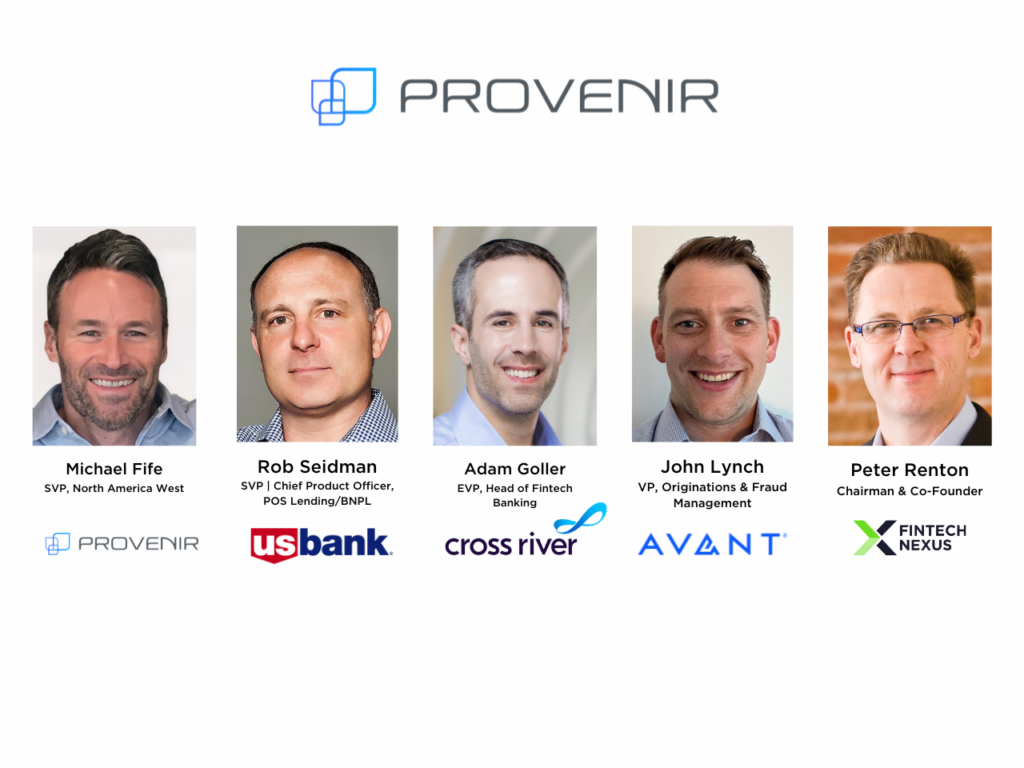

Webinar

How Consumer Lenders Can Reduce Friction Without Compromising on Risk and Fraud Prevention

Mar 21, 2pm EDT

Customer experience is incredibly important to today’s discerning consumers, whether they are looking for financial services…

Also Making News

- USA: Banking apps fall short on fraud protections: report

Consumer Reports Senior Director Delicia Hand said preventing fraud and scams is “crucial” for traditional and digital banks alike, as more of their customers use their mobile apps.

- USA: FirstBank and High Circle introduce banking for the very wealthy

FirstBank, a sponsor bank with a 118-year history rooted in community banking, has teamed up with High Circle, a two-year-old financial platform for High Net-worth Entrepreneurs to introduce banking products designed for high-net-worth individuals and entrepreneurs, leveraging the capabilities of Banking-as-a-Service.

- USA: Why We’re Spending So Much Money

How the rise of frictionless payments drove consumers to buy more.

- Europe: GoCardless to buy Nuapay from EML Payments

GoCardless is creating a full-service bank payments provider through the acquisition of open banking business Nuapay from Australia’s EML Payments in a deal worth €32.75 million.

- UK: Klarna introduces open banking settlements in the UK

Klarna, the AI-powered payments network and shopping assistant, has begun to roll out open banking-powered settlements in the UK.

- USA: Gold Investors Aren’t Switching Into Bitcoin, JPMorgan Says

Outflows from gold exchange-traded funds and a surge in bitcoin ETF inflows fueled speculation investors were shifting from the precious metal into the cryptocurrency.

- USA: Customer Is Still King and Queen of Banking Innovation

In a world where change is constant, digitization has become one of life’s certainties. This advancement is coming to even traditionally staid sectors like financial services and banking, spurring profound transformations.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.