In the new Apple iOS 17.4 update there is a little something for fintech enthusiasts: a new API called FinanceKit.

This is another example of Apple edging its way into open banking after last November the company allowed UK users to connect outside accounts.

Apple’s new update is for US users and is already live with three fintech partners: YNAB, Monarch and Copilot.

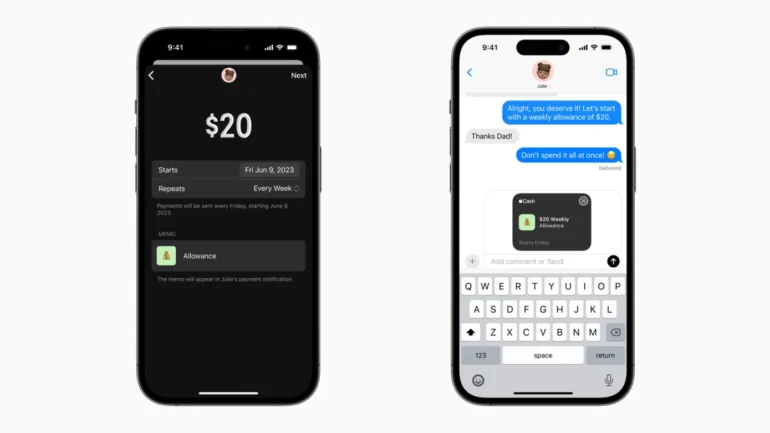

What FinanceKit does is allow developers to fetch transaction balance information from Apple Card, Apple Cash, and Savings with Apple. It is a PR coup for the chosen companies as each shared on X yesterday.

Like pretty much everything with Apple it has been a walled garden when it comes to access to its financial products. But we can see the door beginning to open which will be a great thing for fintech innovation.

Featured

> Apple releases a new API to fetch transactions from Apple Card and Apple Cash

By Ivan Mehta

Apple’s iOS 17.4 update is primarily about adapting iOS to EU’s Digital Market Act Regulation. But the company has also released a new API called FinanceKit that lets developers fetch transactions and balance information from Apple Card, Apple Cash, and Savings with Apple.

From Fintech Nexus

> Not everyone should be an embedded finance provider

By Tony Zerucha

Embedded finance can help small businesses manage their money end-to-end, but not all companies are equipped to offer it properly.

Podcast

Mark Gould, Chief Payments Executive for Federal Reserve Financial Services on the rollout of FedNow

When FedNow launched last July there was a lot of pressure on the Fed to get this move into instant payments right. The head…

Listen Now

Webinar

Navegando los riesgos del onboarding digital en el panorama fintech de América Latina

Mar 12, 2pm EDT (Spanish)

El proceso de onboarding digital sigue siendo un desafío importante para los bancos, las fintech y cualquier empresa que…

Also Making News

- Global: PayPal’s Dan Schulman on the Future of Banking: Digital, Seamless and Consolidated

Payments veteran Dan Schulman sees a future in which consumers pool their financial relationships with a handful of large players, as everything from daily spending to credit, savings and payments merge into a single digital experience.

- USA: How junk fees have changed since Biden’s last State of the Union

In 2023, the Biden administration pledged to reduce “junk fees.” Ahead of this year’s State of the Union, we revisit what progress has been made.

- USA: BlackRock’s Bitcoin ETF Added a Record 12.6K BTC in Tuesday’s Carnage

IBIT’s total inflows surpassed the $9 billion mark on Tuesday and show no signs of easing nearly two months after going live.

- India: Google, Walmart Gain India Fintech Users After Paytm Curbs

Google and Walmart Inc. are rapidly gaining customers from India’s Paytm, the fintech pioneer struggling to navigate central bank restrictions and the potential shutdown of a key payments affiliate.

- USA: Pocketbook and Grasshopper Partner on Commercial Checking Accounts

Pocketbook has selected Grasshopper to provide its small- to medium-sized business (SMB) customers with white-labeled, FDIC-insured commercial checking accounts. The rollout of the products offered by this new partnership was also facilitated by Treasury Prime, the companies said in a Tuesday press release.

- USA: What are the biggest competitive threats to banks out there today … could it be the regulator?

You may or may not know Cornerstone Advisors. If you don’t, you are missing out on major news! They are my favourite bank consulting service in the USA ever since I subscribed to their newsletter Gonzo Banker, years ago.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.