NEW YORK, New York — Throughout society, the rise of influencer marketing has become a force in digital marketing and brand awareness.

Social media influencers have profoundly affected brands, and product integrity, consumer loyalty, and finance are no different.

On Day Two of Fintech Nexus USA 2022, held in New York City at the Javitz Center on May 25-26, 2022, there was an exciting talk on influencer marketing and its power in financial literacy.

This session focused on the rise of finfluencers: influencers specifically concentrating on finance.

The panel included:

- Renita Young, Bloomberg Radio and Quicktake (Moderator)

- Nicky Senyard, Fintel Connect

- CJ MacDonald, Step

- Carie Kelly, BankProv

- Milan Singh, Milansinghhh

But much of the conversation focused on the work of the finfluencer Milan Singh.

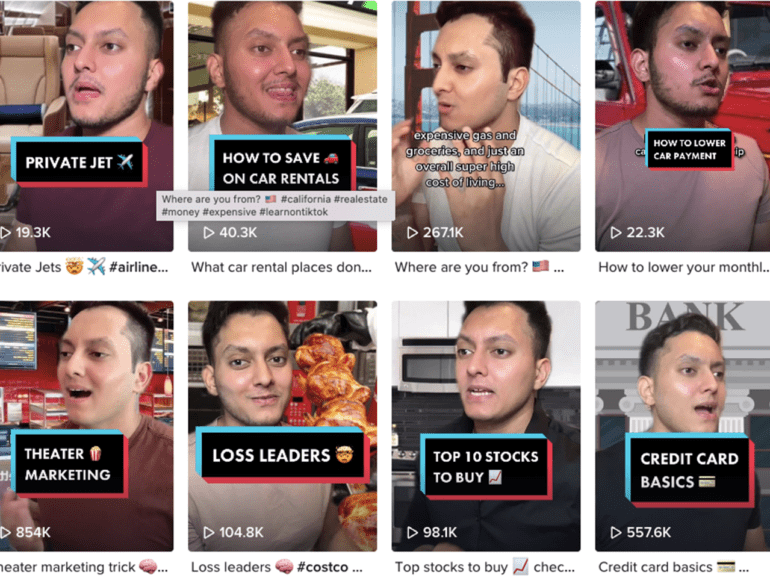

Singh has nearly 3 million subscribers across all social media platforms. Most notable is his popularity on TikTok, with 2.3 million followers.

Becoming a finfluencer

For Singh becoming a finfluencer started as a “little side hustle.”

His first YouTube channel was a gaming channel in high school, but it was only for fun. He then went on to study finance, business, and e-commerce at college for the past five years.

During the pandemic, he took a more serious approach to social media, launching a new channel, beginning with e-commerce and expanding into personal finance to make it more accessible.

“A big role of this was getting on TikTok,” he explains. “It was just wild, like, all the videos start to blow up. I was gaining around half a million followers in the first month. And it was a crazy world. And at the time, I didn’t know how to work with brands and what to charge. I got immersed into it extremely fast.”

Partnering with brands

Singh’s initial focus was growing an audience.

“I was saying no to any brands. And after the fifth or sixth month, I thought, let me see my options because the numbers were getting huge. So I know there’s something here. I didn’t know the scale I could take it to. And once companies started offering me around $2,000, I started to consider.”

For pricing, he clarifies that although he was skeptical, he used his network of creators to understand his value proposition.

“I started offering these higher rates, asking for them and getting them. And that’s when I knew this could be a viable business. And I went fully into the business around six months.”

Whenever possible, Singh works directly with brands and agencies if he does not have direct access to the company.

“If I got a contract for a company, right through somebody, or through a conference like this, then I’ll pitch myself. I’ll have my media kit, my deliverables I offer, and my audience demographics, so they can see if I can bring the conversions or not. I’ll pitch myself and ask them if there is something we can do here, but most of the time, it’s the company’s coming to me.”

In his work with brands, research is also crucial. He says it’s important to set expectations as, in the past, there have been disagreements with brands over what their goals are.

“I research the company, first understanding their product. To know if it will be a good fit for my audience and understand their goals. Are they looking for conversions? Signups? Let’s talk about that.”

Singh’s research involves assessing whether it is profitable for both parties and helping brands understand what they can expect.

Authenticity

The other panelists discussed authenticity, especially within the influencer world. Singh explained that this is an integral part of being a finfluencer because it creates trust with his audience.

“If I repeatedly post that same brand, and the audience sees it repeatedly, they will be more likely to sign up. And overall, the conversion will be much higher in the long term, and it’ll be more beneficial for both sides.”

“There’s always going to be people that don’t like sponsors. They will ask questions like why are you promoting this? Or like was that a one-off post? Or do you even use this? However, with longtime partners, I see these questions less because they’re repeatedly seeing them. So they know I’m using the product myself.”

Ultimately, as brands compete to maximize their opportunities in a fragmented market and consumers seek financial literacy in this fast-changing economic landscape, it will be interesting to see how finfluencers continue to make an impact.