For many players in this market, the new law brings greater legal certainty for investors and companies working with these crypto assets.

Finnovista is a research and industry 'catalyst' firm that is tracking fintech growth across Latin America and Spain; in a recent report on Brazil, they track 219 fintech startups in the country, making it the most prominent Latin American country based on that metric; Mexico follows with 158 startups, then Colombia, Argentina and Chile each having 55 to 80 such startups; an infographic indicates that 26% of Brazil's fintech startups are in the payments sector, 10% in balance sheet lending (with some web presence or other innovation), 2% in true P2P lending and 8% in crowdfunding. Source

The Central Bank of Brazil unveiled stricter regulations for FinTech firms based on the complexity of companies, creating tougher standards for required capital.

Brazil, the largest country in Latin America, is moving closer to regulating cryptocurrencies with its own version of a Bitcoin law.

Brazil, the largest country in Latin America, is moving closer to regulating cryptocurrencies with its own version of a Bitcoin law.

The regulator postponed the implementation of a prudential capital regulation by six months, giving flexibility to fintechs in the sector.

A PYMNTS and Kushki study examines how Brazil sets an example for the rest of Latin America in its embrace of digital payments.

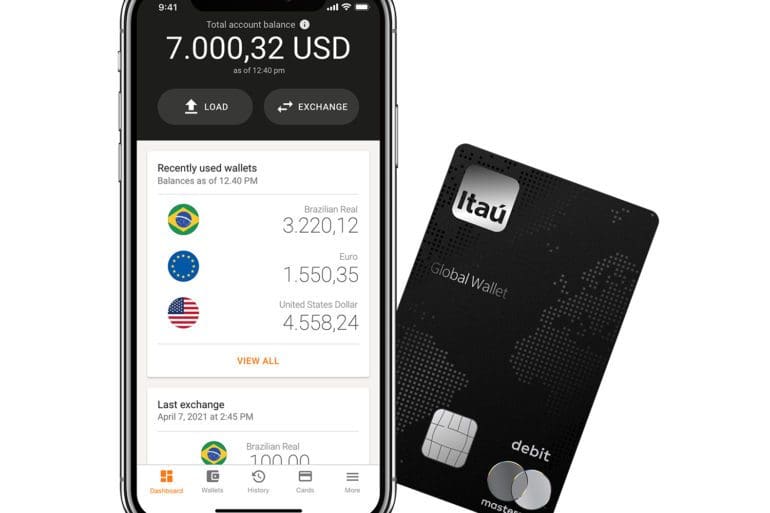

The invite-only Itaú Global Wallet was developed by Rêv on its multi-currency payments processing platform and carries the Mastercard brand.

Bradesco has been beefing up its digital banking arm in recent years and now operates three brands: Next, Digio and Bitz

In addition to acquiring a 3.85% equity stake in the fintech Méliuz, BV will have the option to buy all shares of the controlling block.