Financial exclusion is a global problem, through strategic design and implementation, could CBDCs be the solution?

In several countries of the Latin American region, the projection and growth of multiple FinTechs that promise to continue with the financial evolution and provide more tools for clients and investors stand out.

Revolut, one of the largest digital banks in the world, has announced plans to expand its business to Latin America’s largest markets.

Today, women only hold less than 20% of all tech leadership jobs globally. This phenomenon can feel disheartening and isolating.

Today’s launch of a new project is a tantalizing glimpse of a new wave of European VC, founded and run by former tech startup “operators.”...

The crypto custody firm is enrolling customers a few months ahead of Ethereum’s planned transition to a proof-of-stake mechanism.

Though still the 'Wild West,' the Metaverse is a place banks cannot ignore. Open source tools make it accessible to any size institution.

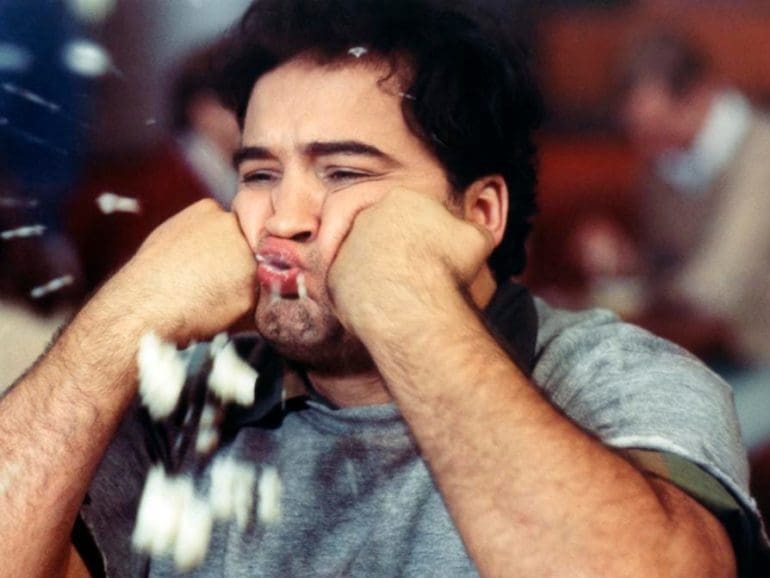

Just as it wasn’t over when the Germans bombed Pearl Harbor (according to Blutarski in the movie Animal House, at least), the fintech revolution isn’t over just because the valuation of two companies (Klarna and Robinhood) has declined.

Apple Pay Later doesn’t cannibalize the Apple Card and “sideline” Goldman Sachs—it’s a stepping stone to a credit card relationship that benefits both Apple and Goldman Sachs.

Financial exclusion is a global problem, through strategic design and implementation, could CBDCs be the solution?